- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ambarella (AMBA) Tops Q4 Earnings & Revenue Projections

Ambarella, Inc. (NASDAQ:AMBA) just released its fourth-quarter and fiscal 2018 financial results, posting adjusted earnings of $0.45 per share and revenues of $70.58 million.

Currently, Ambarella is a Zacks Rank #3 (Hold) and is up over 5% to $48 per share in after-hours trading shortly after its earnings report was released.

AMBA:

Beat earnings estimates. The company posted adjusted earnings of $0.45 per share, beating the Zacks Consensus Estimate of $0.37 per share.

Beat revenue estimates. The company saw revenue figures of $70.58 million, topping our consensus estimate of $70.41 million.

Ambarella revenues sunk 19.3% from the year-ago period. On top of that, full fiscal year sales slipped by 4.8% to $295.4 million.

The company now expects to post first quarter fiscal 2019 revenues between $54.5 million and $57.5 million, which comes in below our current consensus estimate of $59.17 million.

“With the success of our initial development efforts and response from customers, especially in security and automotive, we intend to continue to accelerate the development and deployment of CV solutions in all our key markets,” CEO Fermi Wang said in a statement.

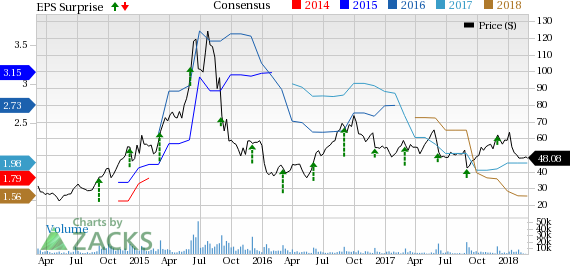

Here’s a graph that looks at AMBA’s Price, Consensus and EPS Surprise history:

Ambarella, Inc. develops video compression and image processing semiconductors. The Company's products are used in digital still cameras, digital camcorders, and video-enabled mobile phones. Ambarella sells its solutions to original design manufacturers and original equipment manufacturers. Its technology is also used in television broadcasting infrastructure systems. Ambarella, Inc. is headquartered in Santa Clara, California.

Check back later for our full analysis on AMBA’s earnings report!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Ambarella, Inc. (AMBA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.