- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Amazon's Music Service And Echo Available In 28 New Markets

Amazon.com Inc. (NASDAQ:AMZN) recently announced expansion of its Music Unlimited service in 28 countries. The company has also begun to ship Amazon Echo devices in these countries.

The streaming service contains 40 million tracks and is not part of Amazon Prime as the latter is not available in these markets.

Amazon’s Echo devices are powered by Alexa smart assistant. Per eMarketer, the devices hold almost 70% of the smart speakers market.

Per Cowen & Co. consumer tracking survey, 84% of the Echo users in the United States use it for listening to music. Thus, widening coverage in 28 new countries will help in expanding the company’s Music Unlimited user base. Consequently, its recurring revenue base will improve.

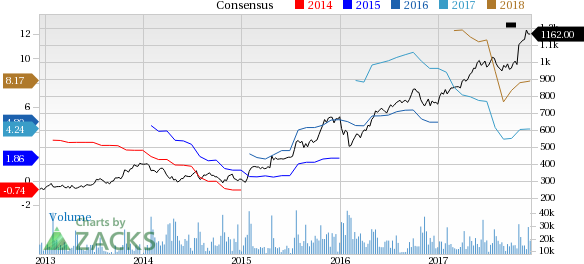

Shares of Amazon have gained 54.9% year to date, substantially outperforming the 18.8% rally of the S&P 500.

Strong Echo Dot Sales to Drive Growth

The demand for Echo devices remains strong. This was clearly reflected in the Thanksgiving weekend and on Cyber Monday.

Per the company’s statement, Echo Dot was the top-selling product on Amazon.com over the holiday weekend. Moreover, it was the best-selling product from any manufacturer in any category on Amazon. Notably, Echo Dot was also Amazon’s bestselling product across manufacturers and categories worldwide on Prime Day’17.

Alexa powered Echo devices help Amazon in selling products and services. The idea is to make Alexa the central point connecting IoT devices used in any household and get unrivaled customer data.

We believe that the expansion will enable Amazon to collect more user data that it can utilize to provide more customer-oriented services. This will bode well for the company’s top line in the long haul.

Zacks Rank & Stocks to Consider

Amazon has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same industry include Groupon (NASDAQ:GRPN) , PetMed Express (NASDAQ:PETS) and Alibaba (NYSE:BABA) . While Groupon and PetMed sport a Zacks Rank #1 (Strong Buy), Alibaba carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Groupon, PetMed and Alibaba is currently projected to be 10%, 10% and 30.7%, respectively.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Groupon, Inc. (GRPN): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.