- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Amazon's (AMZN) Strong Delivery Measures To Address Hurdles

Amazon (NASDAQ:AMZN) has recently faced delivery delays due to a technical hindrance. This impacted orders via its Whole Foods and Amazon Fresh delivery services.

Notably, the company is witnessing a flurry of orders driven by customers’ unwillingness to visit offline stores on fears of contracting the novel coronavirus. Although the company’s delivery capacity remains constant, overflowing orders have been slowing down delivery.

This remains a major concern for the e-commerce giant and might lead to disruption as it might lose customers due to delivery delays in this coronavirus-induced crisis.

Therefore, the company has already started offering concessions to the affected customers in order to retain them on its online shopping platform.

Further, it is making strong efforts to expand delivery capabilities in order to sustain customer momentum in this crisis situation.

Anti COVID-19 Initiatives

COVID-19, which has become pandemic, is compelling people to stay at their homes. This, in turn, is resulting in problems as they are unable to procure items required on a daily basis.

This is leading to an increase in the Internet and online services usage, which underscores the importance of online shopping and quick delivery services.

Although Amazon is facing hurdles in delivering packages on time, its strengthening delivery services remain noteworthy.

We note that the company has recently taken an initiative to bolster its Same-Day Delivery program by making same-day delivery service available in the cities of Philadelphia, Phoenix, Orlando and Dallas for Prime members.

Further, the service in these cities has been equipped to deliver three million items across various product categories. The company has also built mini-fulfillment centers, which are first of their kind buildings.

Notably, the new facilities are located closer to customers, which is likely to help Amazon to reduce the number of hours taken to deliver orders via same-day delivery services.

We believe the latest move is anticipated to help the company manage the increasing number of orders during the coronavirus crisis.

Apart from this, the company’s one-day shipping and many other fast delivery services remain noteworthy and are likely to instill investor confidence.

Additionally, the company is creating a relief fund worth $25 million in order to help its independent delivery drivers and seasonal employees during the corona scare.

Wrapping up

All the above-mentioned strong endeavors reflect Amazon’s commitment toward the betterment of customers, which in turn is likely to drive customer momentum. Moreover, the relief fund move indicates its focus toward the welfare of its workers as well.

We believe these endeavors are likely to aid Amazon in gaining investor confidence in this volatile stock market, thanks to the coronavirus outbreak.

Zacks Rank & Stocks to Consider

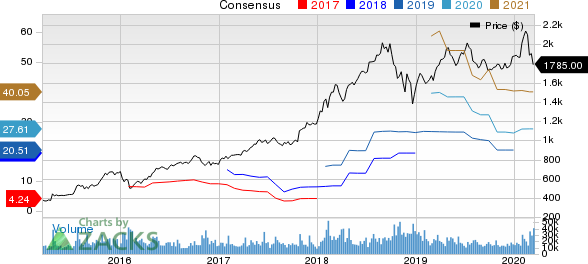

Currently, Amazon carries a Zacks Rank #3 (Hold).

A few better-ranked stocks that can be considered in the retail-wholesale sector are Stamps.com (NASDAQ:STMP) , eBay (NASDAQ:EBAY) and Fiverr International (NYSE:FVRR) . While Stamps.com and eBay sport a Zacks Rank #1 (Strong Buy), Fiverr carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Stamps.com, eBay and Fiverr is currently pegged at 15%, 11.25% and 44.18%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Stamps.com Inc. (STMP): Free Stock Analysis Report

Fiverr International Lt. (FVRR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.