- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Amazon Web Services Launches New Media Services For Videos

Amazon.com, Inc.’s (NASDAQ:AMZN) Amazon Web Services (AWS) recently launched AWS Elemental Media Services, a suite of five cloud based tools to enable building video offerings in cloud and monetize them.

AWS claims that the new services automate video operations management, save a lot of time and effort, and eradicate the need of pricey equipment and infrastructure for video data centers.

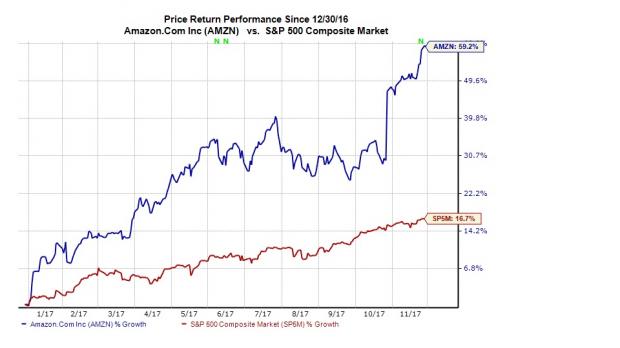

We observe that shares of Amazon that currently carry a Zacks Rank #3 (Hold) have rallied 59.2% year to date, significantly outperforming the S&P 500’s 16.7% gain.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AWS Elemental Media Services

AWS Elemental MediaConvert allows publishers to format and compress video-on-demand content and send them to any playback device. The service claims to offer high quality transcoding and broadcast-level features. AWS Elemental MediaLive enables publishers to encode broadcast-grade live video for connected devices and televisions. AWS Elemental MediaPackage allows producers to build and secure live video streams with added tools like immediate playback.

AWS Elemental MediaStore enables delivery of video from high-performance storage optimized for media. AWS Elemental MediaTailor helps monetize videos by inserting personalized ads.

Our Take

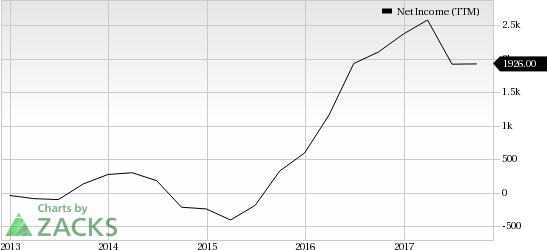

The move indicates that Amazon is working on boosting AWS. That makes sense as the unit that was once started to handle the company’s own storage needs has quickly become a billion-dollar business and the cash cow for Amazon. The business generates much higher margins than retail and therefore has a positive impact on Amazon’s profitability.

Amazon.com, Inc. Net Income (TTM)

We believe that the move will boost functionality, partner ecosystem and the experience AWS offers and lead to continued customer wins. AWS has already taken a lead over rival services, such as Microsoft’s (NASDAQ:MSFT) Azure, Alphabet’s (NASDAQ:GOOGL) Google Cloud Platform and International Business Machines’ (NYSE:IBM) IBM Cloud.

If AWS continues to witness the same kind of success, investors can hope for far more growth.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

International Business Machines Corporation (IBM): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Mid-cap stocks don’t get the same headlines as large caps but move aggressively in both directions, creating outsized opportunities for investors. Unlike their mega-cap...

There’s no doubt it’s been a rough couple weeks for stocks: Both the S&P 500 and the tech-focused NASDAQ have wiped out most of this year’s gains, as of this writing. Stocks...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.