- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Amazon Faces Lawsuit From Daimler Over Trademark Violation

Amazon.com, Inc. (NASDAQ:AMZN) faces a fresh set of allegations from German automaker Daimler AG (DE:DAIGn) over sale of counterfeit products in its marketplace.

In a lawsuit filed in the U.S. District Court in Los Angeles, Daimler alleged Amazon of trademark infringement and claimed that the company sells fake Mercedes-Benz wheel center caps. The lawsuit also claimed that Amazon has not taken steps to handle the infringement issue.

“Amazon’s sale of the infringing products causes significant damage to Daimler,” the complaint states. “For example, sales of the infringing products decrease sales of authentic Mercedes-Benz wheel center caps, and tarnish Daimler’s reputation for quality and excellence. The infringing products are of substantially inferior quality than authentic Daimler wheel center caps.”

The companies have been at loggerheads since April last year when Daimler sued Amazon in a district court and then the U.S. International Trade Commission (USITC) for selling fake Mercedes-Benz wheels from 10 distributors. Both the companies decided to stay the district court case until the USITC case reaches conclusion.

In August this year, Daimler asked for a resumption of the lawsuit in a Washington federal court stating that the USITC case was resolved with key issues still undecided.

Though there are no comments from Amazon on the current lawsuit, the company usually argues that it cannot be held responsible for infringing activities of its third-party sellers. The company claims that it has zero tolerance for the sale of counterfeit items.

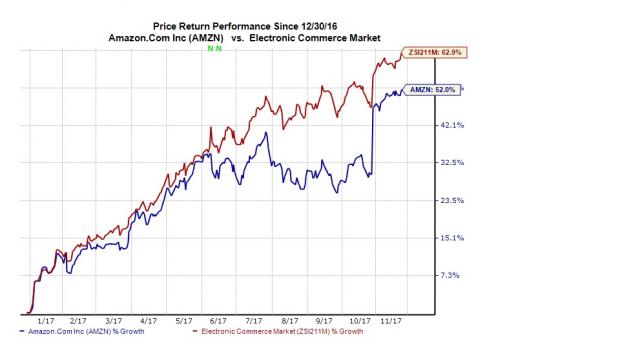

We observe that Amazon shares have gained 52% year to date, underperforming the industry’s 62.9% rally.

Our Take

The growth of the e-commerce industry, with consumers increasingly buying things online, is a dynamic going in favor of Amazon. While big brands may build their own online stores over time, a platform like Amazon allows discovery of new buyers.

Amazon.com, Inc. Net Income (TTM)

Smaller players are far more dependent on Amazon as they don’t have the resources to invest in technology and fulfillment to generate the kind of reach that Amazon can deliver. Amazon’s platform is currently being used by more than 2 million independent sellers.

Moreover, the market is in the early growth phase (considering opportunities in international markets. So, the company’s high growth rates are likely to be sustained over the next few years.

But that should not make Amazon overly confident about its online business. When brands hit by counterfeit charges lose sales and potential customers, the ripple effect will also be felt by Amazon and earn it a bad name.

Zacks Rank and Stocks to Consider

Amazon carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Better-ranked stocks in the broader technology sector include Activision Blizzard (NASDAQ:ATVI) , Applied Materials (NASDAQ:AMAT) and Alibaba (NYSE:BABA) , each carrying a Zacks Rank #2.

Long-term earnings per share growth rate for Activision, Applied Materials and Alibaba is projected to be 13.8%, 13.3% and 30.7%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.