- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Amazon (AMZN) Temporarily Halts Non-Essential Sales In India

With the rampant spread of coronavirus pandemic across the globe and announcement of lockdowns in many countries, people are compelled to stay at homes. This in turn is creating problems as the company is unable to procure items that are required by consumers on a daily basis.

Recently, the Prime Minister of India, Narendra Modi has also announced a lockdown in the country for at least three weeks due to the coronavirus. This has led to further increase in Internet and online services usage.

Keeping in mind the need for basic essential items, Amazon’s (NASDAQ:AMZN) India unit will halt orders for non-essential products, after having implemented the same move in Italy and France.

The company stated that it will focus on the sale and delivery of essential daily items like household staples, packaged foods, healthcare, hygiene and personal safety products.

These initiatives should allow Amazon to focus on the critical needs of the people.The rapid delivery of these items is expected to help people counter the difficult times.

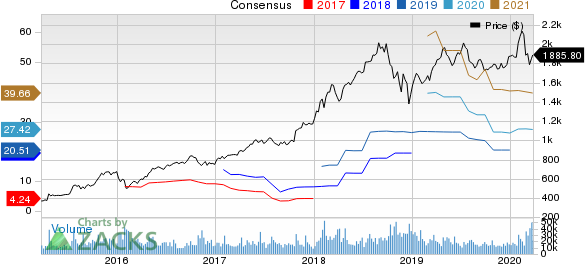

Amazon.com, Inc. Price and Consensus

Amazon’s Current Retail Picture

Per Bloomberg, Amazon is witnessing a flurry of orders on account of customers’ unwillingness to visit offline stores on fears of contracting the deadly virus. Although the company’s delivery capacity remains constant, overflowing orders have been slowing down delivery.

Nevertheless, the company has been making great efforts on the retail front to combat this contagious virus. It stated that Whole Foods stores will dedicate an entire hour to serve only senior citizens in an attempt to keep them safe from crowd, as they are more susceptible to COVID-19 infection.

In addition, the company has recently taken an initiative to bolster the Same-Day Delivery program by making it available in the cities of Philadelphia, Phoenix, Orlando and Dallas for Prime members.

Further, the company has built mini-fulfillment centers that are first-of-their-kind buildings. Notably, the new facilities are located closer to customers, in turn helping Amazon to reduce the number of hours taken to deliver orders via same-day delivery services.

Additionally, Whole Foods stores are closing two hours early in order to sanitize the stores and restock the shelves. Further, the company will continue to deliver Prime orders from these stores during these two hours.

Also, its delivery drivers have been asked to sanitize the delivery vans every day before going out for delivery.

The company’s one-day shipping and many other fast delivery services remain noteworthy, and are likely to instill investor confidence.

Bottom Line

The rampant spread of the coronavirus pandemic across the globe is taking a toll on everyone. So far, the pandemic has infected at least 170,000 people and claimed more than 6,500 lives worldwide.

In order to reduce the spread of the virus, countries like Italy, France, India, among others, have enforced lockdown. This lockdown has created a panic among people and led to a rapid increase in online orders.

Though timely delivery is vital, the health of the employees who take up these deliveries is equally important. Therefore, companies like Amazon and Walmart’s Flipkart are currently focusing only on the delivery of essential items.

Zacks Rank & Other Stocks to Consider

Amazon currently carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader technology sector include Stamps.com Inc. (NASDAQ:STMP) , eBay Inc. (NASDAQ:EBAY) and Atlassian Corp. (NASDAQ:TEAM) . While Stamps.com and eBay sport a Zacks Rank #1 (Strong Buy), Atlassian carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Stamps.com, Atlassian Corp. and eBay is currently projected at 15%, 22.3% and 11.3%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Atlassian Corporation PLC (TEAM): Free Stock Analysis Report

Stamps.com Inc. (STMP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.