- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Amazon (AMZN) Plans To Snap Up Cybersecurity Startup Sqrrl

Amazon.com, Inc. (NASDAQ:AMZN) reportedly plans to acquire Sqrrl Data Inc., a cyber security startup based in Massachusetts. However, Amazon and Sqrrl have not commented on the reports.

Although the deal is yet to be finalized, Axios has reported that it could be worth more than $40 million.

Founded in 2012, Sqrrl makes secure database software for companies and institutions in all sectors, including finance and healthcare, among others. The company analyzes big data to hunt cyber-threats and help companies identify and address them at a faster pace.

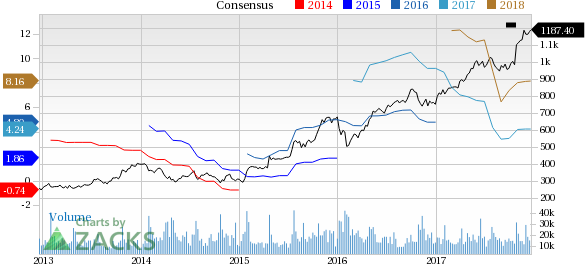

Notably, Amazon has underperformed the industry it belongs to on a year-to-date basis. The company’s shares have gained only 58.3% compared with the industry’s growth of 61.4%.

Why the Acquisition?

Internet is crucial to yet risky for many major corporations and even some governments. Also, the increased adoption of cloud technology has made businesses vulnerable to cyber-attacks. In the last few years, numerous data breaches at high-profile business houses and government agencies have prompted tighter security measures, in turn increasing demand for cyber security solutions.

On the other hand, data breach is always good for cyber security companies, as it increases chances of security-related purchases by both companies and governments. Cyber security is one of the fastest growing markets in the information technology domain and creates economic opportunities. Growing risks such as computer hacking, software piracy and virus deployment are increasing the demand for cyber securities services.

According to market research firm, Gartner, global cyber security spending will grow 7% to $86.4 billion in 2017. Another report by market research report company Zion states that global cyber security market was valued at $105.45 billion in 2015 which is expected to reach $181.77 billion in 2021 and is anticipated to grow at a CAGR of 9.5% between 2016 and 2021.

Amazon, it seems, has chosen to jump the bandwagon at an opportune time. However, we need to wait until an official announcement is made.

Being Very Ambitious

So far this year, Amazon has made the second-highest number of acquisitions since 1998. In October, the retailer acquired Body Labs, a startup that develops AI, computer vision and body-modelling based 3D body shapes and motion for various industries. In August, the company acquired leading natural and organic foods supermarket, Whole Foods Market (NASDAQ:WFM), Inc. for $13.7 billion.

Amazon is gradually choosing the buy option over build, which, along with the other positives, ensures revenue generation in the right way without wasting any time in building its own infrastructure.

To Conclude

Amazon’s global margins are likely to be under pressure at least for a few years, given that it continues to invest aggressively in fulfillment centers, TV shows and movies, AWS, acquisitions, expansion in India and what not.

Amazon has never hesitated to sacrifice margins to pursue its long-term objectives of bringing more customers under its umbrella and giving them reasons to stay. A huge cash balance and technological prowess boost the company’s remarkable risk-taking ability.

Zacks Rank and Stocks to Consider

Amazon has a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are Groupon Inc. (NASDAQ:GRPN) , PetMed Express, Inc. (NASDAQ:PETS) and SMART Global Holdings, Inc. (NASDAQ:SGH) , each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for Groupon, PetMed Express and SMART Global is projected at 7%, 10% and 15%, respectively.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Groupon, Inc. (GRPN): Free Stock Analysis Report

SMART Global Holdings, Inc. (SGH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.