- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Amazon (AMZN) Halts Loan Repayment To Promote Seller Interest

Amazon (NASDAQ:AMZN) recently announced that it is temporarily halting loan repayment in a bid to promote sellers’ interests during the coronavirus-induced crisis.

Notably, the company’s Amazon Lending program, which has provided financing worth millions to several merchants on its platform, does not require borrowers to pay back their loans until Apr 30.

The latest move is in favor of merchants who are witnessing decreasing sales and contracting profits on account of the coronavirus pandemic, which has resulted in lockdowns in several countries and consequently triggered a financial crisis.

Amazon Striving to Sustain Seller Momentum

Although the current scenario of quarantines is leading to surge in online orders, the e-commerce giant has put temporary ban on the supply of non-essential and luxurious commodities to reduce the spread of the deadly virus

This, in turn, is hurting the top line of several sellers on the company’s online retail platform.

Nevertheless, the latest loan repayment pause reflects Amazon’s seller-oriented approach. The process of paying back loads will restart on May 1. The amount of payments will remain same and interests will not get accrued.

We believe efforts toward the betterment of sellers are expected to help the company retain them on its platform, thus sustaining its momentum across sellers amid coronavirus-induced disruptions.

Wrapping Up

Amazon is constantly taking measures to reduce the risk of spreading the coronavirus. Further, its strong endeavors toward serving the interests both the society and merchants remain noteworthy.

These are likely instill investor optimism in the stock amid this challenging situation.

Moreover, a strong seller base and aggressive retail strategies are likely to continue aiding the performance of Amazon online-retail business.

Further, the company’s growing initiatives toward strengthening its ultrafast delivery system remains a major positive.

.

All these factors are expected to continue aiding Amazon in sustaining its dominant position in the booming e-commerce market despite the coronavirus scare.

Zacks Rank & Other Stocks to Consider

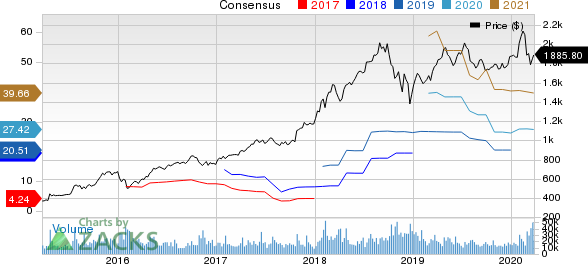

Currently, Amazon carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the retail-wholesale sector include Stamps.com (NASDAQ:STMP) , eBay (NASDAQ:EBAY) and Genesco (NYSE:GCO) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Stamps.com, eBay and Genesco is pegged at 15%, 11.25% and 5%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Genesco Inc. (GCO): Free Stock Analysis Report

Stamps.com Inc. (STMP): Free Stock Analysis Report

Original post

Related Articles

Often as dividend investors we buy stocks that provide us with income now. We take the current yield and happily collect the monthly or quarterly payout. Sometimes, though, it is...

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.