- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Amazon (AMZN) Gears Up For 2nd Digital Day Sale On Dec 29

To make the most of the holiday shopping spree, online giant Amazon.com Inc. (NASDAQ:AMZN) has announced its second annual Digital Day sale on Dec 29.

Amazon will once again extend exciting offers across its digital archive. Customers will get access to more than 5000 deals across eight categories including TV shows, mobile games, apps, e-books, and more.

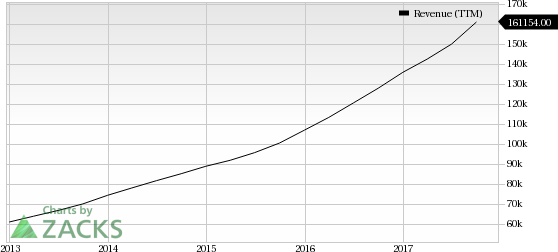

Shares of Amazon have soared 58.8% year to date, underperforming its industry’s 60.2% surge.

Attractive Deals to Woo Customers

On the last weekday of 2017, Amazon will offer deals on digital content to attract consumers who receive gadgets as gifts during the holiday season. The company stated that it will offer considerable discounts on various TV shows, movies, apps, songs, e-books and other software. While some deals will start appearing from Dec 26, the money saving deals will be launched at 12:00 AM ET time on Dec 29.

Amazon is leaving no stone unturned to cash in on holiday shopping. The company recently extended its free shipping deadline to Dec 16 and expanded Prime Free Same-Day Delivery and Prime Free One-Day Shipping options for members across more than 8,000 cities and towns. (Read more: Amazon Eases Off Eleventh Hour Shopping With Exciting Offers).

Our Take

We expect the Digital Day to work in favor of Amazon and boost its revenues. Last year on Digital Day, Amazon witnessed tremendous sales across digital apps, games and comics and the same is expected to happen again this year. Moreover, per Daniel Ives of GBH Insights, Prime customers are estimated to spend 20-25% more this holiday season than last year.

Amazon has built a foothold in the fast-growing e-commerce market and is devising newer ways to attract consumers. eMarketer expects retail e-commerce sales to reach $2.290 trillion in 2017, accounting for 10.1% of total retail sales. This is again expected to surpass 16% by 2021 when e-commerce sales are estimated to touch $4.479 trillion. Growth of the e-commerce industry with increase in online transaction bodes well for the company and its high-growth rate is likely to be sustained over the next few years.

Amazon has a Zacks Rank #3 (Hold).

Groupon (NASDAQ:GRPN) , PetMed Express (NASDAQ:PETS) and Alibaba (NYSE:BABA) are some of the better-ranked stocks in the same industry. While Groupon and PetMed sport a Zacks Rank #1 (Strong Buy), Alibaba carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Groupon, PetMed and Alibaba is projected to be 7%, 10% and 30.7%, respectively.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Groupon, Inc. (GRPN): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.