- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AMAG Pharma (AMAG) Beats On Q4 Earnings, Misses On Revenues

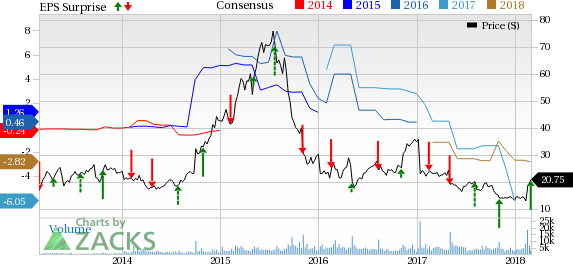

AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG) posted adjusted earnings of 10 cents per share in the fourth quarter of 2017 as against a loss of 31 cents in the year-ago quarter. The reported earnings compared favorably with the Zacks Consensus Estimate of a loss of 58 cents.

Adjusted earnings per share was $1.40 per share. The adjusted earnings exclude purchase accounting adjustments related to Cord Blood Registry deferred revenue, depreciation and intangible asset amortization, non-cash inventory step-up adjustments, stock-based compensation and adjustments to contingent consideration. Quarterly revenues came in at $158.3 million, up approximately 4.5% from $151.6 million in the year-ago quarter, driven by sales growth across the product portfolio. However, the top line marginally missed the Zacks Consensus Estimate of $159 million.

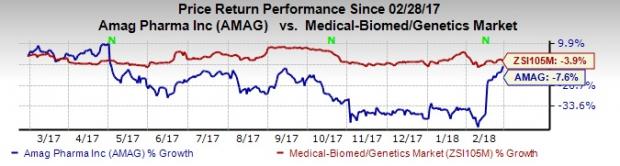

Shares of the company moved up by about 4.5% after the earnings release. Markedly, shares of AMAG have lost 7.6% over a year, compared with the industry’s decline of 3.9%.

Quarter in Detail

Makena sales came in at $100.4 million, up 3.3% year over year.

Combined sales of Feraheme and MuGard amounted to $26.6 million, almost flat year over year. During the quarter, service revenues from Cord Blood Registry came in at $29.8 million, 7.5% higher than $27.7 million in the year-ago quarter.

Total adjusted costs and expenses decreased15.1% year over year.

Two New FDA Approvals in February

The FDA approved label expansion of Feraheme (ferumoxytol injection) beyond the current chronic kidney disease (“CKD”) indication. The new approval includes all eligible adult Iron Deficiency Anemia (“IDA”) patients who have intolerance to or have had unsatisfactory response to oral iron.

In February 2018, the FDA also approved a new administration option for Makena - subcutaneous auto-injector drug-device combination product to reduce the risk of preterm birth in certain at-risk women.

In early 2017, the company expanded its women's health product portfolio with the in-licensing of Intrarosa and bremelanotide. AMAG along with partner, Palatin, plans to file new drug application (“NDA”) for bremelanotide to treat hypoactive sexual desire disorder (HSDD) in this quarter.

The company reduced debt by about 20% in 2017.

2017 Results

The company reported loss of $5.71 per share in 2017 compared with a loss of 7 cents in 2016. The loss was narrower than the Zacks Consensus Estimate of a loss of $6.43.

Revenues increased 12% to $609.9 million in 2017, compared with $532.1 million in 2016. Revenues missed the Zacks Consensus Estimate of $613.8 million.

2018 Outlook

AMAG expects revenues in the range of $500-$800 million for 2018. Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) is expected to be in the range of $100-$130 million.

Zacks Rank & Stock to Consider

AMAG carries a Zacks Rank #3 (Hold).

A few better-ranked stocks from the same space are Regeneron (NASDAQ:REGN) , Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) and Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA) . WhileRegeneron sports a Zacks Rank #1 (Strong Buy), Ligandand Enanta Pharma carry a Zacks Rank #2 (Buy), each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings per share estimates have moved up from $17.13 to $18.65 and from $20.38 to $21.56 for 2018 and 2019 respectively in the last 30 days. The company pulled off a positive earnings surprise in three of the last four quarters, with an average beat of 9.15%.

Ligand’s earnings per share estimates have moved up from $3.54 to $3.78 for 2018 in the last 60 days. The company delivered a positive earnings surprise in three out of the trailing four quarters, with an average beat of 24.88%. Share price of the company moved up 44.7% over a year.

Enanta Pharma delivered a positive earnings surprise in three of the last four quarters, with an average beat of 373.1%. Share price of the company surged 170.1% over a year.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

AMAG Pharmaceuticals, Inc. (AMAG): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Enanta Pharmaceuticals, Inc. (ENTA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.