- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Allegheny (ATI) To Supply Solutions For Oil Pipeline Project

Allegheny Technologies Incorporated (NYSE:ATI) declared that it has been chosen to supply nickel-based alloy products for a large oil pipeline repair project, which has estimated revenue value of $30 million to its Flat Rolled Products (FRP) segment. The company expects shipments to start in the first quarter of 2018.

The project required urgent replacement and the customer selected the company’s innovative solution enabled by its Hot-Rolling and Processing Facility (HRPF) capabilities, which highlights the industry’s shortest production cycle time for nickel-based alloy flat-rolled products.

Additionally, the company offered a highly competitive solution through the use of its differentiated continuous coil, which replaces discrete plate in this application. The differentiated product is made possible by the gauge control of the HRPF and unparalleled power reduction. The innovative solution is the result of the company’s broad manufacturing capabilities, leading technologies and operating reliability.

Allegheny believes that its highly engineered and differentiated specialty material solutions will help to expand its business in the chemical & hydrocarbon processing and oil & gas markets.

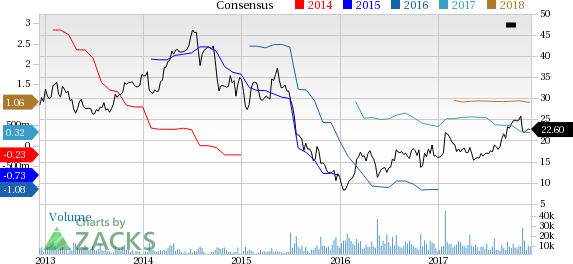

Shares of Allegheny have moved up 30.3% in the past six months, outperforming the industry’s 25.2% growth.

Allegheny, in October, said that it expects the High Performance Metals and Components (HPMC) unit to maintain robust performance especially in the commercial aerospace. Further, the company expects the unit to deliver improved results in the fourth quarter compared with the third.

The FRP unit is expected to benefit from increasing raw material prices in the fourth quarter. The company sees operational improvements and product mix benefits to be carried over in 2018.

Allegheny anticipates significant profit improvement opportunities in 2018, aided by the completion of the start-up and qualification of its new nickel alloys powder facility.

Zacks Rank & Stocks to Consider

Allegheny currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Westlake Chemical Corporation (NYSE:WLK) , Daqo New Energy Corp. (NYSE:DQ) and Kronos Worldwide Inc. (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Westlake Chemical has an expected long-term earnings growth rate of 10.6%. Its shares have moved up 78.2% year to date.

Daqo New Energy has an expected long-term earnings growth rate of 7%. Its shares have surged a whopping 156% year to date.

Kronos Worldwide has an expected long-term earnings growth rate of 5%. Its shares have rallied 111% year to date.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

Allegheny Technologies Incorporated (ATI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The stock market has hit a rough patch lately, with the benchmark SPDR S&P 500 (NYSE:SPY) sliding nearly 3% in a single week. Most sectors have followed the downward trend,...

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.