- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Alibaba Ups The Ante In New Retail With Fresh Investments

Alibaba Group Holding Limited (NYSE:BABA) has entered into a strategic alliance with Ruentex Group and Auchan Retail S.A., as part of its latest bid to ramp up “New Retail” efforts in China.

Alibaba is buying 36.2% stake in China’s leading hypermarket operator, Sun Art Retail Group from Ruentex for $2.9 billion (HK$22.4 billion). The deal will make Alibaba, the second largest stakeholder in Sun Art after Auchan, which is also raising its stake to 36.18%.

Sun Art runs 446 hypermarkets across 29 provinces, municipalities and autonomous regions of China under “Auchan” and “RT-Mart” banners. It also runs unstaffed stores under the “Auchan Minute” brand.

Daniel Zhang, Chief Executive Officer of Alibaba Group stated that, “by fully integrating online and physical channels together with our partners, we look forward to delivering an original and delightful shopping experience to Chinese consumers.”

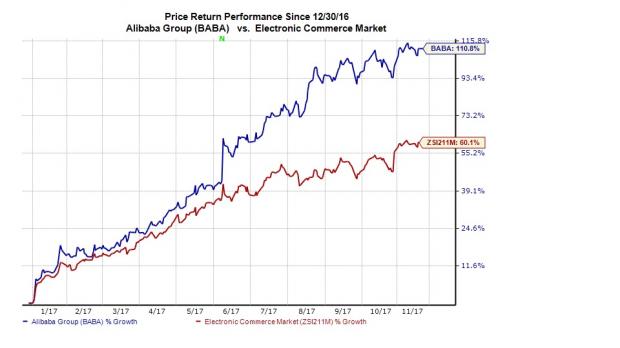

We observe that Alibaba stock has gained 110.8% year to date, substantially outperforming the 60.1% rally of the industry it belongs to.

New Retail Strategy in Focus

Alibaba noted in a press release that this alliance is part of its New Retail push. This strategy is aimed at bridging the gap between online and offline shopping using big data capacity; acquiring new ways to evolve across marketing, inventory and distribution networks.

The broader goal is to tap China’s massive retail space worth approximately $5 trillion and comprising both online and offline options. Notably, offline retail currently constitutes 85% of total retail sales in China despite the enormous growth of e-commerce over the last few years.

Alibaba Group Holding Limited Net Income (TTM)

The effort is already paying off as the company has started operating Hema convenience stores that allows customers to enter by scanning a QR code, select items and pay automatically through Alipay at the checkout.

Increased competition from the likes of eBay (NASDAQ:EBAY) , Amazon (NASDAQ:AMZN) and JD.com (NASDAQ:JD) , and market saturation have forced Alibaba to move beyond hawking goods online. The company has been making investments in offline stores for quite some time now. It purchased 35% stake in department store operator InTime in 2014 and then purchased a 20% stake in retail giant Suning in 2015.

This year, it acquired the remaining stake in InTime and privatized the company. It purchased a stake in grocery chain Sanjiang Shopping Club Co Ltd. The company entered into a strategic partnership with Bailian Group to leverage on its big data capacities and to explore new retail opportunities across outlet design, technology research and development, customer relationship management, supply chain management, payment and logistics.

Last Words

Online retail is expected to see slow growth, while the overall retail market still has plenty of room for growth. This can be attributed to the fact that a large number of customers still prefer to shop offline and will continue to do so going forward.

That being said, the attempt to merge online and offline features of retail by giants like Alibaba and Amazon holds promise as it unites the confidence of shopping offline with the convenience of shopping online. It will not only reshape the retail landscape but also help them fend off competition, if they could manage a first mover advantage.

Alibaba shares currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

JD.com, Inc. (JD): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

When the market narrative becomes too widely accepted, excess seems to be created in some areas of the economy as businesses prepare for what’s coming their way. Today’s stock...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.