- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Airline Stock Roundup: In-Line Q1 Earnings at Spirit Airlines, Virgin

Earnings continued to grab attention in the airline space over the past week. Low-cost carrier Spirit Airlines (NASDAQ:SAVE) reported first-quarter 2015 earnings and revenues in line with the Zacks Consensus Estimate. However, the company’s anticipation of weakness in operating revenue per available seat mile (RASM) in the second quarter hurt the stock.

Another low-cost carrier – Virgin America (NASDAQ:VA) – outshone the Zacks Consensus Estimate on both the top and the bottom line fronts. However, the company’s guidance on capacity and passenger revenue per available seat mile (PRASM) was disappointing.

On the non-earnings front, headlines were dominated by the news of a technical glitch that delayed flights at American Airlines Group (NASDAQ:AAL). Airline behemoth Delta Air Lines (NYSE:DAL) reported traffic data for April, which was adversely impacted by a strong dollar, as has been the case for the last few months.

Alaska Air Group (NYSE:ALK), the parent company of Alaska Airlines, reported healthy traffic numbers for April on the back of strong demand. Another major event in the airline space in the past week was the launch of the airline ETF – the Global Jets ETF (NYSE: JETS) – on April 30, 2015.

The NYSE ARCA Airline index declined 1.35% over the past five trading days mainly due to resurgent oil prices and Spirit Airlines’ tepid guidance. The launch of the airline ETF, however, pleased investors, curbing the magnitude of the fall of the index.

Recap of the Past Week’s Most Important Stories

1. Spirit Airlines’ first-quarter 2015 earnings (excluding special items) of 96 cents per share were in line with the Zacks Consensus Estimate. Operating revenues grew 12.6% from the year-ago quarter to $493.4 million, in line with the Zacks Consensus Estimate. The budget carrier said that it expects RASM to decline in the range of 14% to 15% for the quarter ending Jun 30, 2015 .

2. Delta Air Lines stated, while reporting traffic figures for the month, that its April PRASM, on a consolidated basis, declined 3.5% year over year due to foreign exchange pressure. A strong dollar negatively impacted international business.

Moreover, lower surcharges in international markets also hurt results. Airline traffic, measured in revenue passenger miles, went up 1.8% year over year to 16.87 billion on a consolidated basis. Domestic traffic climbed 2.6% in the month, while the same on the international front was up a mere 0.6%.

Consolidated capacity or available seat miles improved 3.7% to 20.29 billion. Load factor (% of seats filled with passengers) stood at 87% for domestic flights, up 0.6% year over year. However, the metric declined 360 basis points (bps) to 79.1% on international flights. Consolidated load factor was down 150 bps to 83.2%. The company registered a completion factor of 99.8%, with 86.8% of its flights on schedule.

3. Alaska Air Group saw its April air traffic (measured in revenue passenger miles or RPMs) move up 9.8% year over year on a 13.2% rise in capacity. Load factor (% of seats filled by passengers) fell 250 basis points to 83.6%, courtesy a greater rise in capacity. In Apr 2015, the carrier transported 219,000 more passengers than compared to the same month a year ago.

In the first four months of 2015, the company has generated RPMs of 10,458 million (up 9.3% from the corresponding period last year) and ASMs of 12,530 million (up 11.4%). Load factor declined 160 bps year over year to 83.5%.

4. Virgin America’s first-quarter 2015 adjusted earnings of 24 cents per share substantially beat the Zacks Consensus Estimate of 14 cents. Operating revenues came in at $326.4 million surpassing the Zacks Consensus Estimate of $322 million. Revenues also improved 4.1% from the year-ago figure.

5. Several flights of American Airlines Group recently experienced significant delays due to a software glitch. According to media reports, pilots’ iPads crashed abruptly resulting in the delay. Incidentally, iPads are used by the airline for distributing flight plans and other relevant information to its crew.

Performance

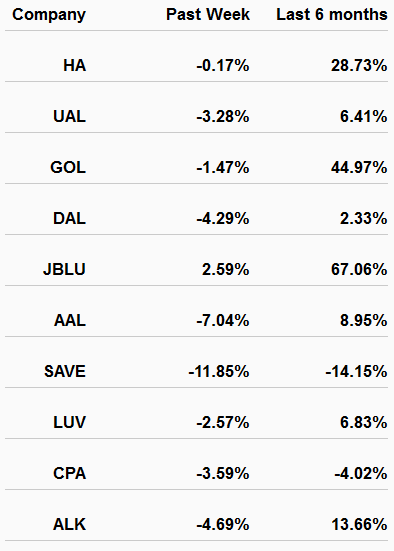

The following table shows the price movement of the major airline players over the past week and during the last 6 months.

As the chart above suggests, all the airline stocks -- with the exception of JetBlue Airways (NASDAQ:JBLU) -- traded in the red over the past week. Shares of Spirit Airlines suffered the most losing 11.85% in the face of a weak RASM guidance provided for the second quarter. Meanwhile, most of the stocks have gained over the last six months, with JetBlue witnessing the highest upside (67.06%) over the period.

What’s Next in the Airline Biz?

With the earnings season nearly over, we expect traffic updates from carriers like Southwest Airlines (NYSE:LUV) in the coming days. Focus will also remain on the price movement of airline stocks given the volatile nature exhibited by oil prices lately.

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.