- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Air Products To Provide Technology To Mozambique LNG Project

Air Products and Chemicals, Inc. (NYSE:APD) has signed a deal to offer its patented liquefied natural gas (LNG) technology, equipment and associated process licensing and advisory services to the Mozambique LNG Project.

Air Products' world-leading LNG manufacturing facility in Port Manatee, FL, will produce two LNG heat exchangers, which will be delivered to the Afungi Peninsula-based project site in Cabo Delgado, Mozambique. Notably, the LNG production plant is expected to be the first onshore LNG project at the Republic of Mozambique in Southeast Africa.

Per the deal with EPC contractor CCS JV, Air Products will offer two proprietary coil wound main cryogenic heat exchangers (MCHE) for the Mozambique LNG Project. Reportedly, MCHEs will run at the site as part of the two distinct LNG production trains geared to generate in total about 13 million tons of LNG per year from the Golfinho/Atum natural gas fields in Mozambique.

Proprietary LNG technology from Air Products processes and cryogenically liquefies valuable natural gas for consumer and industrial use. Notably, it is essential to meet the growing energy needs of the world and the desire for clean energy. The company produced LNG heat exchangers for over five decades and operated in 20 countries worldwide.

Air Products supports the LNG industry by providing key equipment and process technology for the liquefaction process of natural gas for large export plants, small and medium-sized LNG plants, floating LNG plants, and LNG peak shavers.

The company is also involved with the Coral South floating LNG (“FLNG”) project. Notably, it is Mozambique’s first offshore FLNG project and is scheduled to start production in 2022.

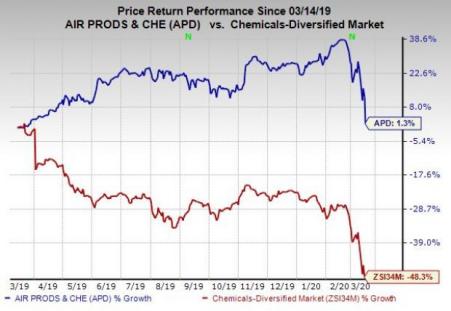

Air Products’ shares have gained 1.3% in the past year against the industry’s decline of 48.3%.

For fiscal 2020, it continues to expect adjusted earnings of $9.35-$9.60 per share, which suggests growth of 14-17% from the year-ago reported figure.

It also expects adjusted earnings of $2.10-$2.20 per share for second-quarter fiscal 2020, implying a 9-15% year-over-year rise.

Air Products and Chemicals, Inc. Price and Consensus

Zacks Rank & Stocks to Consider

Air Products currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Daqo New Energy Corp. (NYSE:DQ) , NovaGold Resources Inc. (NYSE:NG) and Barrick Gold Corp. (NYSE:GOLD) .

Daqo New Energy has a projected earnings growth rate of 353.7% for 2020. The company’s shares have rallied 57.2% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NovaGold has a projected earnings growth rate of 11.1% for 2020. It currently flaunts a Zacks Rank #1. The company’s shares have gained 54.4% in a year.

Barrick Gold currently has a Zacks Rank #2 (Buy) and a projected earnings growth rate of 49% for 2020. The company’s shares have rallied 28.7% in a year.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Barrick Gold Corporation (GOLD): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

Novagold Resources Inc. (NG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Mid-cap stocks don’t get the same headlines as large caps but move aggressively in both directions, creating outsized opportunities for investors. Unlike their mega-cap...

There’s no doubt it’s been a rough couple weeks for stocks: Both the S&P 500 and the tech-focused NASDAQ have wiped out most of this year’s gains, as of this writing. Stocks...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.