Air Products and Chemicals Inc. (NYSE:) signed a second long-term oxygen and nitrogen supply contract with a leading global materials supplier in Guangdong in South China. The move will help to strengthen Air Products' position in the strategic industrial base as well as its relationship with this global customer.

Per the deal, the company will build two sets of state-of-the-art cryogenic air separation plants in Guangdong to produce gaseous oxygen and nitrogen. The new plants are expected to come online in 2018. With the help of existing and new plants, Air Products will be able to increase gas supply capacity.

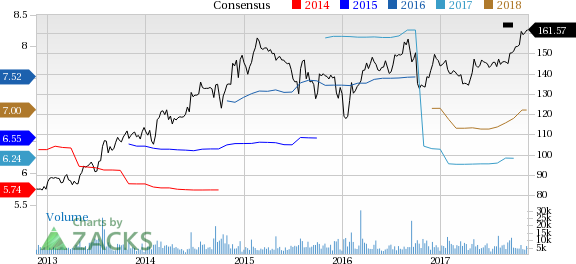

Air Products has underperformed the

industry it belongs to over the last six months. The company’s shares have moved up 12.7% over this period, compared with roughly 15.7% gain recorded by its industry.

Air Products logged fourth-quarter fiscal 2017 adjusted earnings of $1.76 per share, up 18% from the year-ago quarter. Earnings surpassed the Zacks Consensus Estimate of $1.69. Revenues rose 13% year over year to $2.2 billion in the reported quarter, beating the Zacks Consensus Estimate of $2.09 billion.

Air Products expects adjusted earnings per share of $1.60-$1.70 for first-quarter fiscal 2018, up 9-16% from the year-ago quarter. For fiscal 2018, Air Products expects adjusted earnings per share of $6.85-$7.05, up 9-12% year over year.

Air Products has a strong project backlog and benefits from actions to cut operational costs. Moreover, strategic investments in high-return projects, new business deals and acquisitions are expected to drive results in fiscal 2018.

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. Price and Consensus | Air Products and Chemicals, Inc. Quote

Zacks Rank & Other Stocks to Consider

Air Products currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Ingevity Corporation (NYSE:) , ArcelorMittal (NYSE:) and Westlake Chemical Corporation (NYSE:) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingevity has expected long-term earnings growth of 12%. Its shares have gained 35.6% year to date.

ArcelorMittal has expected long-term earnings growth of 11.3%. Its shares have rallied 29.2% year to date.

Westlake Chemical has expected long-term earnings growth of 10.4%. Its shares have moved up 68.4% year to date.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.