- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AI In Focus: 3 Pure-Play Stocks That Hold Promise

“Some people call this artificial intelligence, but the reality is this technology will enhance us.” — Ginni Rometty, Chairman, President, and CEO of IBM (NYSE:IBM).

Easing threats of a robotic apocalypse, the global Artificial Intelligence (AI) market is evolving at a lightning pace. Since its germination in early 1950’s, AI has been enhancing our lives like never before.

In fact, stocks from the AI space have been providing handsome returns, significantly higher than the broader market. Research firm Tractica expects AI market revenues to reach $59.8 billion by 2025. If such an optimistic forecast is to be relied on, it would be a quantum leap over the 2016 level of only $1.4 billion.

Global AI Trends

Be it virtual assistants or self-driven cars, AI has gained prominence across consumer, enterprise, and government sectors around the world. Per ROBO Global, the collective robotics market is anticipated to increase tenfold between 2015 and 2020.

About a month ago, the Kingdom of Saudi Arabia granted citizenship to the humanoid Sophia, developed by Hong Kong-based Hanson Robotics. If this was not fascinating enough, New Zealand-based entrepreneur, Nick Gerritsen recently developed the world’s first AI politician, Sam, who can address local issues related to education, housing and immigration.

We notice that demand for robotic products in the United States has been shooting up at workplaces as well as households. A report by Technavio suggests that the industrial robotics market in the country is expected to see an impressive CAGR of more than 12%.

So, it may not be too wrong to foresee a future where robots live cheek by jowl with humans!

AI Impact on 3 Major Sectors

From Apple Inc (NASDAQ:AAPL).’s SIRI to Microsoft’s Cortana and Amazon’s ALEXA to humanoid Sophia, the impact of AI has been incredible. While all the major sectors are trying to utilize their resources to come up with the best in the burgeoning AI trend, here we have zeroed in on three major sectors that are making the most of it.

Tech Sector: Convergence of AI & Big Data

It is actually the amalgamation of AI with big data analytics that drove Tech growth. In easier words, big data is a huge amount of unstructured data. When big data is integrated, analyzed and simplified, AI models originate.

Various reports suggest that growth in AI is directly proportional to growth in big data space. To substantiate, a report from Bank of America Merrill Lynch (NYSE:BAC) suggests that the big data market is set to reach a worth of $210 billion by 2020, thereby boosting AI and driving tech expenditure in days to come.

MedTech Sector: Robot Assisted Surgeries

AI has been enhancing the healthcare space with clinical applications, diagnostic support, operational efficiency, Electronic Health Record systems, practice workflows and supply chain management.

The growing prevalence of minimally-invasive robot-assisted surgeries, self-automated home-based care, use of IT for quick and improved patient care and shift of the payment system to a value-based model indicate the high prevalence of AI in the MedTech space.

MedTech major Intuitive Surgical Inc (NASDAQ:ISRG) designs, manufactures and markets the da Vinci surgical system — an advanced robot-assisted surgical platform. This AI platform enables minimally-invasive surgery that helps avoid the trauma associated with open surgery. The company plans to expand the usage of da Vinci in general and thoracic surgery, colorectal surgery and hernia repair in the days to come.

Auto Sector: AI Drives Driverless Cars

Although AI-powered cars have not hit the showrooms yet, in February, Ford Motor Company (NYSE:F) made huge investments in Argo AI, to develop a virtual driver system by 2021. In fact, a research report by ignite suggests that by 2020, nearly 250 million cars will be connected to the Internet globally.

With smart sensors, embedded connectivity applications and big data-enhanced geo-analytical capabilities, bigwigs like Alphabet Inc. (NASDAQ:GOOGL) and Tesla (NASDAQ:TSLA) are expending millions of dollars on AI infusion in automobile.

3 Stocks to Bet On

We have selected three pure-play AI companies, which, we believe tap into the promising long-term prospects.

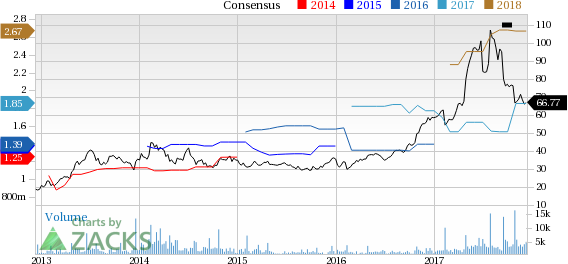

Fanuc Corp. (NYSE:F) offers state-of-the-art factory automation products globally. The company has a Zacks Rank #2 (Buy) and its earnings are estimated to grow 11.8% in the next three to five years.

Headquartered in Yamanashi Prefecture, Japan, Fanuc is a manufacturer of factory automation and robots. Last year, the company announced a collaboration to implement AI on the FANUC Intelligent Edge Link and Drive (“FIELD”) system with NVIDIA Corporation (NASDAQ:NVDA) . The FIELD system is a platform to boost factory production and efficiency with advanced AI and high-end computing technology.

Per reports, Fanuc leverages on proven technology instead of creating new technology. This creates a level of consumer reliability that outpaces its competitor products in the market at large.

Fanuc Corp. Price and Consensus

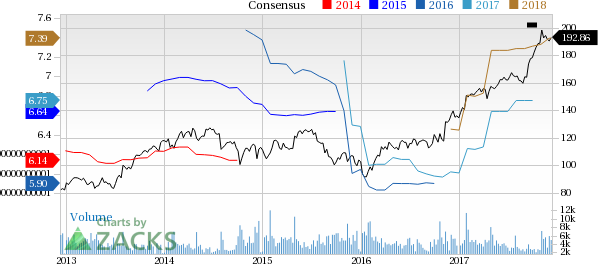

iRobot brought the first self-navigating FDA-approved remote presence robots to hospitals. Additionally, the company introduced the first practical home robot— Roomba — in home cleaning. The company’s product line feature proprietary technologies and advanced concepts in cleaning, mapping and navigation.

iRobot engineers are currently working on an ecosystem of robots to initiate the home-automation technology. The company recently closed the acquisition of Robopolis, the company’s largest European distributor.

iRobot Corporation Price and Consensus

Rockwell Automation Inc (NYSE:ROK). (ROK) offers premium industrial information and automation solutions in various end-markets across the globe. The company has a Zacks Rank #3 and its earnings are projected to climb 11.1% in the next three to five years.

The company brings together leading brands in industrial automation, including Allen-Bradley controls and services, Dodge mechanical power transmission products, Reliance Electric motors and drives, and Rockwell Software factory management software.

In the recently reported fourth quarter of fiscal 2017, Rockwell witnessed strong performance in semiconductor, automotive and metals. The company continues to make progress with OEM machine builders. It has a strong semiconductor business in Asia, and heavy industries business in Latin America.

Rockwell Automation, Inc. Price and Consensus

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Ford Motor Company (F): Free Stock Analysis Report

Tesla Inc. (TSLA): Free Stock Analysis Report

Rockwell Automation, Inc. (ROK): Free Stock Analysis Report

Fanuc Corp. (FANUY): Free Stock Analysis Report

iRobot Corporation (IRBT): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.