Agrium Inc. (NYSE:) and Itafos have entered into a definitive asset purchase agreement. Per the deal, Agrium will divest its Conda, ID phosphate production facility and adjacent phosphate mineral rights to Itafos for around $100 million, including working capital. The company has also inked a deal with Trammo Nitrogen Products, Inc., a fully-owned subsidiary of Trammo Inc., under which Agrium will sell its North Bend, OH Nitric Acid facility.

While the Conda facility and associated assets represent Agrium's superphosphoric acid business in North America, the North Bend facility include the company's nitric acid business in the Midwest region. Both the deals are expected to help pave the way for Agrium's proposed merger with Potash Corporation of Saskatchewan Inc. (NYSE:) which is expected to create $500 million in annual synergies.

As part of the Conda transaction, Agrium and Itafos will enter into long-term strategic supply and off-take agreements. Per the deals, 100% of the ammonia requirements of Conda Phosphate Operations will be supplied by Agrium. Also, the company will purchase 100% of MAP products produced.

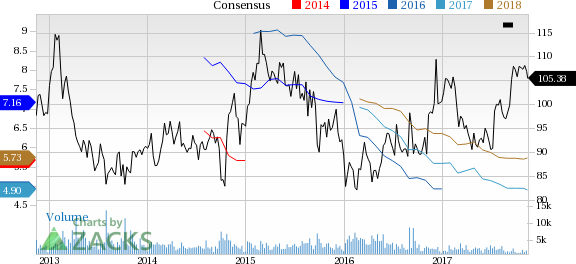

Agrium has underperformed the

industry it belongs to over a year. The company’s shares have moved up around 7.7% over this period compared with roughly 18.1% gain recorded by its industry.

The company posted net loss from continuing operations of $69 million or 52 cents per share in the third quarter of 2017, wider than the year-ago loss of $38 million or 28 cents. Barring one-time items, Agrium’s adjusted loss came in at 23 cents per share, wider than the Zacks Consensus Estimate of a loss of a penny.

Revenues increased 8.7% year over year to $2,382 million in the quarter. However, it missed the Zacks Consensus Estimate of $2,519 million.

Agrium revised its earnings guidance for 2017 to the range of $4.65-$4.80 per share (compared with $4.75-$5.25 expected earlier). The company lowered its guidance due to lower production volumes and unfavorable weather conditions which impacted Retail operations, particularly in areas impacted by hurricanes.

Agrium also expects Retail EBITDA in the range of $1.16-$1.19 billion, and Retail nutrient sales volumes in the range of 9.9-10.2 million tons in 2017. The company anticipates nitrogen production to total 3.3-3.4 million tons. Agrium's expects potash production of 2.4-2.5 million tons in 2017.

Agrium Inc. Price and Consensus

Agrium currently carries a Zacks Rank #3 (Hold).

Ingevity has expected long-term earnings growth of 12%. Its shares have gained 37% year to date.

Westlake Chemical has expected long-term earnings growth of 8.4%. Its shares have moved up 65.7% year to date.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

Westlake Chemical Corporation (WLK): Free Stock Analysis ReportIngevity Corporation (NGVT): Free Stock Analysis ReportPotash Corporation of Saskatchewan Inc. (POT): Free Stock Analysis ReportAgrium Inc. (AGU): Free Stock Analysis ReportOriginal post

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.