- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Aerie's (AERI) Q4 Loss Wider On Higher Operating Expenses

Aerie Pharmaceuticals, Inc. (NASDAQ:AERI) posted fourth-quarter 2017 loss of $1.38 per share, wider than the Zacks Consensus Estimate of a loss of $1.29 and the year-ago loss of 72 cents.

Quarter in Detail

In December 2017, Aerie's lead drug Rhopressa was approved by the FDA for the reduction of elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. This approval came two months ahead of the scheduled Prescription Drug User Fee Act date of Feb 28, 2018.

In the reported quarter, research and development expenses more than doubled to $38.1 million. General and administrative expenses surged 51.5% to $22.2 million. Also, higher operating expenses in the reported quarter reflect increased activities associated with the expansion of employee base to support operational growth and preparatory activities associated with the Rhopressa commercialization efforts apart from a $24.8-million research and development expense related to the Envisia asset acquisition.

For 2017, loss per share came in at $3.37, wider than the Zacks Consensus Estimate of a loss of $3.27.

Pipeline Updates

Aerie currently evaluates its second candidate, Roclatan, a once-daily, quadruple-action fixed-dose combination of Rhopressa and Xalatan. The NDA for Roclatan is expected to be filed in second-quarter 2018. The company has initiated a phase III trial, Mercury 3, in the third quarter of 2017 to prepare for regulatory submission in Europe. It will be a non-inferiority trial comparing Roclatan with prescribed fixed dose combination of Ganfort.

Meanwhile, Aerie plans to launch the drug Rhopressa in mid second-quarter 2018. The company has hired all regional sales directors and district managers as well as more than 30 of an expected 100 territory managers.The company expects to gain preferred formulary coverage for the majority of commercial payers for Rhopressa by late 2018 with most of the Medicare Part D coverage expected to commence in 2019.

Outlook

Aerie expects Rhopress revenues in the range of $20 million to $30 million in 2018.

Our Take

A wider-than-expected loss in the fourth quarter was due to higher operating expenses.

Aerie received a significant boost with the approval of lead drug Rhopressa. The FDA nod came ahead of the PDUFA date in February. This regulatory agency approval will significantly boost Aerie's prospects as glaucoma is one of the largest segments in the global ophthalmic market.

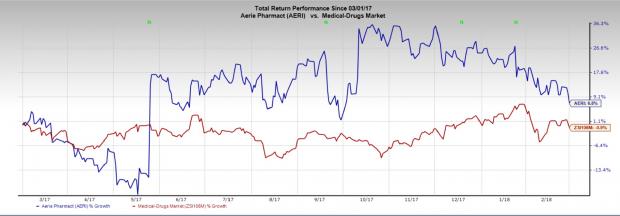

Aerie’s share price has outperformed the industry over the last 12 months. The stock has gained 6.8% versus the industry’s decline of 0.09%.

However, Aerie faces a stiff competition from established, branded and generic pharmaceutical companies’ drugs such as Novartis’ (NYSE:NVS) Simbrinza and Travtan, and Allergan’s (NYSE:AGN) Lumigan as well as products of other smaller biotechnology and pharmaceutical giants. Valeant Pharmaceutical’s (NYSE:VRX) Vyzulta was recently approved for an open-angle glaucoma or ocular hypertension. Rhopressa will confront a tough time in gaining market share due to competition from these products.

Zacks Rank

Aerie carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Allergan plc (AGN): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Valeant Pharmaceuticals International, Inc. (VRX): Free Stock Analysis Report

Aerie Pharmaceuticals, Inc. (AERI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.