- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Aerie (AERI) Gets Early FDA Approval For Lead Drug Rhopressa

Aerie Pharmaceuticals, Inc. (NASDAQ:AERI) announced that the FDA has approved its lead candidate, Rhopressa (netarsudil ophthalmic solution) 0.02% for the lowering of elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension.

The news comes as a significant boost for Aerie given that the company had no approved products in its portfolio. The FDA approval comes two months ahead of the scheduled Prescription Drug User Fee Act goal date of Feb 28, 2018.

Aerie plans to hire a sales force of 100 representatives in the first quarter of 2018 and plans to launch the drug by mid-2018.

An approval was in the cards as the Dermatologic and Ophthalmic Drugs Advisory Committee of the FDA voted in favor of Rhopressa’s approval in October 2017. Members of the committee unanimously agreed that the trials support the efficacy of netarsudil ophthalmic solution for reducing elevated intraocular pressure in patients with open-angle glaucoma or ocular hypertension. In addition, majority of the members agreed that the Rhopressa’s efficacy outweigh safety risks.

The news will surely relieve investors. In October 2016, Aerie withdrew its NDA for Rhopressa in the United States which was submitted in the third quarter of 2016. A third party manufacturing facility in Tampa, FL, not being ready for pre-approval inspection led to the withdrawal. The contract drug product manufacturer had previously informed Aerie and the FDA that it will be prepared for the inspection in January 2017 but then delayed it further. The manufacturer clarified that the delay is not a result of any new finding but the additional time needed to complete the validation of new equipment.

Glaucoma is one of the largest segments in the global ophthalmic market. According to the National Eye Institute, it has been estimated that more than 2.7 million individuals in the United States suffer from glaucoma. This number is expected to reach 4.3 million by 2030.

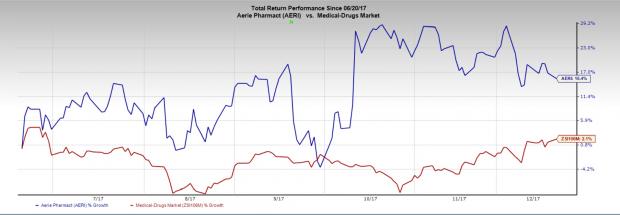

Aerie’s share price has increased 15.4% in the last six months as against the industry’s 2.1% rally.

However, Aerie faces stiff competition from established branded and generic pharmaceutical companies, such as Novartis’ (NYSE:NVS) Simbrinza and Travtan, and Allergan’s (NYSE:AGN) Lumigan, as well as other smaller biotechnology and pharmaceutical companies. Valeant Pharmaceutical’s (VRX) Vyzulta was recently approved for open-angle glaucoma or ocular hypertension. Rhopressa will face a tough time in gaining market share due to competition from these products.

Meanwhile, Aerie’s second product candidate, Roclatan (netarsudil/latanoprost ophthalmic solution) 0.02%/0.005%, which is a fixed dose combination of Rhopressa and latanoprost, achieved its primary efficacy endpoint in two phase III registration trials, named Mercury 1 and Mercury 2, and also achieved successful 12-month safety and efficacy results in Mercury 1. The company expects to submit its NDA for Roclatan in the second quarter of 2018.

Zacks Rank

Aerie currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Allergan PLC. (AGN): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Valeant Pharmaceuticals (NYSE:VRX) International, Inc. (VRX): Free Stock Analysis Report

Aerie Pharmaceuticals, Inc. (AERI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.