- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

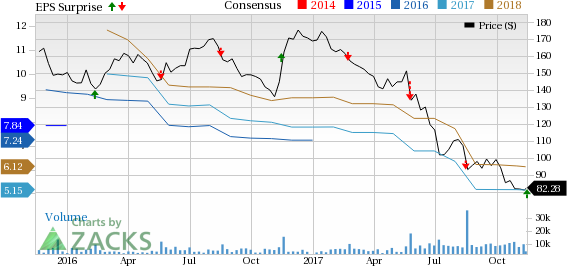

Advance Auto Parts (AAP) Q3 Earnings Top Estimates, Down Y/Y

Advance Auto Parts Inc. (NYSE:AAP) reported adjusted earnings of $1.43 per share in the third quarter of fiscal 2017 (ended Oct 7), declining 17.3% from $1.73 in the prior-year quarter. The figure, however, surpassed the Zacks Consensus Estimate of $1.22. Adjusted operating income declined to $172.2 million from $217.6 million in the third quarter of fiscal 2016.

Advance Auto Parts reported revenues of $2.18 billion, missing the Zacks Consensus Estimate of $2.21 billion. Revenues were 3% lower than the year-ago quarter figure. During the quarter, comparable store sales (comps) were down 3.4% year over year.

Gross profit declined to $947.7 million in the reported quarter from $988.2 million a year ago. Gross margin declined 51 basis points year over year to 43.4%.

Adjusted selling, general and administrative (SG&A) expenses totaled $775.5 million or 35.5% of sales compared with $770.6 million or 34.3% in the year-ago period.

Dividend

On Nov 7, 2017, the board of directors of Advance Auto Parts announced a regular quarterly dividend of 6 cents per share. The dividend will be paid on Jan 5, 2018, to stockholders on record as of Dec 22, 2017.

Financial Position

Advance Auto Parts had cash and cash equivalents of $363.3 million as of Oct 7, 2017, up from $135.2 million as of Dec 31, 2016. Total long-term debt was $1.04 billion as of Oct 7, 2017, almost unchanged from the Dec 31, 2016 figure.

For the fiscal third quarter, operating cash flow was $401 million compared with $427 million in the year-ago period.

Store Update

As of Oct 7, 2017, Advance Auto Parts operated 5,074 stores and 129 Worldpac branches and served approximately 1,250 independently owned Carquest stores.

Advance Auto Parts currently carries a Zacks Rank #3 (Hold).

A few better-ranked automobile stocks worth considering are Allison Transmission Holdings, Inc. (NYSE:ALSN) , PACCAR Inc (NASDAQ:PCAR) and Cummins Inc. (NYSE:CMI) . While Allison Transmission Holdings and PACCAR sport a Zacks Rank #1 (Strong Buy), Cummins carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission Holdings has a long-term growth rate of 10%.

PACCAR has a long-term growth rate of 10%.

Cummins has an expected long-term earnings-per-share growth rate of 12.1%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

PACCAR Inc. (PCAR): Free Stock Analysis Report

Advance Auto Parts Inc (AAP): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.