- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Adobe (ADBE) Q1 Earnings Top, Coronavirus Weighs On Guidance

Adobe Inc. (NASDAQ:ADBE) reported first-quarter fiscal 2020 non-GAAP earnings of $2.27 per share, surpassing the Zacks Consensus Estimate of $2.22. The figure decreased 0.9% sequentially but increased 32.7% on a year-over-year basis.

Adjusted revenues jumped 19% year over year to $3.09 billion, beating the Zacks Consensus Estimate by 1.5%.

This upside was driven by strong demand for the company’s Adobe Document Cloud and Adobe Experience Cloud products, along with growing subscription for cloud application.

Though the company’s fiscal first-quarter results topped expectations, its shares were down 9.6% due to lower-than-anticipated guidance for the fiscal second quarter due to headwinds related to coronavirus.

Management stated that the growing coronavirus crisis could delay enterprises booking decisions, reduce marketing spending and delay consulting service implementations. Consumers are reducing spending of late, which could affect the company’s top line in the fiscal second quarter.

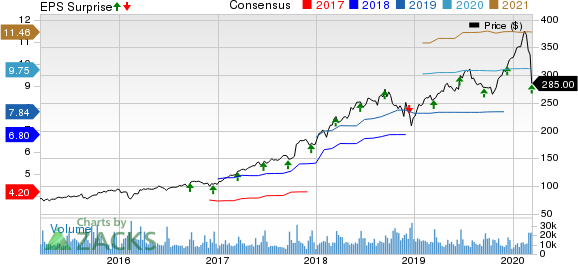

Adobe Systems Incorporated Price, Consensus and EPS Surprise

Top Line in Detail

Adobe reports revenues in three categories — subscription, product, and services & support.

Subscription revenues came in at $2.83 billion (accounting for 91.4% of its total revenues), up 22.6% on a year-over-year basis.

Product revenues totaled $143 million (4.6% of revenues), down 16.4% year over year.

Services &support revenues came in at $123 million (4% of revenues), decreasing 1.6% year over year.

Segment Details

The company operates in two reportable segments — Digital Media and Digital Experience.

Digital Media - This segment generated revenues of $2.17 billion, which increased 22% on a year-over-year basis. The segment comprises Creative Cloud and Document Cloud. Digital Media ARR came in at $8.73 billion. Strength in mobile and overall web traffic drove the Digital Media business.

In the segment, though the COVID-19 situation did not impact the overall business, the company witnessed weakness in China.

Creative Cloud (CC) generated $1.82 billion in revenues, reflecting 22% year-over-year growth. In addition, Creative ARR was up $329 million from the prior-year quarter to $7.58 billion. Growth drivers in the quarter were strong net new subscriptions across user segments and geographies. Product introductions, growth in emerging markets, solid demand for online video creation and improving average revenue per user across key offerings were other positives.

Document Cloud (DC) generated $351 million revenues, up 24% from the year-ago quarter. Moreover, Document ARR came in at $1.15 billion. This was driven by strong customer acquisition, and expanding portfolio of PDF mobile and web applications. Key wins in the quarter included Equifax (NYSE:EFX), Gannett, Shell (LON:RDSa) and Cummins (NYSE:CMI).

Digital Experience - This segment generated revenues of $858 million, up 15% on a year-over-year basis. The segment includes Adobe Experience Cloud. Experience Cloud subscription revenues were $739 million in the fiscal first quarter, up 21% year over year.

Operating Details

Gross margin was 85.4%, which expanded 70 basis points (bps) on a year-over-year basis.

Adobe incurred operating expenses of $1.66 billion, reflecting a 13.5% year-over-year increase. As a percentage of total revenues, sales & marketing and research &development expenses decreased from the prior-year quarter, while general & administrative costs increased.

As a result, adjusted operating margin was 30.3%, reflecting an increase of 360 bps year over year.

Balance Sheet & Cash Flow

At the end of the fiscal first quarter, cash and short-term investment balance was $4.17 billion, slightly down from $4.18 billion in the prior quarter. Trade receivables were $1.39 billion, down from $1.53 billion recorded in the fiscal fourth quarter.

Cash generated from operations was $1.32 billion versus $1.38 billion in the fiscal fourth quarter. During the reported quarter, the company repurchased 2.4 million shares.

Guidance

For second-quarter fiscal 2020, Adobe projects total revenues to be $3.175 billion. The Zacks Consensus Estimate for revenues is pegged at $3.22 billion. Adobe expects year-over-year revenue growth of 19% and 12% from Digital Media and Digital Experience segments, respectively.

Based on a share count of 486 million, management expects GAAP and non-GAAP earnings of $2.10 and $2.35 per share, respectively. The Zacks Consensus Estimate for the quarter is pegged at $2.34 per share.

Zacks Rank & Stocks to Consider

Currently, Adobe carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include Stamps.com Inc. (NASDAQ:STMP) , eBay Inc. (NASDAQ:EBAY) and Atlassian Corp. (NASDAQ:TEAM) . While Stamps.com and eBay sport a Zacks Rank #1 (Strong Buy), Atlassian carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Stamps.com, Atlassian Corp. and eBay is currently projected at 15%, 22.3% and 11.3%, respectively.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

eBay Inc. (EBAY): Free Stock Analysis Report

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Atlassian Corporation PLC (TEAM): Free Stock Analysis Report

Stamps.com Inc. (STMP): Free Stock Analysis Report

Original post

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.