- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Across-The-Board Losses For The Major Asset Classes Last Week

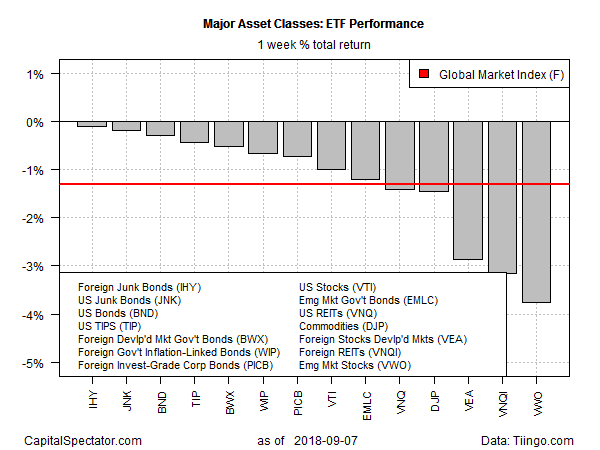

Selling weighed on all the main categories of global markets last week, based on a set of exchange-traded products. The biggest slide was posted in stocks in emerging markets.

Vanguard FTSE Emerging Markets (NYSE:VWO) slumped a hefty 3.8% in the US-holiday-shortened trading week through September 7. The decline left the ETF at its lowest close in more than a year.

An escalating trade war is a factor weighing on sentiment for assets in emerging markets. Rising interest rates in the US are another.

“Emerging economies have borne the brunt of the market stress since the start of the year,” wrote Didier Saint-Georges, managing director at asset manager Carmignac, in a note to clients. “In drying up the global flow of dollars, the Fed has weakened the entire EM asset class and literally wrecked those countries most reliant on dollar financing. The trade standoff initiated by the Trump administration thus amounts to a double whammy, with contagion doing the rest of the damage.”

Foreign junk bonds posted the smallest loss last week. VanEck Vectors International High Yield Bond (IHY) shed a relatively light 0.1%.

Last week’s selling nicked an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights slumped 1.3% last week — its first weekly decline in a month.

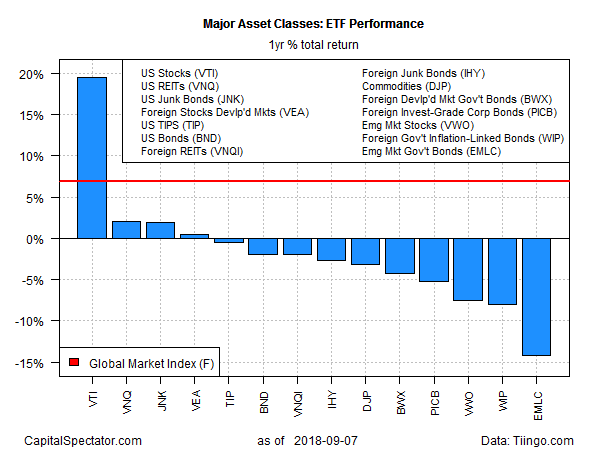

For one-year results, US stocks are still the extreme bullish outlier. Vanguard Total Stock Market (NYSE:VTI) posted a strong 19.5% total return for the 12 months through last week’s close. No other corner of the major asset classes comes close.

The second-best performance for the one-year change: Vanguard Real Estate (VNQ), which is up a modest 1.8% for the trailing one-year period.

The biggest setback over the past year: VanEck Vectors JP Morgan Emerging Local Currency Bond (NYSE:EMLC), which has lost 14.2% as of Friday’s close vs. the year-ago level (even after factoring in distributions).

For perspective, GMI.F is up 6.9% over the past year in total-return terms.

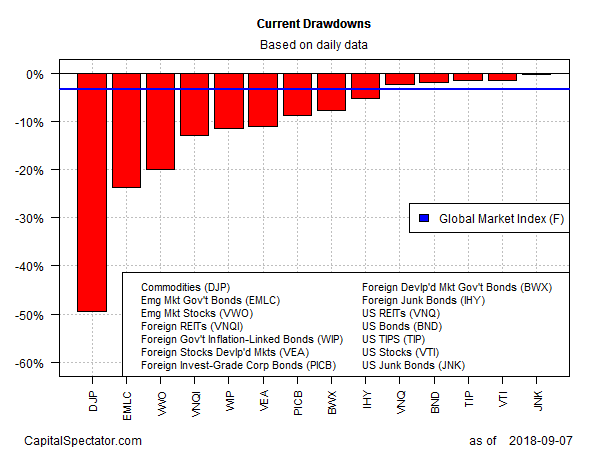

For current drawdown, broadly defined commodities continue to post the biggest decrease. The iPath Bloomberg Commodity (DJP) is nursing a nearly 50% peak-to-trough decline. At the opposite extreme, US junk bonds have a virtually nil drawdown at the moment, based on SPDR Bloomberg Barclays (LON:BARC) High Yield Bond (JNK).

GMI.F’s current drawdown is a mild -3.3%.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.