- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Achillion's Renal Disease Candidate Gets Orphan Drug Status

Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN) announced that the FDA has granted orphan drug designation to its lead factor D inhibitor candidate, ACH-4471, for the treatment of C3 Glomerulopathy (C3G), a serious renal disorder.

We note that the orphan drug designation is granted to drugs capable of treating rare diseases that affect less than 200,000 people in the United States. The status makes ACH-4471 eligible for seven years of marketing exclusivity in the United States, following an approval for C3G. The designation also makes the company eligible for certain other benefits, including tax credits related to clinical trial expenses, exemption from the FDA user fee and assistance from the FDA in clinical trial design.

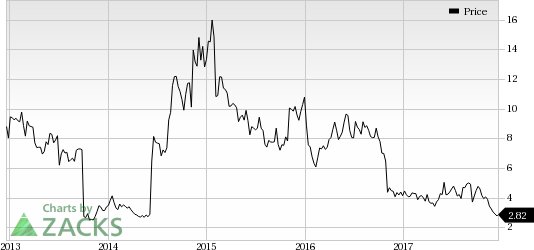

Shares of Achillion have underperformed the industry so far this year. The stock has lost 31.7% in contrast to the industry’s gain of 3%.

Preliminary data announced last month from a phase II study evaluating ACH-4471 demonstrated potential in treating C3G by reducing proteinuria, excess proteins in urine, by 50% over the treatment duration of 14 days

Achillion also announced the initiation of a phase I bioavailability study that will evaluate extended release oral tablet formulationsof ACH-4471. The endpoint of the study is to achieve once or twice daily dosing regimens of ACH-4471 with interim results expected by mid-2018.

Apart from C3G, the company is also developing ACH-4471 in a phase II study in patients with paroxysmal nocturnal hemoglobinuria (“PNH”).The candidate also enjoys orphan drug status for this indication.

Achillion has plans to initiate a phase II study in the first half of 2018 to evaluate the long-term potential of ACH-4471 in combination with Alexion Pharmaceuticals, Inc.’s (NASDAQ:ALXN) Soliris for treating PNH.

We remind investors that Achillion faced a major setback when Johnson & Johnson (NYSE:JNJ) sold its stake in Achillion last month, following the termination of the global license and collaboration agreement for developing hepatitis C treatments in September. With no approved products in its portfolio, Achillion has lost out on future revenues in the form of milestone payments.

Zacks Rank & Another Stock to Consider

Achillion carries a Zacks Rank #2 (Buy).

Another stock that investors may consider is Corcept Therapeutics Incorporated (NASDAQ:CORT) . The stock carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Corcept’s earnings per share estimates have increased from 78 cents to 88 cents for 2018 over the last 60 days. The company delivered a positive earnings surprise in two of the trailing four quarters with an average beat of 14.32%. The company’s stock is up 128% so far this year.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Johnson & Johnson (JNJ): Free Stock Analysis Report

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Achillion Pharmaceuticals, Inc. (ACHN): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.