- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Abercrombie (ANF) Beats On Q3 Earnings & Sales, Stock Up

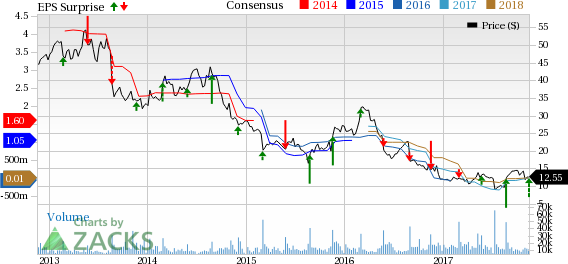

Abercrombie & Fitch Co. (NYSE:ANF) reported robust third-quarter fiscal 2017, wherein both its earnings and sales beat the Zacks Consensus Estimate and improved year over year. Notably, this was the company’s second straight positive earnings surprise and the third consecutive sales beat.

Results gained from significant progress on its strategic initiatives and strength in Hollister as well as direct-to-customer business, amid a highly promotional retail backdrop.

Consequently, shares of this Zacks Rank #3 (Hold) stock surged 25.5% in the pre-market trading hours. Additionally, the company’s initiatives like strategic capital investments, cost saving efforts, loyalty and marketing programs have aided Abercrombie to outperform the industry in the last three months. The stock gained 29.9% compared with the industry’s growth of 14.1%.

Q3 Synopsis

The company posted third-quarter adjusted earnings of 30 cents per share outpacing the Zacks Consensus Estimate of 24 cents. Also, the bottom line increased substantially from 2 cents earned in the year-ago quarter. Currency tailwinds, net of hedging, were roughly 1 cent per share in the quarter.

Net sales of $859.1 million surpassed the Zacks Consensus Estimate of $820 million and grew 5% year over year. The upside was driven by comparable sales (comps) growth of 4% as well as currency tailwinds impacting sales by 1%.

Brand-wise, net sales improved 10% to $508.1 million at Hollister but the same was down 2% to $351 million for Abercrombie. From a geographical view point, net sales grew 4% and 5%, in the United States and international markets, respectively. Direct-to-consumer sales performed well and accounted for 23% of the net sales, recording a growth of 24%.

The company remains encouraged by comps performance as it marked the fourth consecutive quarter of sequential improvement, driven by its strategic initiatives. Further, on a segmental basis, comps for Hollister increased 8%, offset by a 2% decline at Abercrombie.

Gross profit margin, on a constant currency basis, contracted 80 basis points (bps) to 61.3%, owing to reduced average unit cost that was more than offset by lower average unit retail.

Abercrombie reported adjusted operating income of $37.3 million for the quarter, substantially up from adjusted operating income of $13.6 million recorded in the prior-year period.

Financials

Abercrombie ended the quarter with cash and cash equivalents of $459.3 million and gross borrowings under its term loan agreement of $268.3 million.

As of Oct 28, 2017, inventories were $570.5 million, up 11% from the prior-year period.

On Nov 14, the company declared its quarterly dividend of 20 cents per share on the Class A Common Stock. This will be payable on Dec 11, 2017, to shareholders of record as on Dec 1.

Outlook

Following third-quarter results, management provided guidance for fiscal 2017 and the fourth quarter. The company expects foreign currency to be a tailwind, reflecting slight gains in sales and operating income.

For the fiscal fourth quarter, comps are projected to be up low-single digits while sales are anticipated to be in the band of up mid- to high-single digits. This includes gains of nearly $38 million from the 53rd week and roughly $20 million from foreign currency.

However, gross margin is projected to decline roughly 100 bps from the prior-year rate of 59.3%. Also, operating expense, including other operating income, is expected to decrease nearly 1% from $553.7 million recorded in the prior-year period. Abercrombie also expects average shares outstanding of about 70 million shares in the quarter.

Furthermore, the company expects effective tax rate to be in the mid 30s range for both the fiscal year and the fourth quarter.

Management expects to introduce four full-price stores in the quarter, following five stores opened till date that includes two outlet stores. Also, it plans to shutter nearly 60 stores in the United States by the end of the fiscal year through natural lease expirations. This includes 14 stores which are closed year to date.

Additionally, the company envisions capital expenditures to be roughly $110 million for fiscal 2017, up from $100 million, guided earlier.

Looking for Solid Picks, Check These

Investors can count upon some better-ranked stocks in the same industry like Zumiez Inc. (NASDAQ:ZUMZ) , Boot Barn Holdings, Inc. (NYSE:BOOT) and The Children's Place, Inc. (NASDAQ:PLCE) each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zumiez, with a long-term earnings growth rate of 18% has pulled off an average positive earnings surprise of 27.1% in the last four quarters.

Boot Barn Holdings, with a long-term earnings growth rate of 15.7% has delivered positive earnings surprise of 100% in the last quarter.

Children's Place, with a long-term earnings growth rate of 9% has come up with an average positive earnings surprise of 14% in the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As the digital economy starts to go online across businesses and the world, investors have to be aware of the companies and services that will be at the forefront of this...

Wall Street Indexes remain under pressure today but have held above the lows we saw on Tuesday as the Trump administration tariffs came into force. The announcement of tariffs on...

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.