- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Second Week Of Losses Weigh On All Major Asset Classes

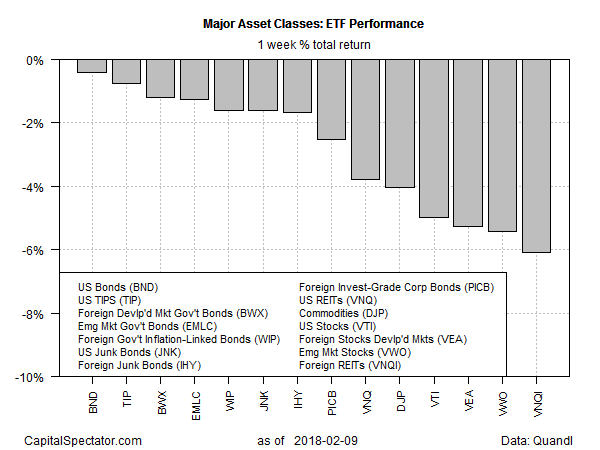

Red ink continued to spill across all the major asset classes last week, based on a set of exchange-traded products. The declines mark the second straight week of across-the-board selling.

The biggest setback was in foreign real estate/REITs. Vanguard Global ex-US Real Estate (NASDAQ:VNQI) suffered a sharp 6.1% decline over the five trading days through Feb. 9, settling at its lowest close in two months.

The lightest tumble was posted by US investment-grade bonds. Vanguard Total Bond Market (MX:BND) dipped a relatively soft 0.4%. Although BND’s latest decline is mild, the ETF ended last week at its lowest level since May 2017, based on adjusted prices that factor in distributions.

The recent rise in Treasury yields, driven by expectations of higher inflation, is weighing on fixed-income securities generally. The slide in bond prices is unusual at a time of falling stock markets, but there’s a macro explanation, Robin Griffiths, chief technical strategist at ECU Group, said on CNBC today.

In normal rotation from bull to bear, you’d go straight into government bonds, but this is the problem. With interest rates going up, because the economy is strong and inflation is picking up, government bonds have become not the safest asset class in the planet but toxic waste.

So, by relative comparison you’re sort of trapped into equities even though you know they are not good value.

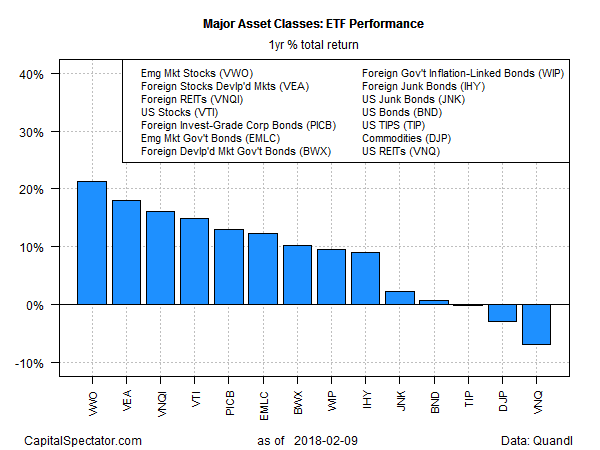

Despite the recent market turmoil, the one-year trend summary continues to reflect an upside bias in most corners. Although returns have been trimmed lately, broadly defined equity markets continue to post solid gains, led by emerging markets.

Vanguard FTSE Emerging Markets (NYSE:VWO) continues to hold the top spot for the major asset classes for one-year performance, posting a 21.3% total return through last week’s close.

Losses in the one-year column are currently limited to a handful of markets, with US real estate investment trusts sliding the most vs. the year-earlier level. Vanguard REIT (NYSE:VNQ) is off 7% for the year through Feb. 9.

The yield-sensitive corner of real estate investment trusts has been hit by a two-front storm of rising interest rates and disappointing earnings news.

“REITs have underperformed significantly due to disappointing 2018 earnings guidance that has come below Street expectations,” John Kim, a REIT analyst at BMO Capital Markets, said on The Real Deal.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.