- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

A. O. Smith (AOS) Set To Launch ProLine XE Combi Boiler

A. O. Smith Corporation (NYSE:AOS) is set to roll out a ProLine XE Combination (Combi) Boiler in early 2018 that would deliver instant hot water as well as comfortable space heating for residential customers. Further, the service-friendly compact design of the latest product will offer easy installation, set-up as well as maintenance besides a host of other benefits to professional contractors.

The combi boiler’s critical components like the built-in circulator can easily be moved to an easily accessible location within the unit that simplifies service and maintenance. The user-friendly interface of the product features a backlit LCD display, offering text-based diagnostic information. Other notable features of the latest product include its set-up wizard, best-in-class energy efficiency, as well as reliability and space saving capabilities.

The product is capable of delivering up to 4.8 gallons of hot water per minute, making it the highest capacity in the combination boiler category. It also comes with an excellent energy-saving performance with 95% Annual Fuel Utilization Efficiency (“AFUE”) and a 10:1 turndown ratio. The company believes that the product is well-equipped to address hot water demands of residential customers in any season or climate.

Existing Business Scenario

A.O. Smith has been witnessing robust top-line momentum, driven by stellar demand for its products in China and boilers and commercial water heaters in the United States. Further, U.S. commercial water heater industry volumes are likely to go up by 10% this year, primarily backed by strong demand for electric units. Moreover, its Lochinvar-branded products have benefited from the transition from lower-efficiency to higher-efficiency boilers, new product introduction and market share gain.

The company is also taking up multiple capital expenditure initiatives to fortify business. The acquisition of the residential water treatment company, Aquasana, last year has been adding to its strength. The buyout will help the company to bring Asia-based reverse osmosis water treatment platform into the United Staes. Aquasana's carbon-based products will also provide the company a chance to cross-sell water treatment products in China.

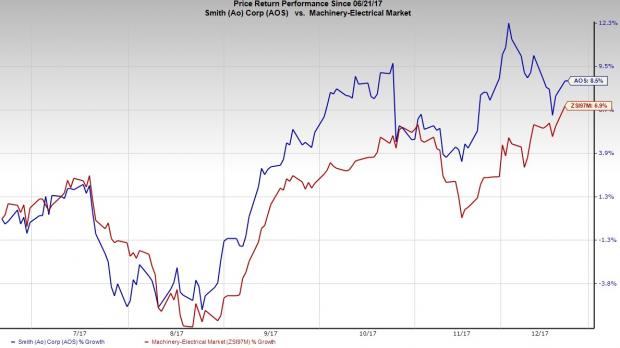

Notably, the Zacks Rank #3 (Hold) company’s shares delivered a return of 8.6% in the past six months, outperforming the industry’s average growth of 6.9%.

However, the company’s SG&A expenses in China have been quite high over the past few quarters, adding to the company’s overall operating expenses. Also, continuous rise in steel prices adds to the company’s woes.

Stocks to Consider

Some better-ranked stocks from the same space include Alamo Group, Inc. (NYSE:ALG) , Applied Industrial Technologies, Inc. (NYSE:AIT) and Avery Dennison Corporation (NYSE:AVY) . While Alamo Group sports a Zacks Rank #1 (Strong Buy), Applied Industrial Technologies and Avery Dennison carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alamo Group has outpaced estimates twice in the preceding four quarters, with an average earnings surprise of 6.1%.

Applied Industrial Technologies has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 9.7%.

Avery Dennison has surpassed estimates in the preceding four quarters, with an average positive earnings surprise of 6.9%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Smith (A.O.) Corporation (AOS): Free Stock Analysis Report

Alamo Group, Inc. (ALG): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Avery Dennison Corporation (AVY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.