- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

6 S&P 500 Tech Stocks To Soothe A Coronavirus-Scarred Portfolio

The coronavirus pandemic has been devastating for global stock markets including three major U.S. indices, namely Dow Jones, S&P 500 and Nasdaq. The unabated panic selling pushed all the three indices into the bear market territory, marking the fastest downside in history.

However, based on the $2-trillion stimulus package from the US government, the indices recovered handsomely on March 24. The Dow rallied 2,112.98 points or 11.37%, recording its biggest single-day gain after 1933. (Read More: US Government Reaches Deal on Stimulus Package: 5 Top Picks)

The S&P 500 and Dow Jones were up more than 1% and 2%, respectively, on Mar 25. Markedly, for the first time since Feb 12, the S&P 500 climbed on two consecutive days. The Dow's 14% gain over the successive sessions was also its strongest two-day performance since 1987.

Nevertheless, the overall market rally was mixed as several senators threatened to delay a vote. The stimulus package eventually got Senate’s approval by a voting ratio of 96-0 and sent it to the House of Representatives, which is likely to vote on Friday.

Tech Stocks to Stay Afloat From Possible Market Recovery

Although the economic impact of the pandemic coronavirus is still unfathomable, Senate’s approval of the stimulus package definitely boosts investors’ morale who are having a tough time wading through the market turbulence.

Investors looking to ride on a possible stimulus-led rebound should park money in stocks that are fundamentally strong with solid prospects.

Technology stocks remain attractive owing to consistent digital transformation in the sector. Rapid adoption of cloud computing along with the ongoing infusion of AI and machine learning as well as the accelerated deployment of 5G technology, blockchain, IoT, autonomous vehicles, AR/VR and wearables are major tailwinds.

Here we pick six tech stocks that apart from boasting strong fundamentals carry either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Best Buys

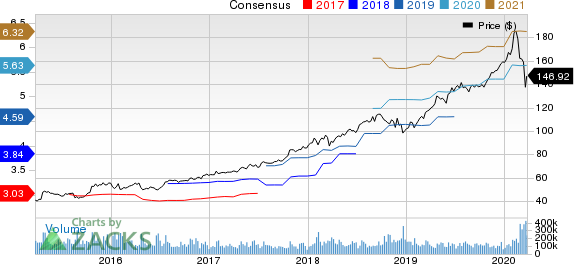

Microsoft (NASDAQ:MSFT) is well-poised to benefit from the robust adoption of Azure cloud platform and Office 365 applications. Moreover, coronavirus-led work from home surge drove the uptake of Teams, which now has more than 44 million daily active users (DAUs), thereby lending this Zacks Rank #1 stock a competitive edge against Slack and Zoom.

The Zacks Consensus Estimate for fiscal 2020 earnings is pegged at $5.64 per share, having been revised 5.2% upward in the past 60 days. Earnings are expected to grow 18.7% from the figure reported in the previous year.

Qorvo (NASDAQ:QRVO) is benefiting from the robust adoption of its wireless connectivity, base station and Gallium Nitride (GaN) technology-based solutions. Moreover, this Zacks #1 Ranked company’s expanding portfolio of 5G solutions amid accelerated deployment of 5G is a key catalyst.

The Zacks Consensus Estimate for Qorvo’s fiscal 2021 earnings stands at $6.07 per share, having moved 6.7% north over the past 60 days. Earnings are expected to grow 5.4% from the figure reported in the preceding year.

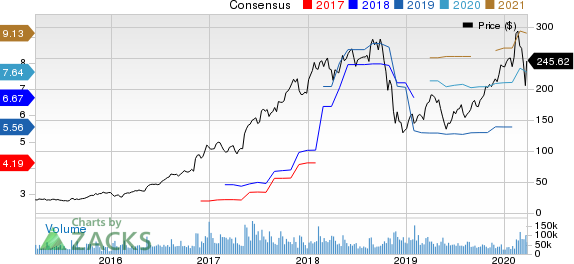

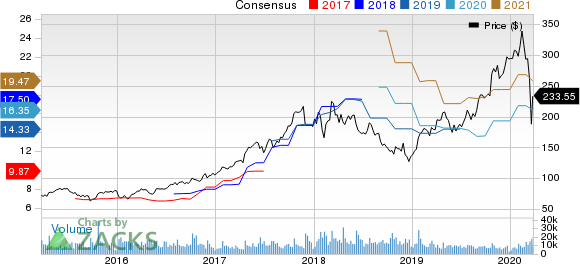

NVIDIA (NASDAQ:NVDA) is gaining traction from strong growth in GeForce desktop and notebook GPUs, which is aiding its gaming revenues. Moreover, an uptick in Hyperscale demand is a tailwind for this Zacks #2 Ranked stock’s data-center business. Additionally, ray-traced gaming, rendering, high-performance computing, AI and self-driving cars are key growth prospects.

The consensus mark for NViDIA’s fiscal 2021 earnings has increased 8.8% to $7.65 over the past 60 days, suggesting growth of 32.1% from the year-ago reported figure.

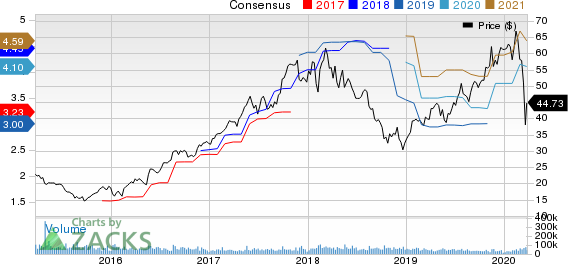

Applied Materials (NASDAQ:AMAT) is well-poised to gain from integration of advanced machine learning capabilities across its semiconductor fabs to enhance automated defect analysis.

This Zacks Rank #2 stock developed an automated defect classification technology that utilizes different imaging techniques to identify and eliminate defects in chip manufacturing. Moreover, the company's commitment toward development of new AI and machine learning-powered computing materials and designs, holds promise.

The consensus mark for fiscal 2020 earnings is pegged at $4.15 per share, having been raised 10.1% in the past 60 days. Earnings are expected to grow 36.5% from the figure reported a year earlier.

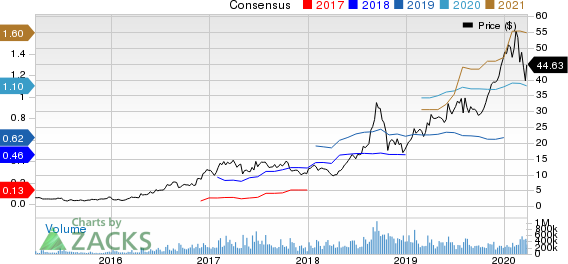

Advanced Micro Devices (NASDAQ:AMD) , based on the robust adoption of its Ryzen, Radeon and latest second-gen EPYC server processors, gained a significant traction across high-performance PC, gaming and data center markets. All these spaces benefited from the coronavirus-induced social distancing that led to buoyancy in demand for gaming and work-related laptops plus PCs.

Moreover, the growing clout of GPUs driven by the increasing adoption of AI techniques and machine learning tools in industries like gaming, automotive and blockchain holds promise for this #2 Ranked stock.

The consensus mark for fiscal 2020 earnings is pegged at $1.10 per share, having moved 1.9% north in the past 60 days. Earnings are expected to soar 71.9% from the prior-year reported number.

Lam Research (NASDAQ:LRCX) is benefiting from continued strength in logic and foundry spending. Transition to new data-enabled economy, in which DRAM and NAND continue to ride on density growth, is also favoring this Zacks Rank #2 company’s prospects. Moreover, sturdy adoption of 3D architecture is driving its non-memory segments.

The consensus mark for fiscal 2020 earnings stands at $16.35 per share, having been revised 7.5% upward in the past 60 days. Earnings are expected to grow 12.4% from the figure reported last year.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Qorvo, Inc. (QRVO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.