- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

6 Reasons To Add Lazard (LAZ) To Your Portfolio Right Now

Armed with cost-reduction initiatives, a strong financial advisory and asset management segments, Lazard Ltd. (NYSE:LAZ) appears a promising pick right now. Moreover, it is well-positioned to capitalize on the rising rate environment.

Lazard has been witnessing upward estimate revisions, reflecting analysts’ optimism. The stock has seen the Zacks Consensus Estimate for current-year earnings and that of 2018 being revised 2.6% and 1.4% upward, respectively, over the last 60 days. As a result, the stock carries a Zacks Rank #2 (Buy).

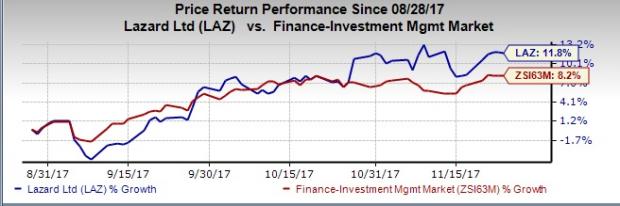

Shares of the company have widely outperformed the industry over the past three months. The stock has gained 11.8% compared with the industry’s rally of 8.2%.

Here’s What Might Drive the Stock Higher

Earnings Strength: Lazard recorded an earnings growth rate of 20.8% over the last five years compared with 3.9% of the industry it belongs to. The earnings growth rates for the current and the next year are anticipated to be 13.8% and 4.8%, respectively.

Further, the company has an impressive earnings surprise history, having outpaced the Zacks Consensus Estimate consistently in each of the trailing four quarters. The average beat was 14.2%. It also has a Growth Score of B.

Revenue Growth: Organic growth remains strong at Lazard. Revenues witnessed a compound annual growth rate of 5.1% over the last five years (2012-2016). Further, the top line is expected to increase 12.2% in 2017 compared with 7.3% growth estimated for the industry.

Favorable ROE: Lazard’s return on equity (ROE) supports growth potential. Its ROE of 38.81% compares favorably with the industry’s 11.75% average, implying that it is efficient in using its shareholders’ funds.

Prudent Expense Management: Lazard is diligently working on its cost-containment measures. In 2012, the company announced cost-reduction initiatives for which, the full impact of the savings was reflected in 2014. During 2014, 2015 and 2016, the company reported GAAP-adjusted operating margin of 25.5%, 26.4% and 25.0%, respectively, versus the targeted 25%.

Stock Looks Undervalued: The stock looks undervalued with respect to its price-to-earnings and price-to-sales ratios. Also, it has a Value Score of A.

Favorable VGM Score: Lazard has a VGM Score of A. Our research shows stocks with a VGM Score of A or B when combined with a Zacks Rank #1 (Strong Buy) or 2 offer the best upside potential.

Other Stocks to Consider

Some other top-ranked stocks from the same space are Federated Investors (NYSE:FII) , Ameriprise Financial (NYSE:AMP) and BlackRock (NYSE:BLK) .

Federated Investors has witnessed a positive earnings estimate revision of 3.9% for the current year over the last 60 days. Its share price has rallied 16.2% in the past three months. The company sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ameriprise Financial has seen the Zacks Consensus Estimate for the current-year earnings being revised 6.9% upward over the last 60 days. The company’s share price has increased 15.8% in the past three months. The stock carries a Zacks Rank of #2.

BlackRock has witnessed an upward earnings estimate revision of 1.5% for the current year over the last 60 days. Its share price has risen 15.8% in the past three months. The company is a Zacks #2 Ranked player.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

AMERIPRISE FINANCIAL SERVICES, INC. (AMP): Free Stock Analysis Report

Federated Investors, Inc. (FII): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

Lazard Ltd. (LAZ): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.