- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

5 Top Low-Beta Stocks Flying High Despite Severe Volatility

Wall Street has been grappling with volatility over the past three weeks with coronavirus cases increasing significantly each passing day. The market has been on a roller-coaster ride with a gain of 5-7% one day and a decline of 7-8% on the next day. Market participants are yet to see any signs of stabilization.

Meanwhile, not all stocks are bearing the brunt of the market turmoil. A closer look at the market tells us a different story. A few low-beta (beta value less than 1 but greater than zero) stocks have actually recorded strong gain since these are less volatile than the broader market. Investment in some of such stocks with a favorable Zacks Rank is likely to be fruitful at this juncture.

Severe Volatility Rattles Wall Street

On Mar 9, Wall Street put up its worst performance since the last recession in 2008. The coronavirus outbreak and an unexpected crude oil price war between the OPEC and Russia-led consortium resulted in the collapse of the global stock markets.

The three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — plunged 7.8%, 7.6% and 7.3%, respectively. In fact, the Dow plummeted 2,013.7 points, recording its worst-ever single-day performance pointwise and biggest single-day drop percentagewise since Oct 15, 2008.

However, on Mar 10, U.S. stock markets recovered some lost ground with the Dow posting a gain of 1,167.14 points. Notably, the Dow, the S&P 500 and the Nasdaq Composite rallied 4.8%, 4.9% and 5%, respectively. The indexes are currently around 15% away from their all-times highs achieved in mid-February.

Meanwhile, on Mar 9, the CBOE VIX — which reflects S&P 500 option bets to calculate expectations for volatility over the coming 30 days — jumped 30% to close at 54.46. This was the VIX’s highest closing since October 2008. On Mar 10, the VIX — popularly recognized as Wall Street’s best fear gauge — closed at 47.30, which was still significantly higher than its historical average range of 19 to 20. This clearly indicates that the market will remain choppy in the near term.

5 Low-Beta Stocks Flying High

We have narrowed down our search to five low-beta stocks that have popped in the past month, when coronavirus-led concerns shook global financial markets. We have applied three selection criteria.

We have picked stocks that witnessed upward earnings estimate revision for the year in the past 30 days. This indicates these stocks have strong potential irrespective of day-to-day market fluctuations. Second, these stocks have solid EPS growth rate for 2020. Third, each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

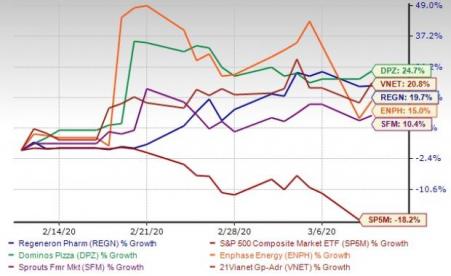

The chart below shows the price performance of our five picks in the past month.

Regeneron Pharmaceuticals Inc. (NASDAQ:REGN) is a biopharmaceutical company that discovers, invents, develops, manufactures and commercializes medicines for treating various medical conditions worldwide.

The Zacks Rank #1 company has an expected earnings growth rate of 16.5% for the current year. The Zacks Consensus Estimate for the current year has improved by 4.6% over the past 30 days. The stock has a beta of 0.77 and has risen 19.7% in the past month.

Enphase Energy Inc. (NASDAQ:ENPH) is a global energy technology company that delivers energy management technology for the solar industry. It designs, develops and sells home energy solutions for the solar photovoltaic industry.

The Zacks Rank #1 company has an expected earnings growth rate of 33.7% for the current year. The Zacks Consensus Estimate for the current year has improved 25.7% over the past 30 days. The stock has a beta of 0.21 and has jumped 15% in the past month.

Sprouts Farmers Market Inc. (NASDAQ:SFM) is a healthy grocery store, provides fresh, natural, and organic food products in the United States. Its unique model features fresh produce at the center of the store, an expansive bulk foods section and a vitamin department focused on overall wellness.

The Zacks Rank #1 company has an expected earnings growth rate of 3.2% for the current year. The Zacks Consensus Estimate for the current year has improved by 14.2% over the past 30 days. The stock has a beta of 0.35 and has rallied 10.4% in the past month.

Domino's Pizza Inc. (NYSE:DPZ) operates as a pizza delivery company in the United States and internationally. It operates through three segments: U.S. Stores, International Franchise, and Supply Chain.

The Zacks Rank #2 company has an expected earnings growth rate of 13.8% for the current year. The Zacks Consensus Estimate for the current year has improved by 2.5% over the past 30 days. The stock has a beta of 0.26 and has rallied 24.7% in the past month.

21Vianet Group Inc. (NASDAQ:VNET) provides carrier and cloud-neutral Internet data center services to Internet companies, government entities, blue-chip enterprises and small-to mid-sized enterprises in the People's Republic of China.

The Zacks Rank #2 company has an expected earnings growth rate of 66.7% for the current year. The Zacks Consensus Estimate for the current year has improved by 11.1% over the past 30 days. The stock has a beta of 0.13 and has climbed 20.8% in the past month.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Enphase Energy, Inc. (ENPH): Free Stock Analysis Report

21Vianet Group, Inc. (VNET): Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.