- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

5 REITs Poised to Continue Their Winning Streaks in 2022

Real Estate Investment Trusts (REITs) managed to pull off a decent performance this year. The FTSE NAREIT All REITs Index has gained 39.1% since the beginning of the year through Dec 29, outperforming the S&P 500 Index’s growth of 29.41%, as recovery in the economy translated into greater demand for the real estate.

The REIT sectors, namely data centers, infrastructure and industrial REITs, which support the digital economy, have continued to prosper so far, while the social-distancing-sensitive sectors have experienced a rebound.

With growth in cloud computing, the Internet of Things and big data, and an increasing number of companies opting for third-party IT infrastructure, data-center REITs are experiencing a boom in the market. Also, the tower REITs continue to witness high demand amid an increase in mobile data usage, spectrum availability and high network investments by wireless carriers. The wireless data consumption is likely to increase considerably over the next several years and therefore the constituents of these sectors have a chance to succeed.

Additionally, demand for self-storage space has increased owing to the flexible working environment and the improving housing market while move-outs remain low amid the prevalent health crisis, supporting occupancy levels.

Industrial REITs prove to be a great beneficiary of the e-commerce flourish and the supply-chain strategy transformations. Along with the fast adoption of e-commerce, the logistics real estate is anticipated to gain from a rise in inventory levels. The sector witnessed total returns of 57% since the beginning of the year through November 2021.

Recovery in the economy and relaxation of the coronavirus-related restrictions are aiding the rebound in the advertising environment. The out-of-home (OOH) advertising is evolving rapidly and continues to increase its market share compared with the other forms of media. In the upcoming years, higher technology investments are expected to further provide a cushion to OOH advertising.

Moreover, the chosen stocks must be consistent performers as the long-term value of a company is not affected by its short-term instability. With economic indicators exhibiting a recovery trend since the pandemic and the market dynamics of individual asset categories play a pivotal role in REITs’ operating performance, there is immense scope for growth.

Stock Picks

Here we handpicked five REITs that are poised to continue their winning streaks in 2022, using the Zacks Screener. Besides having solid fundamentals, these REITs hold a top Zacks Rank, indicating high chances of market outperformance over the next 1-3 months. These stocks are witnessing estimate revisions too, indicative of analysts’ bullish sentiment surrounding the same.

Boston, MA-based American Tower (NYSE:AMT) Corporation AMT is an independent operator of wireless communications towers. Its extensive and geographically-diversified communication real-estate portfolio is well-poised to benefit from the increasing capital spending by wireless carriers due to 5G deployments and the future deployment of an additional spectrum.

Recently, American Tower announced the completion of the acquisition of CoreSite Realty Corporation. The move offers American Tower the opportunity to capitalize on the latter's highly interconnected data center facilities and critical cloud on-ramps.

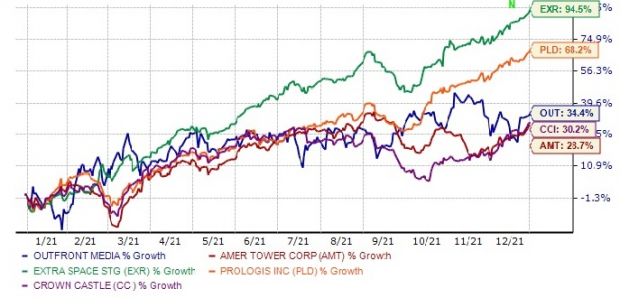

American Tower currently has a Zacks Rank #2 (Buy). Shares of AMT have gained 28.7%, outperforming the S&P’s growth of 28.4% in the year so far. In addition, the stock has seen the Zacks Consensus Estimate for both 2021 and 2022 funds from operations (FFO) per share being revised marginally north to $9.49 and $10.32 in a month’s time, respectively.

Prologis (NYSE:PLD) Inc. PLD is a leading industrial REIT that acquires, develops, operates and manages industrial properties in the United States and worldwide. PLD continues to benefit from the scale of its platform.

This industrial REIT behemoth’s performance in the recent quarters reflects robust demand for its properties, an increase in market rents and low vacancies. Given Prologis’ capacity to offer high-quality facilities in the key markets and a robust balance sheet, it is well poised to bank on these trends.

Prologis has a Zacks Rank of 2 at present. Shares of the industry player have gained 68.2%, outperforming the S&P’s growth of 28.4% in the year so far. Additionally, the stock has seen the Zacks Consensus Estimate for both 2021and 2022 FFO per share being revised marginally north in two months’ and a month’s time, respectively, to $4.12 and $4.62.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Houston-based Crown Castle International (NYSE:CCI) Corp. CCI is a leading independent operator of wireless communication towers in the United States. Given its ability to offer a holistic network solution with towers, fiber and small cells plus ample liquidity, Crown Castle is well poised to grow, banking on these trends.

CCI currently carries a Zacks Rank of 2. Shares of Crown Castle have gained 30.2%, outperforming the S&P’s growth of 28.4% so far in the year. In addition, the stock has seen the Zacks Consensus Estimate for 2021 and 2022 FFO per share being revised marginally north in three months’ and a month’s time to $6.89 and $7.37 respectively.

Located in Salt Lake City, UT, Extra Space Storage (NYSE:EXR) Inc. EXR is a notable name in the self-storage industry. This REIT is focused on expanding through accretive acquisitions, mutually beneficial joint-venture partnerships and a third-party management platform.

Shares of this currently Zacks #2 Ranked EXR have gained 94.5%, outperforming the S&P’s growth of 28.4% in the year so far. The consensus estimate for its 2021and 2022 FFO per share has moved up 1.1% and 2.1% to $6.86 and $7.68 over the past month, respectively.

Headquartered in New York, OUTFRONT Media Inc. OUT is a leading provider of OOH advertisement space in the key markets throughout the United States and Canada. With a diversified portfolio, both geographical and industry wise, OUT is well poised to gain from its improving billboard business, backed by a solid presence in the key markets and an improving industry.

Shares of OUTFRONT Media have gained 34.4%, outperforming the S&P’s growth of 28.4%, in the year so far. OUT currently sports a Zacks Rank #1(Strong Buy) . The stock has seen the Zacks Consensus Estimate for 2021 and 2022 FFO per share being revised 13.8% and 6.1% upward in the past two months.

Here’s how the above stocks have performed in the year so far.

Note: Anything related to earnings presented in this write-up represent FFO — a widely used metric to gauge the performance of REITs.

Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through November, the Zacks Top 10 Stocks gained an impressive +962.5% versus the S&P 500’s +329.4%. Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (AMT): Free Stock Analysis Report

Prologis, Inc. (PLD): Free Stock Analysis Report

Crown Castle International Corporation (CCI): Free Stock Analysis Report

Extra Space Storage Inc (EXR): Free Stock Analysis Report

OUTFRONT Media Inc. (OUT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.