- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

5 Must-Buy S&P 500 Large-Cap Growth Stocks At A Discount

Wall Street and other global stock markets have grappling with severe volatility over the past three weeks due to the coronavirus outbreak. Several governments, central banks and global economic agencies have taken a series of pre-emptive measures to minimize the impact of coronavirus on the economy and stock markets. However, markets are yet to stabilize and make northbound movement.

Meanwhile, several growth stocks have become ultra-cheap at present, some of which have strong growth potential with a favorable Zacks Rank, as a result of regular market fluctuations.

Severe Volatility Rattles Wall Street

Wall Street collapsed in February, especially in the last week. For the week ended Feb 28, the Dow, the S&P 500 and the Nasdaq Composite —tumbled 12.4%, 11.5% and 10.5%, respectively, recording their worst-ever weekly decline since October 2008. All three indexes entered in correction territory and are in the negative territory year to date.

However, on Mar 2, these indexes had regained some lost ground on news that several major central banks worldwide are likely to take initiatives to stimulate the global economy. This, in turn, helped them to move out of the correction mode. The Dow, the S&P 500 and the Nasdaq Composite rallied — 5.1%, 4.6% and 4.5%, respectively.

On Mar 3, the Fed opted for a surprising emergency rate cut of federal funds by 50 basis points. Despite this measure, Wall Street remained extremely choppy with the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — tumbling 2.9%, 2.8% and 3%, respectively. Moreover, investors rushed toward safe-haven sovereign government bonds resulting in historically low yields.

Meanwhile, on Mar 4, the Dow, the S&P 500 and the Nasdaq Composite surged — 4.5%, 4.2% and 3.9%, respectively, following former vice president Joe Biden’s emergence as the frontrunner of the Democratic Party’s presidential race and U.S. Congress’ decision to release emergency funds.

Various Preventive Measures

Several governments, central banks and global economic agencies are taking preventive measures to revive global economic growth. In the United States, the Fed reduced the benchmark lending rate by 50 basis points and the Congress has decided to release around $8 billion emergency funds to fight the spread of the coronavirus domestically.

The Bank of Canada has lowered benchmark interest rate by half a percentage point to 1.25%. The Reserve Bank of Australia reduced cash rate by 25 basis-points to a new low of 0.5%. The Bank of Japan boosted investor confidence with announcement that it would provide "ample liquidity" to keep financial markets stable.

Moreover, the International Monetary Fund and the World Bank have decided to release $50 billion and $12 billion, respectively, as aid packages for coronavirus affected countries in order to revive global economic. growth.

5 S&P 500 Growth Stocks at Ultra-Cheap Prices

Growth investors are primarily focused on stocks with aggressive earnings or revenue growth, which should propel their stock price higher in the future. Here we have applied three-tier selection criteria for our top picks.

Firstly, these are large-cap (market capital >10 billion) stocks as these stocks have strong business model and long history of operation. Secondly, these stocks have robust growth potential for rest of the year and witnessed solid earnings revisions in the past 30 days. Thirdly, each of our picks carry a Zacks Rank #2 (Buy) and Growth Score of A. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

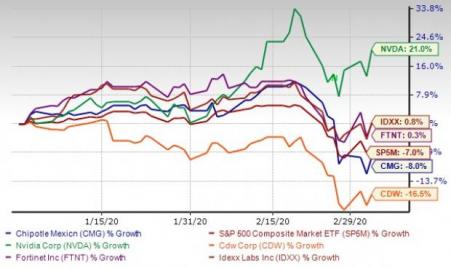

The chart below shows the price performance of our five picks year to date.

Chipotle Mexican Grill Inc. (NYSE:CMG) operates quick-casual and fresh Mexican food restaurant chains globally. The company has an expected earnings growth rate of 31.4% for the current year. The Zacks Consensus Estimate for the current year has improved by 2.2% over the past 30 days. The stock price is 22.2% below its 52-week high recorded on Feb 20.

NVIDIA Corp. (NASDAQ:NVDA) operates as a visual computing company worldwide. It operates in two segments, GPU and Tegra Processor. The company has an expected earnings growth rate of 34.7% for the current year (ending January 2021). The Zacks Consensus Estimate for the current year has improved by 9.9% over the past 30 days. The stock price is 11.2% below its 52-week high recorded on Feb 20.

CDW Corp. (NASDAQ:CDW) provides integrated IT solutions to business, government, education and healthcare customers in the United States, the U.K. and Canada. The company has an expected earnings growth rate of 9.2% for the current year. The Zacks Consensus Estimate for the current year has improved by 1.8% over the past 30 days. The stock price is 22.6% below its 52-week high recorded on Jan 16.

Fortinet Inc. (NASDAQ:FTNT) is a provider of network security appliances and Unified Threat Management network security solutions to enterprises, service providers and government entities worldwide. The company has an expected earnings growth rate of 10.1% for the current year. The Zacks Consensus Estimate for the current year has improved by 0.4% over the past 30 days. The stock price is 13.8% below its 52-week high recorded on Feb 6.

IDEXX Laboratories Inc. (NASDAQ:IDXX) develops, manufactures, and distributes products and services primarily for the companion animal veterinary, livestock and poultry, dairy, and water testing markets worldwide. The company has an expected earnings growth rate of 12.3% for the current year. The Zacks Consensus Estimate for the current year has improved by 0.2% over the past 30 days. The stock price is 12.6% below its 52-week high recorded on Feb 19.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Fortinet, Inc. (FTNT): Free Stock Analysis Report

CDW Corporation (CDW): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.