- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

5 Chemical Growth Stocks To Revitalize Your Portfolio In 2018

The chemical industry has gotten its mojo back after being roiled by the global economic crisis. The industry enjoyed a positive run this year, helped by an upswing in the world economy and strength across major end-use markets such as construction, electronics and automotive.

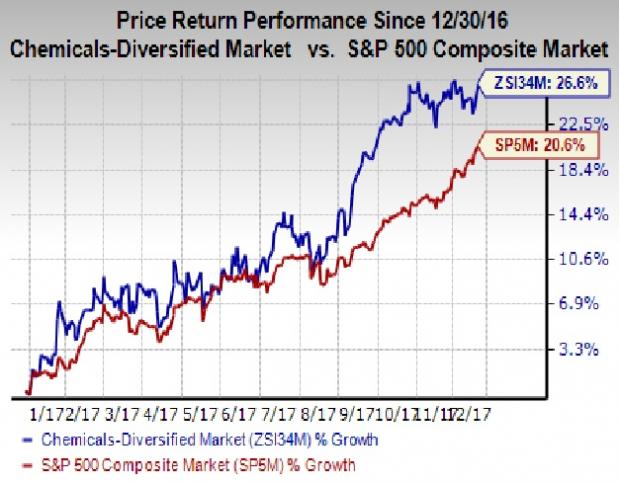

The Zacks Chemicals Diversified industry has outperformed the broader market year to date. The industry has gained around 26.6% over this period, topping S&P 500’s corresponding return of roughly 20.6%.

U.S. Chemical Industry to Ride Growth Wave

The U.S. Chemical Industry has recovered from the damaging effects of Hurricane Harvey and is set for solid growth in 2018. The American Chemistry Council (ACC), an industry trade group, envisions national chemical production (excluding pharmaceuticals) to rise 3.7% in 2018, further accelerating to a 3.9% growth in 2019. The growth is expected to be spurred by higher demand across light vehicles and housing markets, capital investments and improved export markets.

The trade group also expects basic chemicals production to expand 4.7% in 2018 and further gain steam with a 5.2% rise in 2019 on the heels of new capacity additions. Major export markets such as Latin America and Asia are expected to play a significant role in production growth.

The United States remains an attractive investment destination for chemical investment and domestic chemical makers continue to enjoy the advantage of access to abundant and cheaper feedstocks and energy. This is driving investment in chemical production projects.

Per the ACC, roughly 320 chemical projects have been already announced worth more than $185 billion, 62% of which is foreign direct investment. Moreover, roughly 65% of the chemical investment announced since 2010 are complete or under construction. New capacity is expected to provide a boost to chemical production as these investments come on stream.

The ACC also expects chemical industry capital spending to rise 6.3% in 2018 and 6.8% in 2019 and eventually reach $48 billion by 2022.

EU Chemical Sector Back in Business

The European chemical industry has also swung back to life on the back of improving global economic sentiment and a resurgent Eurozone economy. Eurozone’s recovery has been backed by declining unemployment and strengthening business and consumer confidence.

The outlook for the European chemical industry is positive. The European Chemical Industry Council (CEFIC) expects chemical output in the European Union to rise 2% year over year in 2018. Per the CEFIC, the growth of manufacturing production across sectors such as automotive, construction, metal production and electronics in the European Union has led to higher demand for chemicals in the region. Exports of chemicals produced in European Union have also increased, particularly, in Asia and Russia.

Demand Strength Across Key End-Markets

Chemical makers continue to see strong demand from construction and automotive sectors – major chemical end-use markets. A recovery across housing and commercial construction markets has been a tailwind for the chemical industry. The underlying trends in the housing space remain healthy, backed by steady buyer demand, low mortgage rates, high homebuilders’ confidence, low unemployment levels and rising rent costs.

The automotive sector also continues its good run amid certain challenges, supported by an improving job market, rising personal income, improved consumer confidence, low fuel prices, impressive vehicle launches and attractive financing options.

Another positive is a recovery in demand in the energy space – a key chemical end-market that had been out of favor for a while. The recovery has been driven by the rebound in crude oil prices. The recent uptrend in oil prices has been supported by a decline in U.S. oil stockpiles and extension of oil production cuts by OPEC and other major world producers until the end of 2018. Improving fundamentals in the energy space is expected to support chemical demand next year.

5 Chemical Growth Plays

The chemical industry is looking up, making it an attractive investment proposition for 2018. The industry’s momentum is expected to continue next year on sustained demand strength across major end-markets and significant capital investment. Amid such a backdrop, it would be a prudent idea to invest in chemical stocks with compelling growth prospects if you are looking to reap solid returns from your portfolio in 2018.

Growth investors look for stocks with aggressive earnings or revenue growth potential, which should lead to higher stock prices. With the help of our Style Score System, we have picked five stand-out chemical stocks that have excellent prospects and might offer solid investment returns.

Our research shows that stocks with Growth Style Score of A or B when combined with Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) offer the best investment opportunities in the growth investing space. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos Worldwide, Inc. (NYSE:KRO)

Headquartered in Dallas, TX, Kronos sports a Zacks Rank #1 and a Growth Score of A. The company has expected earnings growth of 41.1% for 2018. It delivered average positive earnings surprise of 58.8% over the trailing four quarters. Kronos also has a long-term expected earnings per share (EPS) growth rate of 5%. (Looking for the Best Stocks for 2018? Be among the first to see our Top Ten Stocks for 2018 portfolio here.)

Kraton Corporation (NYSE:KRA)

Our next pick in the space is Texas-based Kraton, armed with a Zacks Rank #1 and a Growth Score of A. The company has an expected EPS growth of 30.6% for 2018. It also delivered average positive earnings surprise of 32.9% over the trailing four quarters. Earnings estimates for 2018 for the company have also increased by around 10% over the last 60 days.

Ingevity Corporation (NYSE:NGVT)

South Carolina-based Ingevity is another attractive choice with a Zacks Rank #2 and a Growth Score A. The company has expected earnings growth of 14.3% for 2018. The company also delivered positive earnings surprise in each of the trailing four quarters with an average positive surprise of 10.4%. The stock has a long-term expected EPS growth rate of 12%.

W. R. Grace & Co. (NYSE:GRA)

Headquartered in Columbia, MD, W. R. Grace carries a Zacks Rank #2 and Growth Score A. The company has expected earnings growth of 8.5% for 2018. It also delivered positive earnings surprise in each of the trailing four quarters with an average positive surprise of 6.3%. Its long-term projected EPS growth rate is 12%.

Arkema S.A. (OTC:ARKAY)

France-based Arkema sports a Zacks Rank #2 and a Growth Score of A. The company has expected earnings growth of 8.3% for 2018. The Zacks Consensus Estimate for 2018 for the company have increased by around 1% over the last 60 days. Arkema also has a long-term expected EPS growth rate of 13.1%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Kraton Corporation (KRA): Free Stock Analysis Report

W.R. Grace & Co. (GRA): Free Stock Analysis Report

Ingevity Corporation (NGVT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.