- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

5 Best Stocks To Buy In A Coronavirus-Led Bear Market

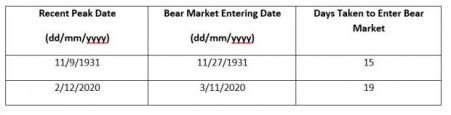

It seems the U.S. stock market’s bull run is coming to an end. The Dow has already plunged into the bear-market territory for the first time in a decade. And the blue-chip index’s descend from a recent peak has been the fastest since the Great Depression. This time, it just took 19 trading days for the 30-stock average to enter bear market, while in November 1931, when the Great Depression was evolving, the index took a brisk 15 days to pullback at least 20%.

Other major benchmarks, including the broader S&P 500, are also headed for a bear market. What’s more, the period of a typical bear market has a propensity to be pretty lengthy. On average, bear market for the Dow and the S&P 500 lasts for 206 and 146 trading days, respectively, per data compiled by Dow Jones Market Data. U.S. stocks, by the way, had already slipped into correction mode in February.

But what’s dragging stocks into a bear market? Investors are particularly tensed about the economic impact of the fast spread of coronavirus across the globe. Several companies have already raised alarm bells about the outbreak weighing on their earnings, and supply chains getting disrupted. And it will certainly lead to both a demand and a supply shock for the global economy, as it mostly erupted in China. After all, China is one of the world’s largest exporters and importers of goods.

Top equity strategist at Goldman Sachs (NYSE:GS), David Kostin, thus expects S&P 500 companies to see a collective drop of almost 15% in their earnings for the second quarter, and a drop of around 12% in the third.

Meanwhile, President Trump failed to quell worries about the possible economic slowdown from the coronavirus. In an attempt the curb the negative impact of the virus on the economy, he announced travel restrictions with Europe, and promised to offer “a payroll tax cut or relief” to both business houses and hourly wage earners.

But his proposals were received with scepticism from both Democrats and Republicans, as they were mostly looking for a more robust fiscal policy to counter slowing economic growth. At the same time, it’s quite evident, not all his proposed plans are likely to get passed in the Democratic-controlled House of Representatives. In fact, U.S. Treasury Secretary Steven Mnuchin did mention that it will take some time for the economic stimulus measures to get through Congress.

Recently, the World Health Organization declared the coronavirus outbreak a global pandemic. After all, governments from Italy to California have imposed bans on public gatherings in a move to restrict the spread of the illness. And this restriction in consumer movement will ultimately impact economic growth worldwide.

Which Stocks to Buy in a Bear Market?

No doubt, when the broader market nosedives, companies that offer big-ticket items like autos, machinery, high technology and home improvement items tend to take a beating. After all, they are cyclical stocks and do well when the economy is in a sound condition. But when the market is tanking and the economy is feared to enter a recession, it pays to switch to defensive sectors like healthcare, consumer staples and utilities. Stocks from these sectors are generally non-cyclical, or companies whose business performance and sales are not highly correlated with the activities in the larger market.

Health is no doubt a priority, and consumers will continue to avail healthcare products and services in difficult economic times. Similarly, food, beverage and tobacco companies are true defensive plays as demand for such staple stocks remains unaltered during market gyrations. Utilities too are deemed defensive stocks as electricity, gas and water are essentials.

5 Solid Choices

We have selected five solid stocks from the aforesaid areas that should make meaningful additions to your portfolio. These stocks flaunt a Zacks Rank #1 (Strong Buy) or 2 (Buy).

UnitedHealth Group Incorporated (NYSE:UNH) operates as a diversified health care company in the United States. The company has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has moved 0.1% up over the past 60 days. The company’s expected earnings growth rate for the next quarter and current year is 16.7% and 9%, respectively.

Pacira BioSciences, Inc. (NASDAQ:PCRX) provides non-opioid pain management and regenerative health solutions. The company has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has risen 19.8% over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 109.1% and 52.1%, respectively.

Turning Point Brands, Inc. (NYSE:TPB) provides tobacco products in the United States. The company has a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has climbed 5.1% over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 9.3% and 10.2%, respectively. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Coca-Cola Company (NYSE:KO) has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has moved 0.4% north over the past 60 days. The company’s expected earnings growth rate for the next quarter and current year is 4.8% and 6.6%, respectively.

Sempra Energy (NYSE:SRE) develops and operates energy infrastructure. The company has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has risen 3.2% over the past 60 days. The company’s expected earnings growth rate for the next quarter and current year is 12.7% and 5.2%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Sempra Energy (SRE): Free Stock Analysis Report

Coca-Cola Company (The) (KO): Free Stock Analysis Report

Pacira Pharmaceuticals, Inc. (PCRX): Free Stock Analysis Report

Turning Point Brands, Inc. (TPB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.