- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

5 Berkshire Stocks That Made Buffett Beat The Market In 2017

Warren Buffett’s impeccable knack for investment has enabled him to beat markets most of the time since 1964, when he took over the reins of Berkshire Hathaway Inc. (NYSE:BRKa) BRK.A, BRK.B. This makes Buffett the unrivaled investment guru, widely followed by equity investors across the world.

His investment acumen is evident from the way Berkshire Hathaway has grown into a conglomerate, piece by piece, over the years as a result of numerous small and big acquisitions. Now, Berkshire Hathaway houses more than 90 subsidiaries, selling everything from ice-cream to insurance under one roof.

Buffett manages a huge portfolio of equities, cherry picked by himself and invested in float primarily generated from Berkshire Hathaway’s insurance business. Buffett eyes bargain stocks and mostly considers the intrinsic value (fair value of a stock calculated by its future earnings power) of a stock for making investment.

His investment apart from value also includes understanding of the business, competitive advantages and capable management. These iron clad rules of value investing and his prowess to read Wall Street like a book has earned his securities portfolio impressive returns on investment for the past several years, a trend which continued this year too despite markets’ bull run.

How Have the Markets Been This Year?

The bull run of the U.S equity markets is now 9 years old, the second-longest in recent financial history. The 2017 boom was marked by Donald Trump’s take over of the White House, which pushed major indices to multiple highs on several occasions. The indices were favored by Trump’s pro growth policies to boost the economy and corporate profits, cut taxes, loosen regulations, increase spending and inflation.

Trump promised to double the pace of economic growth from 2%, create 25 million jobs over 10 years, and make the domestic economy the strongest in the world. The positive sentiments sent the stock markets rallying.

Performance of Buffett’s Equity Portfolio

Despite equity markets’ strong rally, Buffett was able to emerge as a winner. The value of his investment portfolio as of Dec 31, 2017 was $157.65 billion, up 29% from Dec 31, 2016, which compared favorably with the S&P 500’s gain of 17.2% during the same time frame. The top five positions account for nearly 60% of the portfolio: Wells Fargo (NYSE:WFC), Kraft Heinz Co., Apple Inc., (NASDAQ:AAPL) , Coca-Cola and Bank of America Corp. (NYSE:BAC) .

5 Stocks That Outperformed

While Buffett’s portfolio includes equity investments in several publicly traded companies, some of them like Coca Cola, Wells Fargo, Kraft Heinz Co. and Philips 66, which reserve big chunks, gave sub-par returns.

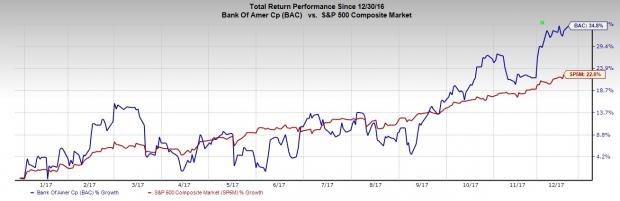

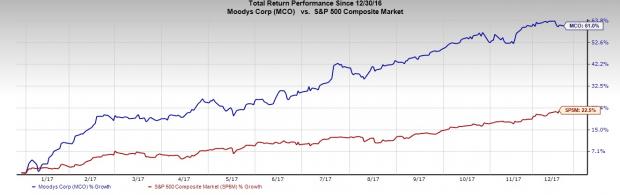

Nevertheless, the portfolio returns outshone the markets. Here are some stocks that helped to deliver returns. Each has outperformed the S&P 500’s growth of 22.5% year to date.

Apple Inc. designs, manufactures and sells mobile communication devices (iPhone and iPad), media devices (iPod, Apple TV) personal computers (Mac), and related software, services, peripherals and networking solutions, worldwide.

The stock, which comprised nearly 11.7% of the company’s investment portfolio as of Sep 30, 2017, has returned a good 53% year to date. It carries a Zacks Rank #3 (Hold). (Looking for the Best Stocks for 2018? Be among the first to see our Top Ten Stocks for 2018 portfolio here.)

Bank of America is a financial holding company. Its banking and non-banking subsidiaries provide a diverse range of banking and non-banking financial services and products. The stock, which comprised nearly 9.7% of the company’s investment portfolio as of Sep 30, 2017, has returned a 33.5% year to date. The stock carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

American Express Co. (NYSE:AXP) is a diversified financial services company, offering charge and credit payment card products, and travel-related services worldwide. The company continues to witness strong loan growth and credit metrics, plus lower operating costs. A solid market position, strength in card business and significant opportunities from a secular shift toward electronic payments are growth drivers.

The stock, which made up nearly 7.7% of the company’s investment portfolio as of Sep 30, 2017, has delivered 35% year-to-date returns. The stock carries a Zacks Rank #3.

Moody’s Corp. (NYSE:MCO) is a leading provider of credit ratings, research, data & analytical tools, software solutions & related risk management services, quantitative credit assessment services, credit training services and credit process software to banks and other financial institutions.

The stock made up nearly 1.9% of the company’s investment portfolio as of Sep 30, 2017, and has returned a whopping 62% year to date. The stock carries a Zacks Rank #1 (Strong Buy).

Southwest Airlines Co. (NYSE:LUV) is a passenger airline that provides scheduled air transportation in the United States. It primarily provides short-haul, high-frequency, point-to-point and low-fare services. Southwest Airlines is a leisure-oriented point-to-point carrier operating largely in Las Vegas, Chicago (Midway) and Phoenix.

The stock, which reserved nearly 1.5% of the company’s investment portfolio as of Sep 30, 2017, has returned 31% year to date. The stock carries a Zacks Rank #3.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Southwest Airlines Company (LUV): Free Stock Analysis Report

Bank of America Corporation (BAC): Free Stock Analysis Report

Moody's Corporation (MCO): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

American Express Company (AXP): Free Stock Analysis Report

Berkshire Hathaway Inc. (BRK.B): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.