America’s economic growth significantly has been significantly impacted by the coronavirus outbreak, with many expecting the country’s GDP to contract in the first two quarters this year. The coronavirus pandemic has wreaked havoc on the society, and dragged the stock market into bear territory. Many companies are anticipated to go bankrupt, and the current lockdown is certainly causing disruptions across multiple sectors.

Domestic and international flights have been cancelled, and many routes are shut down to curb the spread of the deadly virus. Thus, airlines are among the hardest hit by the coronavirus pandemic. Retailers primarily selling discretionary items are also among the biggest losers. In fact, retailers have not just been hit by the lockdown but also the economy, which is heading for a recession. It’s obvious that in such a scenario, consumers won’t be spending much, which will ultimately weigh on discretionary players.

In fact, in a shutdown economy businesses that involve congregating large number of people will also take a beating. Notable among them are restaurants. As for the housing sector, increasing job losses, due to the shutdown, are few to take advantage of the current low interest rate to buy homes.

Financials haven’t been spared either. Amid a low interest rate environment, and a weak economy that the extended lockdown would create, banks and other financial institutions are likely to bleed. But let’s admit stocks from these battered sectors will certainly gain traction in the near term, primarily due to the recent fiscal stimulus package.

The Senate unanimously passed the coronavirus relief package by a vote of 96-0. And airlines, in particular, will receive almost $60 billion in financial assistance as part of the Senate’s relief package. The bipartisan coronavirus aid package offers $25 billion in loans for passenger airlines, and $4 billion for cargo airlines. Passenger airlines also get $25 billion to pay workers through September, and cargo airlines get an additional $4 billion. Needless to say, that such stimulus initiative will certainly help airlines stay afloat.

In the rescue package worth $2 trillion, at least $250 billion is expected to be set aside for direct payments to individuals, and another $250 billion for unemployment benefits. Such measures should pep up consumer spending levels, and in turn buoy consumer discretionary companies including retailers.

The deal also focuses on providing $350 billion to small business houses as loans. Lest we forget that most of the restaurant stocks are small businesses. And finally, the relief package sets aside nearly $500 billion for distressed companies. This should benefit hard-hit sectors including construction and financials.

Housing, in itself, is expected to boom this year and millennials will act as the key catalysts. Most of these individuals will turn 30 next year and consider buying their first home. In fact, millennials are expected to take half of all mortgages this year, surpassing both Generation X and Baby Boomers, per realtor.com.

And when it comes to banks, in particular, Fed’s annual Comprehensive Capital Analysis and Review known as CCAR too confirmed that banks are well-prepared to combat the coronavirus crisis. The regulatory test proved that these financial institutions do have the necessary cushion to withstand a “severely adverse” economic condition.

Notably, legendary investors, namely Bill Nygren, Charlie Munger and Warren Buffett too have allocated more than 30%, 90% and 45% portion of their respective portfolios to the financial sector this year, especially the banks. What’ more, non-interest expenses of banks are increasing at a slower rate than total assets, which should boost profits margins. Significant improvement in operational efficiency also helped banks curtail expenses.

Nonetheless, we have selected fundamentally sound stocks from the aforesaid winning sectors that are likely to be meaningful additions to your portfolio. Here’re the picks –

Azul S.A. (NYSE:) provides passenger and cargo air transportation services in Brazil, but has expanded operations with selected non-stop service to the United States. The company, currently, sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for its current-year earnings increased 0.7% over the past 60 days. The company’s expected earnings growth rate for the current year is 7.2%. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Best Buy Co., Inc. (NYSE:) operates as a retailer of technology products, services, and solutions in the United States.The company, currently, has a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for its current-year earnings improved 1.4% over the past 60 days. The company’s expected earnings growth rate for the current year is 4.1%.

Chipotle Mexican Grill (NYSE:), Inc. (NYSE:) operates Chipotle Mexican Grill restaurants. As of Dec 31, 2019, it operated 2,580 restaurants in the United States.The company, currently, has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings increased 0.7% over the past 60 days. The company’s expected earnings growth rate for the current year is 29.4%.

D.R. Horton, Inc. (NYSE:) operates as a homebuilding company in East, Midwest, Southeast, South Central, Southwest, and West regions in the United States.The company, currently, has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings increased 6.1% over the past 60 days. The company’s expected earnings growth rate for the current year is 21.5%.

Metropolitan Bank Holding Corp. (M (NYSE:) B) provides a range of business, commercial, and retail banking products and services in the New York metropolitan area. The company, currently, has a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings increased 5.5% over the past 60 days. The company’s expected earnings growth rate for the current year is 23.6%.

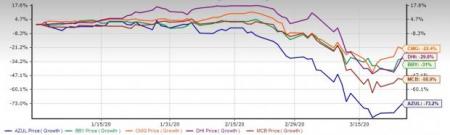

Notably, shares of Azul, Best Buy, Chipotle Mexican Grill, D.R. Horton and Metropolitan Bank have declined 73.2%, 31%, 22.4%, 29.8% and 50.9%, respectively, so far this year.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

Citigroup Inc. (C): Free Stock Analysis ReportBest Buy Co., Inc. (BBY): Free Stock Analysis ReportChipotle Mexican Grill, Inc. (CMG): Free Stock Analysis ReportD.R. Horton, Inc. (DHI): Free Stock Analysis ReportAZUL SA (AZUL): Free Stock Analysis ReportOriginal postZacks Investment Research

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.