- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

4 Reasons Why You Must Add Visa (V) Stock To Your Portfolio

We believe that Visa Inc. (NYSE:V) is a solid choice for investors seeking exposure in the thriving payments’ space. Among many other factors, the company’s investments in technology and global network, its robust brand name, and acquisition of Visa Europe bode well.

In the last 30 days, the Zacks Consensus Estimate for the company’s earnings has increased 1.5% for fiscal 2018 and 0.9% for 2019 to $4.05 and $4.68, respectively. This reflects analysts’ optimism about its prospects. The stock currently carries a Zacks Rank #2 (Buy).

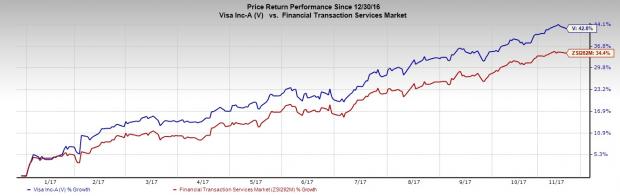

Further, shares of Visa have rallied 42.8% this year, outperforming the industry’s gain of 34.7%. This impressive price performance reflects investors’ positive stance following the company’s strong fourth-quarter results and favorable outlook for 2018.

Key aspects that make Visa an attractive investment option are:

Strong Earnings Outlook – Visa provided guidance for fiscal 2018. It expects annual net revenue growth of high single digits on a nominal dollar basis, earnings per share (EPS) growth of mid-40s on a GAAP nominal dollar basis, and high end of mid-teens on an adjusted, non-GAAP basis (versus 23% growth in fiscal 2017). Operating margins are expected in the high 60% range (versus 65.4% in fiscal 2016 and 67.3% in fiscal 2017). Strong earnings guidance instills investors’ confidence in the company.

Consistent Revenue Growth – Visa’s revenues have grown consistently over the past several years. It has witnessed a CAGR of 12.7% from 2008-2017. We strongly believe that the company will retain its revenue momentum in the coming quarters on the back of its strong market position and attractive core business that continue to drive up on new deals, renewed agreements, accretive acquisitions, increasing spending via cards, shift to digital form of payments and expansion of service offerings. The company expects annual net revenue growth of high single digits on a nominal dollar basis for fiscal 2018.

Visa Europe Acquisition Delivering Strong Value – The company completed the acquisition of Visa Europe in June 2016. The company stands to gain a competitive edge from a robust business model and increased scale with the acquisition of Visa Europe as it projects Europe to be a $3.3-trillion payments’ market and a high growth region in the future. The deal has been accretive to the company, having contributed to its top line by bolstering payments volume, cross-border volume and processed transactions. The deal contributed to fiscal 2017 EPS by mid single digits and management expects an addition of high single digits to fiscal 2018 EPS.

Strong Balance Sheet Position – Visa enjoys a solid cash and available-for-sale investment position along with strong free cash flow. Its free cash flow increased 11.2% in fiscal 2017. Management expects more than $9 billion in free cash flow in fiscal 2018 (pointing to growth of 5.9% year over year). Its strong balance sheet enables it to make acquisitions and fund capital expenditure that should drive growth in the long run.

Other Stocks to Consider

A few other stocks in the same space sharing the Zacks Rank with Visa are Total System Services, Inc. (NYSE:TSS) , Western Union Co. (NYSE:WU) and Green Dot Corp. (NYSE:GDOT) . You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Total System surpassed estimates in each of the last four reported quarters with an average positive surprise of 5.7%.

Green Dot beat estimates in each of the last four reported quarters with an average positive surprise of 26.9%.

Western Union delivered positive surprises in three of the last four reported quarters with an average positive surprise of 9.1%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Visa Inc. (V): Free Stock Analysis Report

Total System Services, Inc. (TSS): Free Stock Analysis Report

Green Dot Corporation (GDOT): Free Stock Analysis Report

Western Union Company (The) (WU): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.