- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

4 Electronic Stocks Worth A Bet Despite The Coronavirus Jolt

Technology stocks are anticipated to bounce back from the coronavirus-induced correction in the past week, backed by secular use of electronics across various sectors and exponential growth in cloud computing. (Read: Tech Stocks Reverse Declines Following Coronavirus Scare)

Notably, on Mar 2, 2020, the tech-laden NASDAQ Composite (IXIC) was up 4.5%. Further, the Technology Select Sector SPDR Fund (XLK), which tracks the performance of U.S. tech stocks, was up 5.8%. The recovery is a testament to the resilient nature of the overall technology sector. (Read: Forget Coronavirus: 5 Must-Buy Nasdaq Stocks to Tap Rally)

Markedly, the electronics space is gaining from growing proliferation of advanced instruments, electronic testing equipment solutions, thermal management systems, electrical connectors, motors, wearables, electronic design, and metrology solutions across all major sectors worldwide.

Primary Factors Driving Growth in Electronics Space

Evolution of semiconductor manufacturing processes from 10 nanometer (nm) to 7 nm and even 5 nm technology, is expected to boost innovation in electronics and in turn bolster prospects.

The companies involved in developing the next-generation electronic devices are looking forward to carve out a niche in the fourth industrial revolution or Industry 4.0.

Ongoing democratization of IoT techniques and AI is transforming robotics, industrial automation, transportation systems, retail, healthcare, defense, banking and finance, aerospace, utility, among other sectors.

Further, rapid adoption of innovative consumer-focused IoT devices like smart home devices, fitness trackers and home security solutions, smart TVs with 8K resolution, dual-screen laptops, high graphics performance gaming PCs amid accelerated deployment of 5G is fueling demand for the products offered by electronics solution providers.

Making the Right Choice

Considering the long-term growth prospects of electronics stocks one should avail the opportunity of the sell-off witnessed in the last week.

We believe fundamentally-strong companies have greater possibilities of bouncing back once the impact of coronavirus subsides.

Nevertheless, the immense prospects of the electronics industry make it difficult to pick the right stock. It is here that the Growth Style Score comes in handy. Our Growth Style Score condenses all the essential metrics from the company's financial statements to achieve a true sense of quality and sustainability of its growth.

With the help of our Zacks Stock Screener, we have filtered stocks that have a favorable combination of a Growth Score of A or B and a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Per Zacks’ proprietary methodology, stocks with this favorable combination offer solid investment opportunities in the growth investing space.

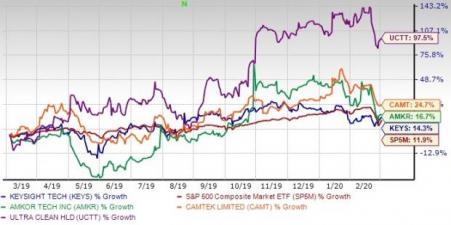

Moreover, each of the stocks has outperformed the S&P 500 in the past year despite looming coronavirus led dip.

One Year Price Performance

4 Key Picks

Amkor Technology, Inc. (NASDAQ:AMKR) is expected to benefit from solid demand for advanced packaging technologies in the consumer and mobile markets.

Moreover, accelerated deployment of 5G, is expected to strengthen the company’s position in the communications market.

Further, momentum across RF module, ADAS infotainment applications and power management areas, are promising.

The Zacks Consensus Estimate for earnings for 2020 has improved 25% to $1.00 over the past 30 days.

Further, Amkor currently has a Zacks Rank #1 and a Growth Score of A.

Ultra Clean Holdings, Inc. (NASDAQ:UCTT) is riding on improvement in fab utilization, which is expected to bolster growth in services division.

Moreover, the company is well poised to deal with the COVID-19 crisis led supply bottlenecks on uptick in memory segment.

The Zacks Consensus Estimate for earnings for 2020 has improved 35% to $1.89 over the past 30 days.

Markedly, the company currently has a Zacks Rank #1 and a VGM Score of A.

Camtek Ltd. (NASDAQ:CAMT) is anticipated to gain from high demand of its metrology and inspection equipment solutions for different applications including CMOS image sensors and interconnect packaging devices.

Moreover, the company expects strong demand across other territories and improvement in backlog to reduce the near-term business impact led by coronavirus.

The Zacks Consensus Estimate for earnings for 2020 has improved 9.1% to 72 cents over the past 30 days.

Further, Camtek currently has a Zacks Rank #2 and Growth Score of B.

Keysight Technologies, Inc. (NYSE:KEYS) is well poised to beat coronavirus-led business impact on rising demand of its semiconductor measurement solutions on the back of allegiance of semiconductor companies to develop chips on next-generation process technologies.

Moreover, growing clout of company’s innovative PathWave Test 2020 software holds promise. Further, adoption of latest support solutions, including Keysight Care, is expected to lead to gross margin expansion in the days ahead.

The consensus mark for earnings for fiscal 2020 has improved 3.7% to $5.38 over the past 30 days.

Notably, the company currently has a Zacks Rank #2 and a Growth Score of B.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Ultra Clean Holdings, Inc. (UCTT): Free Stock Analysis Report

Amkor Technology, Inc. (AMKR): Free Stock Analysis Report

Camtek Ltd. (CAMT): Free Stock Analysis Report

Keysight Technologies Inc. (KEYS): Free Stock Analysis Report

Original post

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.