- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

4 Battered Tech Bets On Investors' Radar Amid Coronavirus Sell-Off

The pandemic coronavirus has been a rude shock to the stock markets. All three major US indices namely, the Dow Jones, the S&P 500 and the Nasdaq have declined roughly 30% since mid-February. Moreover, the unabated panic selling pushed all the three indices into the bear market territory, marking to be the fastest in history.

Coronavirus disease (COVID-19) is wreaking havoc on global trade, investments, tourism, supply chains and particularly, consumer confidence. Threat of a global recession is increasing day by day as the total number of infections crosses 244,500 with at least 10,000 deaths, per the Johns Hopkins University data.

The economic impact of a recession will be severe as Economic Policy Institute expects three million job losses by the summer despite a moderate fiscal sop. OECD now anticipates global GDP to dip as low as 1.5% in 2020 from its previous projection of 3% provided in November 2019.

Can Equity Markets See a Speedy Recovery on Higher Stimulus?

Per CNBC and Goldman Sachs (NYSE:GS) analysis, there have been 12 bear markets since World War II, the average decline being 32.5%. On average, these bear markets lasted 14.5 months and took a couple of years to rebound.

However, some analysts now expect the equity markets to recover much faster than what was previously anticipated. This is primarily based on the various stimulus measures announced by the central banks and governments around the world to fight the economic downturn due to the pandemic.

Notably, the U.S. government is preparing several packages of aid and compensation comprising $50 billion as small business loans. (Read More: The Countdown to the Recovery Has Begun)

Meanwhile, the European Central Bank announced a new temporary asset purchase program of private and public sector securities called Pandemic Emergency Purchase Programme (PEPP) worth €750 billion.

Beleaguered Tech Stocks: Lucrative Buys

Investors are in particular having a tough time sailing through the current market turbulence. However, the panic-driven sell-off is creating buying opportunities in teeming proportion across sectors like technology, which remains attractive owing to consistent digital transformation.

Rapid adoption of cloud computing along with the ongoing infusion of AI and machine learning as well as the accelerated deployment of 5G technology, blockchain, IoT, autonomous vehicles, AR/VR and wearables are major tailwinds.

Here we highlighted four technology stocks that have lost more than 40% year to date. Given the aforementioned factors, investors should take advantage of the beaten-down prices.

Moreover, these stocks have a favorable combination of a Growth Score of A and a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Our Picks

Amkor Technology (NASDAQ:AMKR) is expected to benefit from solid demand for advanced packaging technologies in the consumer and mobile markets. Moreover, accelerated deployment of 5G is expected to strengthen the company’s position in the communications space. Additionally, the momentum across RF module, ADAS infotainment applications and power management areas is encouraging.

This Zacks #1 Ranked stock’s earnings are anticipated to jump 78.6% this year. Shares of Amkor Technology have declined 55.5% year to date.

Digital Turbine APPS has been exhibiting an impressive performance, spurred by buoyant advertiser demand and incremental uptake of innovative offerings including SingleTap, Notifications and Folders.

This Zacks Rank #2 company recently concluded the acquisition of Mobile Posse with an aim to strengthen its comprehensive mobile content delivery platform, which is anticipated to boost adoption further.

Digital Turbine’s fiscal 2021 earnings are expected to surge 82.5%, indicating an improvement from the year-ago reported figure. The stock has been down 47.7% year to date.

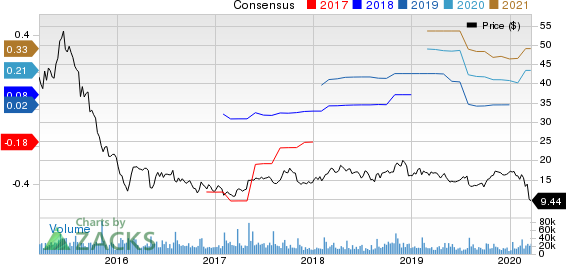

FireEye’s (NASDAQ:FEYE) subscription-based cloud protection service helps end-customers identify malware on any network and take preventive measures automatically.

As enterprises and governments urge a majority of their workforce to work remotely to limit the spread of the coronavirus, the threats of hacking are increasing exponentially. Moreover, as people are subjected to quarantines, the usage of internet-based services is booming, thereby offering huge scope for hackers to make a kill.

This Zacks #2 Ranked company expanded FireEye-as-a-Service (FaaS) to incorporate its threat intelligence and analytics in all alerts that its customers receive and not just those from FireEye's technology stack.

The company’s 2020 earnings are expected to soar 320%, suggesting a rise from the previous year’s reported figure. The stock has dropped 43.3% year to date.

Perion Network (NASDAQ:PERI) is riding on an expanding publisher base, increasing number of unique searches and higher revenues per month (RPM).

Moreover, Perion’s search business Codefuel’s improving revenue trajectory, driven by product innovation and effective sales effort, holds promise. Further, the buyout of Content IQ (CIQ) is expected to enhance this Zacks Rank #2 company’s digital branding division, Undertone, with more personalization content capabilities.

The company’s 2020 earnings are expected to increase 36.7%, implying growth from the prior year’s reported figure. The stock has plunged 41% year to date.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Amkor Technology, Inc. (AMKR): Free Stock Analysis Report

Perion Network Ltd (PERI): Free Stock Analysis Report

FireEye, Inc. (FEYE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.