- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3D Systems Releases Preliminary Q4 Results, Delays Filing

3D Systems Corporation (NYSE:DDD) released preliminary fourth-quarter 2017 and full-year results and announced that it will delay filing its annual report on Form 10-K. The company rescheduled its earnings release to Mar 14 adding that the deferment was due to accounting for revenues and costs related to product warranties.

Preliminary Results

The company expects revenues for the fourth quarter in the range of $176-$178 million, reflecting 6-7% growth compared with the prior-year period. The Zacks Consensus Estimate for the metric stands below at $164 million.The top-line rise is likely to be driven by robust a performance in healthcare, materials, software and on-demand manufacturing coupled with more balanced regional execution.

Also, GAAP loss is expected in the band of 8-10 cents per share in contrast to earnings of 5 cents in the comparable period last year. Non-GAAP earnings are expected within 3-5 cents, down from 15 cents in fourth-quarter 2016. The Zacks Consensus Estimate for quarterly bottom line is pegged lower at a couple of cents.

For 2017, the company projects revenues to grow about 2% year over year and come within $645-$647 million. GAAP loss for the year is anticipated in the range of 58-60 cents per share compared with a loss of 35 cents in the prior year. The company estimates non-GAAP loss to lie within 1-3 cents against non-GAAP earnings of 46 cents in 2016.

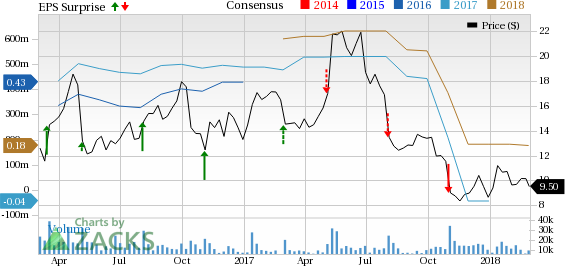

Earnings History

The company’s bleak earnings surprise history shows estimate misses by a huge margin in three of the trailing four quarters, the average negative surprise being a whopping 83.8%. Last quarter, the company reported an adjusted loss of 20 cents, lagging estimates by a massive 281.8%. The bottom line was dragged by top-line decline as well as a disproportionate rise in cost of sales.

3D Systems Corporation Price, Consensus and EPS Surprise

Also, 3D Systems’ earnings estimates have moved south in the past month, indicating a bearish analyst sentiment for the stock. The Zacks Consensus Estimate for 2017 earnings has been revised downward from a loss of 4 cents to a 5-cent loss over the past 30 days due to a downward estimate revision versus none upward.

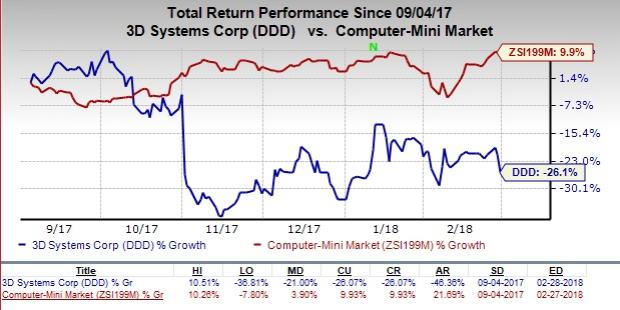

Over the last six months, shares of 3D Systems have underperformed the industry. The stock has plunged 26.1% against the industry's positive return of 9.9%.

Factors at Play

In the third quarter,the company had conducted a deep and extensive review of inventory based on year-to-date demand, customer data and market trends, and had also recorded a significant adjustment to the same. Moreover it implemented organizational changes to improve execution and increased investments as it shifts to a worldwide go-to-market structure.

Despite a steady momentum of healthcare offerings, robust demand for production printers and materials plus higher efficiency in “demand manufacturing services”, 3D Systems is apprehensive of a rough ride in the near future. The industry is battling a widespread decline in demand for enterprise 3D printers over the past two years. Other headwinds including economic slowdown, inflation, currency fluctuations and commodity price vagaries also marred the performance of most players in the industry.

Nonetheless, we still believe the acquisition of Vertex-Global Holding B.V to unlock multiple opportunities for the billion-dollar digital dentistry space. Also, the company’s efforts to streamline its cost structure by focusing on IT infrastructure, go-to-market and innovation are likely to stoke growth.

Given the numerous challenges grappling 3D Systems, the company has a Zacks Rank #4 (Sell).

Stocks to Consider

A few better-ranked stocks in the same space are HP Inc. (NYSE:HPQ) , Motorola Solutions, Inc. (NYSE:MSI) and Harris Corporation (NYSE:HRS) , each holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

HP Inc. has a decent earnings surprise history. The company recorded an average beat of 4.8% over the trailing four quarters, outpacing estimates thrice.

Motorola Solutions has an impressive earnings surprise history for the preceding four quarters, beating estimates each time with the average being 11.8%.

With four back-to-back earnings beats, Harris Corporation has a striking average positive surprise of 6.7%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

HP Inc. (HPQ): Free Stock Analysis Report

3D Systems Corporation (DDD): Free Stock Analysis Report

Harris Corporation (HRS): Free Stock Analysis Report

Motorola Solutions, Inc. (MSI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.