- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Ways To Play Rising Rates With Inverse Treasury ETFs

The fixed income space has been out of investors’ favor for much of this year given the looming concerns of the Fed dialing back its easy monetary policy ever since late May.

Though the Fed surprised the market with its ‘no taper’ shocker in September, a slew of positive economic data on employment, manufacturing and consumer spending has lately reignited fears of QE3 tapering, thereby leading to rising yields (read: 3 Bond ETFs Popular in the 'No Taper' Aftermath).

Yields on 10-year Treasury notes rose to around 2.9% currently and are slowly approaching the 3% mark seen in early September. Plus, the gap between the yields on short-term (2 years) and longer-term (10-years) notes has widened to a large extent, representing the highest level in nearly two and a half years.

Given the situation, investors are definitely pulling their money out of the long-term bond market. However, opportunistic investors could capitalize this beaten down Treasury bonds in the form of inverse ETFs.

For those investors, we have highlighted the three most popular inverse Treasury ETFs that could be worth playing in the current bond market. Before we do that, let’s quickly take a look at how it works (read: Guide to the 10 Most Popular Leveraged Inverse ETFs).

Inverse ETFs

Inverse ETFs provide opposite exposure that is a multiple (-1X, -2X or -3X) of the performance of the underlying index using various investment strategies, such as, swaps, futures contracts and other derivative instruments.

Since most of these funds seek to attain their goals on a daily basis, their performance could vary significantly from the inverse performance of the underlying index or benchmark, over a longer period when compared to a shorter period (such as, weeks, months or years) due to the compounding effect.

ETFs To Consider

Given the existing situation, investors could play the long-term Treasury bonds having residual maturity of 20 years or more by shorting the Barclays U.S. 20+ Year Treasury Bond Index.

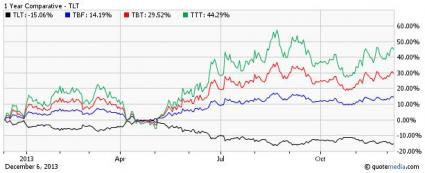

This can be done by investing in any of the following three inverse ETFs – ProShares Short 20+ Year Treasury ETF (TBF), ProShares UltraShort Barclays 20+ Year Treasury ETF (TBT) and ProShares UltraPro Short 20+ Year Treasury ETF (TTT).

TBF is the largest and most popular ETF in the inverse bond space with AUM of $1.6 billion and average daily volume of more than one million shares. It seeks to provide 1x inverse (or opposite) exposure to the daily performance of the Barclays U.S. 20+ Year Treasury Bond Index.

TBT, having AUM of nearly $4.5 billion, provides two times (2x or 200%) inverse exposure while TTT having AUM of $111.3 million delivers three times (3x or 300%) inverse exposure of the same index. TBT is more liquid than TTT, suggesting a tight bid/ask spread (read: Time to Buy Treasury Bond ETFs?).

In terms of performance, the product with three times exposure delivered higher returns of 34.73% in the year-to-date timeframe. The UltraShort and Short ETFs added a respective 23.70% and 11.47% so far this year. These returns are largely attributed to the negative sentiment prevailing in the bond market on tapering concerns.

Bottom Line

As a caveat, investors should note that these products are suitable only for short-term traders as these are rebalanced on a daily basis (see: all the Inverse Bond ETFs here).

Still, for ETF investors who are bearish on the bond market in the near term, any of the above products could make for an interesting choice. Clearly, a near-term short could be intriguing for those with high-risk tolerance, and a belief that the “trend is your friend” in this corner of the investing world.

Related Articles

When it comes to the economy, we’re in a bit of a weird spot: The data tells us that, despite inflation fears, interest rates are likely to fall in the year ahead. Falling rates...

Telegram Group Inc. is a globally recognized messaging service company, offering a cloud-based mobile and desktop messaging application. Known for its strong focus on security,...

Many investors regard passively managed index mutual funds or ETFs as favorable options for stock investing. However, they may also find that actively managed funds offer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.