- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Ultra Cheap ETFs For Value Investors

Researchers have come up with different explanations for the “value premium”, ever since Fama and French published their famous research paper in 1992, showing outperformance of value stocks over growth stocks over long term.

Further, numerous academic studies conducted since then have shown that value stocks have delivered higher returns with lower volatility compared with growth stocks over the long term in almost all the markets studied.

Does that mean that investors should ignore growth stocks? Not at all; growth stocks shine in certain market cycles and value stocks in some others. But given their proven performance over long term, value stocks and funds should be a predominant part of any ‘core’ portfolio.

Also, while some of the small cap companies have high return potential, they are mostly riskier and require frequent monitoring, and on the other hand established large cap companies with solid balance sheets and stable cash flows are less risky and thus more suitable for long term investors.

Are Cheaper Funds Better?

Expense ratios are an important factor in the return of an ETF and in the long-term, cheaper funds can significantly outperform their more expensive cousins, other things remaining the same.

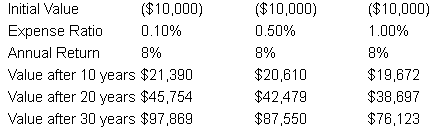

The following table shows how high expanses can affect fund returns. In the example, we put $10,000 in three funds, with annual expense ratios of 0.10%, 0.50% and 1.00% respectively and assumed that all three of them returned 8% per annum.

The difference in total returns (after expenses) becomes very significant as we increase the holding period. For the purpose of simplicity of calculations, we have ignored transaction costs and taxes.

We may add that expense ratio is not the only cost involved in investing in an ETF but it usually is the major cost, however investors need to look at other implicit costs too in addition to expense ratio.

Below, we have analyzed three large cap value ETFs with ultra-low expense ratios that should be considered by investors for their long-term, core portfolios.

Schwab U.S. Large-Cap Value ETF (SCHV)

SCHV provides broad exposure to large-cap U.S. stocks with value style characteristics, representing about half of the market capitalization of stocks in the Dow Jones U.S. Large Cap Total Stock Market Index.

Launched in December 2009, the fund has so far been able to attract assets worth $713.4M, which are invested in 356 holdings. With an annual fee of just 7 basis points, this product is the cheapest option in the space. Additionally, the dividend yield at 2.5% is quite attractive.

Financials (24.3%), Consumer Staples (12.2%), Energy (11.6%) and Consumer Discretionary (11.1%) are the top four sectors, the fund has invested in. With almost a quarter of the asset base invested in financials stocks, the product is likely to benefit from continued outperformance by the sector.

Exxon, GE, P&G, Chevron and Wells Fargo are among the top holdings. With top ten holdings accounting for just about 27% of the asset base, the fund is pretty well diversified.

SCHV is a Zacks Rank #1 (Strong Buy) ETF.

Vanguard Value ETF (VTV)

VTV follows a full-replication approach to track the performance of the CRSP US Large Cap Value Index. With AUM of $11.2 billion and an expense ratio of just 10 basis points, this is one of the largest and cheapest funds within the space.

Exxon, J&J, GE, Chevron and Microsoft are among the top holdings. The fund is quite well diversified with top ten holdings accounting for just about 28% of the asset base. Financials (22.6%), Healthcare (14.4%) and Energy (12.6%) are the top sectors. The product has returned 18.8% year-to-date.

VTV is an Zacks Rank #2 (Buy) ETF.

Vanguard Russell 1000 Value ETF (VONV)

VONV tracks the Russell 1000 Value Index, which predominantly comprises value stocks of large U.S. companies.

The fund charges a low expense ratio of 15 basis points while the SEC yield is attractive at 2.2% currently. Financial Services (29.6%), Energy (14.9%) and Healthcare (13.0%) are the top sectors in terms of asset allocation. Looking at the holdings-- Exxon, GE, Chevron, J&J and P&G occupy the top spots. The fund holds 649 stocks with top ten holdings accounting for about 27% of the asset base.

VONV is a Zacks Rank #1 (Strong Buy) ETF.

Original post

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.