- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Stocks To Gain As Trump Pulls Plug On Infamous MedTech Tax

The U.S. Medical Device industry has been riding high on optimism, courtesy of the Senate’s latest decision to postpone an industry-wide excise tax for another two years, known as the ‘Medical Device’ tax.

Notably, the tax will be effective from on Jan 1, 2020. The bill also delays the so-called Cadillac tax, a 40% tax on employer insurance, until 2022.

The repeal of the tax paradigm is expected to boost hiring and investment among the 9,000 America-based medical device manufacturers, instilling investor’s optimism in them.

The Medical-Device Tax

“This is a tax on innovation, a tax on jobs and a tax on the health and well-being of millions of American patients.” – Scott Whitaker, president and CEO of the Advanced Medical Technology Association.

The Medical-Device taxes were originally implemented in 2013 as part of the Obamacare. The taxes imposed a 2.3% excise tax on MedTech manufacturers, reducing the research and development (R&D) prospects.

Considering the headwinds, the senate placed a temporary suspension on these taxes from January 2016 to December 2017. Per data provided by the medical device trade group (in a Ken Blackwell article published by The Daily Caller), the partial two-year repeal of the MedTech tax resulted in around 83% rise in R&D investments by MedTech players.

However, the taxes were again brought back on Jan 1, 2018. But on Jan 22, the Fed came with its new law of respite with a $31-billion bill of tax cuts.

Why is the MedTech Fraternity Happy?

Revamps R&D Stature

MedTech companies will now be able to reinvest profits (tax savings) and enhance the R&D stature, launch new products, reduce capital depreciation, invest in early stage med-tech companies, execute clinical trials and ‘fuel the next generation of life-changing technologies for patients.’

A report by the Association for the Advancement of Medical Instrumentation suggests that big shots like Boston Scientific (NYSE:BSX) expressed concern in an email statement regarding lesser investments in innovative projects with leading medical facilities if the taxes were back.

Employment

The tax repeal is likely to reinforce domestic production, increase hiring of skilled professionals and lower the nation’s overdependence on offshore productions. Reports suggest that a complete repeal could generate more than 53,000 jobs very soon and increase wages.

Per a report by Modern Healthcare, reports suggest that 28,000 jobs were lost nationally in three years in which the tax was in effect. If the taxes were reestablished, the nation might have suffered cumulative loss of 25,000 jobs by 2021.

Let’s take a quick look on three major MedTech companies that are going to make the best out of the recent Tax-Repeal upheaval.

3 Stocks to Ride High on the Trends

There are hardly any evidences of MedTech companies witnessing strong R&D growth and margin expansion because of the tax-repeal in 2016. However, the market expects the recent tax-repeal to have a favorable impact on R&D and margin in the upcoming quarters. If that happens, the following three companies would be the leading ones.

We have taken the help of the Zacks Stock Screener to select favorable stocks. To shortlist the stocks from the vast universe of medical devices, we have picked the ones that carry a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

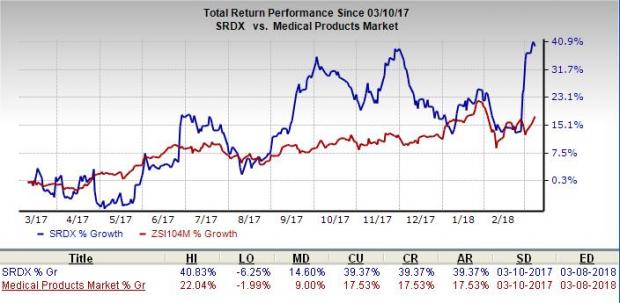

Surmodics, Inc. (NASDAQ:SRDX) : The stock sports a Zacks Rank #1. In the past year, the stock has returned 39.1%, higher than the industry’s return of 16.9%.

Surmodics’ efforts to improve research and development stature have been a key growth driver. The company’s whole product solutions pipeline and sirolimus-based below-the-knee DCB (Drug Coated Balloon) program deserve a mention. Surmodics has been making progress using its internally developed .014 DCB balloon platform

In the non-drug delivery R&D pipeline, Surmodics received the FDA clearance for its Telemark support microcatheter. The Telemark support microcatheter offers superior crossability for complex coronary and peripheral lesions. This microcatheter combined Surmodics' extreme composite shaft technology with a high performance pristine hydrophilic coating, that together provide exceptional deliverability, kink resistance and complex lesion crossing.

First quarter of fiscal 2018, R&D expenses were 46% of net sales, up from 33.6% of net sales in the year-ago quarter.

Edwards Lifesciences Corp. (NYSE:EW) : The stock has a Zacks Rank #2. In the past year, the stock has returned 49.1%, higher than the industry’s return of 24.7%

In December 2017, Edwards Lifesciences announced a strategic framework. The outlook indicates the company’s long-term growth strategy and recent progress in technology pipeline. In THV (Transcatheter Heart Valves), Edwards Lifesciences expects to maintain its leadership in the global TAVR market through increased focus on expanding patient access.

On the margin front, the company anticipates moderate expansion in gross margin on an improving mix, partially offset by capacity investments. More specifically, in terms of capacity investments, heavy investments are going into facilities and expanding the capacity in the United States and outside. Edwards Lifesciences also expects the global TAVR opportunity to exceed $5 billion by 2021.

Haemonetics Corporation (NYSE:HAE) :The stock sports a Zacks Rank #1. In the past year, the stock has returned 57.7%, higher than its industry’s return of 15%

Continued momentums in new business generation and geographical expansion have helped the company deliver strong results in the quarter. The company’s strong cash position boosts investors’ confidence. The expansion in gross and operating margin buoys optimism. The raised fiscal 2018 adjusted earnings guidance is also impressive.

The Paradox

Not to forget, the brunt of this tax relief is huge!

A report published by the Congressional Budget Office (CBO) projects that the two-year suspension will cost the federal government about $3.7 billion during that period and $310 billion to federal-budget deficits over the next decade.

Notably, the federal budget deficit reached $228 billion in the first three months of the current fiscal, $18 billion more than the deficit in the first quarter of fiscal 2017.

However, Republicans spurned these concerns with the belief that tax cuts will drive faster growth and national prosperity.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Boston Scientific Corporation (BSX): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Surmodics, Inc. (SRDX): Free Stock Analysis Report

Haemonetics Corporation (HAE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.