- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Shipping Stocks to Grace Your Portfolio in 2022

The Transportation sector is widely diversified in nature, housing airlines, railroads and shipping stocks to name a few. Gradual resumption of and subsequent uptick in economic activities had led the sector put up a much-improved showing in 2021.

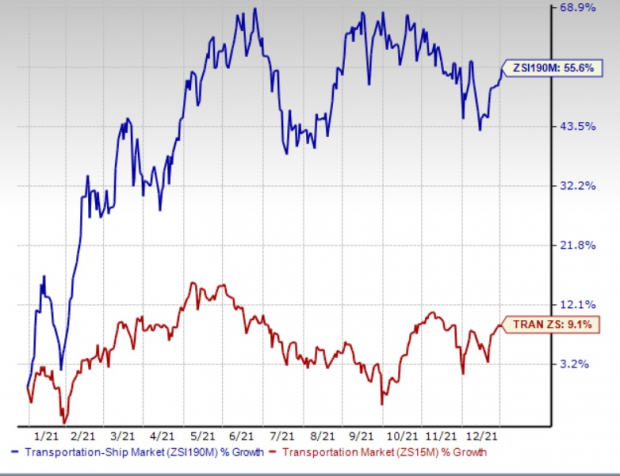

One of the brightest corners of the sector in the year gone by was the one housing shipping stocks. The Zacks Transportation - Shipping industry surged 55.6% in 2021, outperforming the Zacks Transportation sector’s 9.1% growth.

The outperformance was owing to factors like soaring demand for goods and commodities. What's more encouraging is that these factors should continue aiding the sector in the current year as well.

Against this backdrop, it appears to be prudent to add shipping stocks to one’s portfolio. Stocks like ZIM Integrated Shipping Services ZIM, Global Ship Lease (NYSE:GSL) GSL and Genco Shipping (NYSE:GNK) & Trading GNK, all of which gained significantly in 2021, are likely to continue their dream run in 2022 as well and are therefore considered prudent bets.

Let’s delve deep and analyze the reasons for the bullishness surrounding the shipping stocks in the current year.

The well-being of the participants in this industry is directly proportional to the health of the economy. Strength in manufactured goods and improving global economic conditions bode well for the industry.

With economic activities and trading volumes likely to continue improving despite the emergence of the new variants of COVID-19 like Omicron, the shipping industry is likely to continue flourishing. This is because shipping stocks are responsible for transporting bulk of the goods involved in world trade.

Per the outlook for 2022 provided by Moody’s, earnings for shipping stocks are likely to be much higher than the pre-COVID levels over the next 12 months as trading volumes are expected to remain strong. With demand for goods and commodities likely to maintain its upward trend in 2022 despite capacity being limited, rates should remain high. Therefore no or minimal addition of ships and the phasing out of some older vessels should keep the fleet size restricted and freight rates elevated in the current year.

The dry bulk market is likely to remain attractive in 2022 as economic activities gradually gather steam. Improved demand for dry bulk commodities and a relatively slow fleet growth are expected to boost the freight rate market in the current year. The northward movement of the Baltic Dry Index — a proxy for global dry freight rates across 23 routes — for most of 2021 buoys optimism for the dry bulk market.

With the resumption of economic activities, many companies, including some shipping players, are reactivating their shareholder-friendly measures like increasing their respective dividend payouts, which underline their financial strength and confidence in the business. This welcoming trend is likely to continue in 2022.

Moreover, oil price is likely to decline in 2022, which should support bottom-line growth of shipping companies. In December 2021, the U.S. Energy Information Administration (EIA) slashed its oil price forecast. The EIA in its December short-term energy outlook stated that it expects the average Brent spot price to be $70.05 per barrel for 2022.

This marks a decline from its November forecast wherein it had expected the average Brent spot price at $71.91 per barrel for 2022. It projects the same to average $73 per barrel during the first quarter of 2022. This estimate is $5.26 per barrel lower than its previous prediction.

With things looking rosy for the shipping industry in 2022, as pointed out in this article, adding shipping stocks to one’s portfolio seems a prudent move.

Below we present three shipping stocks that have a strong potential for 2022 and have seen upward earnings estimate revisions. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

ZIM Integrated Shipping Services went public in 2021. Shares of ZIM have had an amazing run on the bourses, gaining a phenomenal 410.1% since its IPO on Feb 28. Bullishness surrounding the containership market is a huge positive for ZIM. The containership market is being aided by ramped-up manufacturing activities in Asia besides other factors.

The Zacks Consensus Estimate for ZIM’s current-year earnings has moved up 43.7% over the past 60 days. ZIM currently flaunts a Zacks Rank #1). You can see the complete list of today’s Zacks #1 Rank stocks here.

Global Ship Lease is being aided by the bullish sentiment surrounding the containership market. GSL’s strong balance sheet is an added positive. Highlighting its financial prowess, GSL’s board announced in December 2021 a 50% hike in its quarterly dividend, taking the total to 37.5 cents per share (annualized $1.50). The increased dividend will be effective this year in the March quarter.

The upped dividend highlights Global Ship Lease’s commitment to create shareholder value. Following the 50% hike, the dividend amount jumped more than thrice the amount declared by GSL in January 2021. GSL’s expected earnings growth rate for the first quarter of 2022 is a massive 178.8% from first-quarter 2021 levels.

The Zacks Consensus Estimate for its current-year earnings has moved up 2.25% over the past 60 days. GSL currently flaunts a Zacks Rank of 1. Shares of GSL have gained 44.2% in a year’s time.

Genco Shipping & Trading is being aided by the optimism surrounding the dry bulk market. Increased fleet utilization with the gradual reopening of the economy and an upturn in world trade are also aiding GNK.

GNK’s expected earnings growth rate for the first quarter of 2022 is well above 100% from the first-quarter 2021 levels. The Zacks Consensus Estimate for its current-year earnings has moved up 15.4% over the past 90 days. GNK currently carries a Zacks Rank #2. Shares of GNK have gained 93% in a year’s time.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genco Shipping & Trading Limited (GNK): Free Stock Analysis Report

Global Ship Lease, Inc. (GSL): Free Stock Analysis Report

ZIM Integrated Shipping Services Ltd. (ZIM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.