- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Retailers To Buy

Stocks are the only item that, when they go on sale, people DON'T want to buy them.

But stock pull backs, like the one we've had so far in 2014, provide real opportunities for investors.

It's time to think about all those stocks that you've said, "if only I had bought that a year ago." Because pull backs mean that investors can suddenly get their favorite stocks much cheaper.

What stocks are on your wish list?

It's time to get that wish list out and go stock shopping.

Retail Was Hot But Now It's Not

A lot of the stocks on my own personal wish list are retailers. It's been a hot sector the last few years as the niche retailers have been able to expand both in the United States and internationally as the global economy improved.

But by the end of 2013, valuations and expectations got too expensive for my blood. While many of the retailers have growth, forward P/Es in the 30s and 40s were too high. It looked like the opportunity to buy had passed me by.

But 2014 is turning out to be very different than 2013. While the overall market indices have pulled back just 3% to 5%, some individual sectors, including retail, have been hit much harder.

Many of the retailers have been disappointing on earnings. Some have also warned about a "challenging" retail environment and have lowered full year guidance. And then, to top it all off, there's the awful weather.

Because of the negative perceptions of the sector, some of the hottest retail stocks have gone on sale.

3 Hot Retail Stocks That Are Now on Sale

1. lululemon

2. Tractor Supply

3. Restoration Hardware

It wasn't easy to find three hot retailers that have gotten cheaper AND have a Zacks Rank of #1, #2 or #3. Many retailers are Zacks Rank #4 (Sell) or #5 (Strong Sells). But these three companies currently are Zacks Rank #3 (Hold) stocks.

What they also have in common is a strong distinctive corporate culture with a strong brand.

lululemon has a "manifesto" that is printed on its shopping bags and around its stores with phrases like: "Do one thing a day that scares you" and "Sweat once a day to regenerate your skin."

Tractor Supply's marketing slogan is: "For Life Out Here" and it publishes a free quarterly magazine called "Out Here" with articles about local artisans, craft and home projects and recipes.

Restoration Hardware has a vision statement that says: "To create an endless reflection of hope, inspiration and love that will ignite the human spirit and change the world."

Brand is important and these three retailers have it in spades.

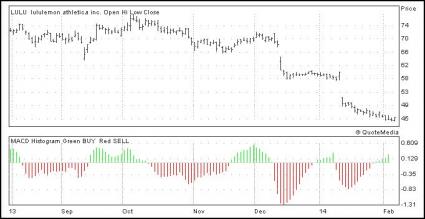

1. lululemon athletica inc. (LULU)

lululemon is a Canadian yoga and athletic wear retailer with stores in Europe, the United States and Canada.

lululemon's problems are well known. In 2013, it had to recall its most popular yoga pants because of a quality problem with the pants being too sheer. Then the CEO resigned and a multi-month search for a new CEO commenced. Only recently, was new management put in place.

On Jan 13, lululemon warned on the fourth quarter stating that comparable store-sales will be in the negative low-to-mid single digits. EPS guidance was also cut.

"We were on track to deliver on our sales and earnings guidance through the month of December; however, since the beginning of January, we have seen traffic and sales trends decelerate meaningfully," said John Currie, lululemon’s CFO.

It warned just after the first polar vortex when half the United States and Canada was huddled in their homes. Since then, there has been yet another polar vortex and the bad winter weather has continued.

It's On Sale

At the beginning of 2013, lululemon was trading at 40x forward earnings. Now, after shares have plunged, it is trading at just 20x.

Forward P/E = 20

Fiscal 2013 expected EPS growth: 2.3%

Fiscal 2014 expected EPS growth: 16.7%

Zacks Rank #3 (Hold)

Shares have fallen about 22% in the last month. If you liked lululemon before, why not buy it at nearly 25% off?

2. Tractor Supply Company (TSCO)

Tractor Supply operates 1,276 stores in 48 states in mainly rural areas so if you haven't heard of it, you probably live in a big city. It serves recreational farmers and ranchers as well as tradesmen and small businesses.

On Jan 28, Tractor Supply did it again, beating the Zacks Consensus Estimate by 4.6%. It hasn't missed the estimate in 5 years.

So why are shares down big in the last month?

Tractor Supply guided 2014 slightly under the consensus which sent investors scurrying. However, several analysts believe that Tractor Supply is just being conservative and that guidance will be raised later in the year.

Otherwise, the Tractor Supply expansion story is still intact.

It's On Sale

There hasn't been a big pullback in Tractor Supply's shares in 5 years. This is the first opportunity to get in at a lower level in a long time. The forward P/E has dropped as the stock has slid.

Forward P/E = 24

2014 expected EPS growth: 12.6%

Zacks Rank #3 (Hold)

Shares are down about 15% in the last month. This is your chance. Buy the dip.

3. Restoration Hardware Holdings Inc. (RH)

Restoration Hardware is a luxury furniture and accessories retailer with retail galleries, the sourcebook and online sales at RH.com. It operates 70 retail stores and 17 outlet stores.

With housing recovering, especially at the luxury end, furniture sales have been strong as well. On Dec 12, the company reported fiscal third quarter results which beat the Zacks Consensus again.

Restoration Hardware re-IPO'd in December 2012 and it has beat every quarter since. It is not scheduled to report again until April.

Comparable-store sales soared another 29% with net revenue up 39%.

Yet shares have plunged on fears about the nasty winter weather and an expensive real estate build out possibly leading to a warning for the fourth quarter.

Forward P/E = 25

Fiscal 2013 expected EPS growth: - 25%

Fiscal 2014 expected EPS growth: 188%

Zacks Rank #3 (Hold)

Shares are down about 17% over the last month on these fears to 6-month lows. It's a chance to get a top of the line retailer much cheaper than in 2013.

Look for Buying Opportunities

Pull backs are a chance to get your favorite stocks on the cheap.

These three hot retailers have seen extremely large sell offs. If you liked these stocks at their all-time highs, you have to like them even more now that they're on sale.

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

With Q4 2024 earnings reporting about wrapped up, the trends remain positive, although the outlook for 2025 earnings growth has dimmed. Stocks in leadership positions have begun...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.