- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 MedTech Stocks To Rebound After Coronavirus-Led Recoil

The massive coronavirus outbreak in China has sent shock waves through the global health community. The Center for Diseases Control and Prevention (CDC) has reported that 10 people have succumbed to the virus in the United States, while 99 cases have been confirmed in total, as of Mar 5.

While most U.S. stocks have been hit by the outbreak, the mixed impact of the epidemic on U.S. MedTech companies is interesting. The virus has without a doubt bumped up sales of respiratory masks to unforeseen levels. Meanwhile, medical device firms are facing supply chain disruptions.

The FDA has issued an emergency use authorization (EUA) of a diagnostic test for the novel coronavirus, which will allow the use of the test panel in any CDC-qualified laboratory across the United States.

There are a few MedTech companies whose business within emerging markets, particularly China, has faced an immediate aftermath of the coronavirus.

In this regard, Boston Scientific (NYSE:BSX) projects a preliminary $10 million to $40 million potential headwind to first-quarter 2020 revenues as a result of deferred procedures and supply chain disruptions. Boston Scientific anticipates a reduction in volume for all non-emergency medical device procedures as its China business is bound to have been affected in February as well as March by the outbreak.

Similarly, Becton Dickinson (NYSE:BDX) expects around a $20-$30 million headwind to second-quarter fiscal 2020 revenues.

Meanwhile, there are a few MedTech stocks that deserve investors’ attention at the moment following several recent initiatives taken by them to control the coronavirus-led damage.

Novavax, Inc (NASDAQ:NVAX) recently announced the start of animal testing for a potential coronavirus vaccine. Management at Novavax stated that human testing for the vaccine will begin by the end of spring 2020.

QIAGEN (NYSE:QGEN) also announced the shipping of its newly-developed QIAstat-Dx Respiratory Panel 2019-nCoV test kit to four hospitals in China for evaluation.

3 Stocks to Focus On:

There are a few companies which are expected to recover from the initial virus-dealt jolt on strong segmental performance in markets outside of China. The following are three such companies with a Zacks Rank #2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

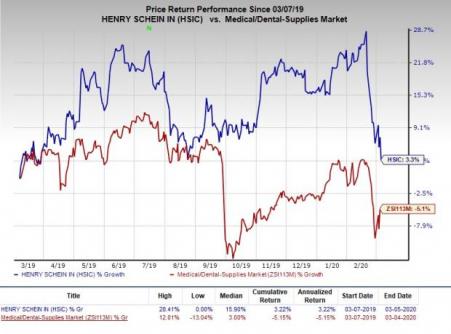

Henry Schein (NASDAQ:HSIC) : This Zacks Rank #3 distributor of dental equipment recently witnessed an uptick in demand for masks through its dental and medical distribution business in Asia. Per the recommendations of the WHO and CDC, the company has compiled a list of masks, face shields, gloves, isolation gowns and other infection prevention products for customers who are seeking protective equipment for their dental practice. To overcome the global supply chain disruptions which happened as a result of the epidemic, the company has leveraged its extensive network of supplier partners.

In the past year, the company’s shares have outperformed the industry. The stock has rallied 3.3% against the industry’s 5.1% decline.

Medtronic (NYSE:MDT) : Despite a top-line shortfall reported in the third quarter of fiscal 2020, the fourth-quarter outlook of this Zacks Rank #2 company remains unchanged. This is because the company anticipates significant acceleration in revenue growth in other key business segments like CVG, RTG and MITG. This would most likely mitigate any initial adverse impact of the virus and keep Medtronic on a steady growth track. The company has activated response teams in China and the Asia-Pacific region as well as globally. Although the company’s China businesses account for almost 7% of its global share, the dying out of the outbreak with time is expected to improve procedure uptake and sort the supply chain disruption.

In the past year, the company’s shares have outperformed the industry. The stock has rallied 10% compared with the industry’s 0.2% rise.

Align Technology (NASDAQ:ALGN) : This Zacks Rank #3 manufacturer of clear aligner systems and intra-oral scanners has China as its largest market, generating almost 8% of the company’s total sales. As a result of the virus outbreak, the company expects a sequential decline in revenues within the APAC region, which is likely to offset to some extent, the growth momentum projected for the first quarter of 2020.The company also expects 20,000 to 25,000 less Invisalign cases and $30 million to $35 million less revenues from its Invisalign and iTero product sales in China. Despite this current uncertainty in China affecting the first-quarter outlook, the company is optimistic about continuing to witness solid momentum in the Americas, across EMEA and other APAC markets like Japan, Australia, New Zealand, South-East Asia, Taiwan, and Korea. In fact, just like in the case of the SARS virus, management hopes the coronavirus issue will be soon controlled.

In the past year, the company’s shares have outperformed the industry.The stock has lost 0.1% compared with the industry’s 5.2% fall.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Medtronic PLC (MDT): Free Stock Analysis Report

QIAGEN N.V. (QGEN): Free Stock Analysis Report

Boston Scientific Corporation (BSX): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Henry Schein, Inc. (HSIC): Free Stock Analysis Report

Novavax, Inc. (NVAX): Free Stock Analysis Report

Original post

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.