- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Factors That Make Lamb Weston (LW) An Attractive Stock

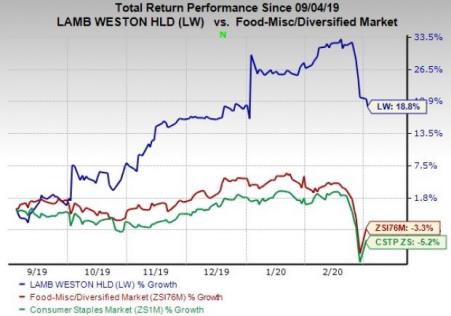

Lamb Weston Holdings Inc. (NYSE:LW) is benefiting from robust growth initiatives which have been boosting investors’ optimism for quite some time. Notably, shares of this leading frozen potato products provider have gained 18.8% in the past six months against the industry’s decline of 3.3%. Also, the stock compared favourably with the Zacks Consumer Staples sector’s drop of 5.2% in the same time frame.

Let’s discuss the factors that are likely to keep driving the company’s performance.

Strength in Global Segment

Global segment contributed more than half of Lamb Weston’s second-quarter fiscal 2020 sales and is a major driver for the future. Sales in the segment increased 15% to $539.6 million. Volumes increased 14% on strong sales and gains from acquisitions as well as extra shipping days owing to Thanksgiving holiday. Price/mix inched up 1% on pricing adjustments in multi-year contracts. This segment is likely to remain a tailwind to Lamb Weston’s growth in fiscal 2020.

Focus on Capacity Expansion

The company has been undertaking initiatives to boost offerings and operating capacity. These efforts enable Lamb Weston to effectively meet rising demand conditions for snacks and fries. Recently, the company announced a joint venture with Sociedad Comercial del Plata in Argentina. Lamb Weston expects to capture greater revenue prospects in Argentina through this deal. Moreover, it will enable the company to cater to the growing needs of high-quality potato fries in the broader South American market. Apart from this, the company’s acquisition of joint venture interests in Lamb Weston BSW around mid-fiscal 2019 is yielding. Also, the takeovers of Ready Meals and Marvel Packers (in 2019 and 2018, respectively) have bolstered Lamb Weston’s market share in Australia.

Speaking about capacity-expansion endeavors, the company completed the expansion of a facility located at Hermiston, Oregon on Jun 18, 2019. The expansion has facilitated the addition of a new processing line for increasing the production of frozen french fries. This is expected to cater to demand conditions in North America and key export markets as well as support higher production needs.

LTO’s: Key Revenue Driver

Lamb Weston has been benefitting from its limited time offers or LTO innovations, which are a key part of the company’s long-term prospects. Incidentally, LTOs boosted growth and market share gains in fiscal 2018 and fiscal 2019. More specifically, LTOs are aiding volume growth in the company’s Global segment. Management is positive about further prospects from new LTOs.

We believe that the aforementioned upsides are likely to help this Zacks Rank #2 (Buy) stock maintain its solid footing in the food space.

Other Stocks to Consider

Hershey Company (NYSE:HSY) , with a Zacks Rank #2 (Buy), has long-term earnings per share growth rate of 7.7%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Procter & Gamble (NYSE:PG) which carries a Zacks Rank #2, has a long-term earnings growth rate of 7.4%.

e.l.f. Beauty Inc. (NYSE:ELF) , which carries a Zacks Rank #2, has a long-term earnings growth rate of 3.8%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Hershey Company (The) (HSY): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

e.l.f. Beauty Inc. (ELF): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.