- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 ETFs With The Most Facebook Exposure

The social media giant Facebook (FB) has made an impressive comeback following its stellar second quarter results. In fact, FB shares have nearly doubled over the past three months, suggesting that the worst might be over for the company that had been seeing weak mobile advertising revenues since its IPO.

After all, mobile advertising revenues now account for 41% of the total revenue in the second quarter, up from 30% in the first quarter. This increasing advertising trend is expected to continue, as mobile revenue would soon exceed revenues from desktop advertisements, as per management.

This fast-growing mobile advertising market is boosting investors’ confidence in the company’s growth outlook. Additionally, Facebook recently launched a number of products, such as Twitter-like hashtags (#), Facebook Home and Instagram’s video application to attract advertisers.

These offerings have definitely spurred FB’s customer base, leading to a 51% spike in the monthly mobile active users during the second quarter. The lined-up products such as the Reader and television-like spot offerings for advertisers (reportedly for $2.5 million a day) can continue to fuel further growth in the months ahead.

Moreover, Citigroup has a bullish outlook on the company’s growth and the resulting upgrade of the stock to ‘Buy’ has spread optimism across the whole tech sector.

Facebook currently has a Zacks Rank #2 (Buy), suggesting that it will continue to outperform in the remainder of the year. Given the bullish outlook and the impressive run in FB share prices, we have highlighted three ETFs with heavy exposure to this social networking giant, any of which could be great ways to play this booming trend in the space:

Global X Social Media Index ETF (SOCL)

This fund tracks the Solactive Social Media Index, holding 27 securities in the basket. Of these firms, FB takes the top spot, making up roughly 13.01% of assets. In terms of country exposure, U.S. firms take half of the portfolio, closely followed by China (28%) and Japan (13%).

The fund debuted a year and a half ago in the social media space and has amassed $66.7 million in its asset base. The ETF charges 0.65% in fees and expenses and sees light volumes on most days.

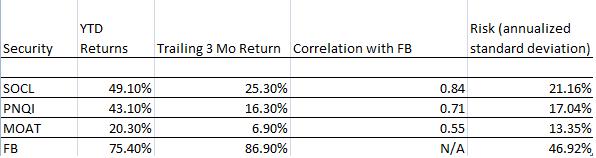

The ETF is up 49.1% year-to-date and increased 25.3% in the trailing three-month period. The fund currently has a Zacks ETF Rank of 3 or ‘Hold’ rating with ‘High’ risk outlook.

PowerShares Nasdaq Internet Portfolio (PNQI)

This fund provides broad exposure to the Internet industry by tracking the NASDAQ Internet Index. The ETF holds 81 stocks in its basket with FB at the top position, accounting for 8.76% of total assets.

In addition to information technology, the product also offers exposure to consumer discretionary firms (31%). The fund has accumulated AUM of $179.6 million while charges 60 bps in fees per year, though volume is light.

PNQI gained 16.3% in the past three months and 43.1% year-to-date. The fund currently has a Zacks ETF Rank of 3 or ‘Hold’ rating with a ‘High’ risk outlook.

Market Vectors Wide Moat ETF (MOAT)

This ETF follows the Morningstar Wide Moat Focus Index and provides equal-weighted exposure to 21 U.S. securities that have a unique sustainable competitive advantage in their respective industries. The fund has managed assets worth $372.2 million so far and charges 49 bps in expense ratio. The product trades in good volume of roughly 100,000 shares per day.

Here again, Facebook is the top firm with 8.41% allocation. From a sector perspective, information technology takes the largest share with 32.8%, closely followed by industrials (19.4%) and financials (14.1%).

In terms of performance, the ETF added 6.9% in the trailing three months and 20.3% so far this year.

Bottom Line

While it is true that Facebook has generated much more returns than the ETFs, the exposure to only FB requires above par risk appetite given its higher volatility (annualized standard deviation is 46.92%). In order to minimize this risk, investors could definitely look to the three ETFs that have a high correlation to that of FB’s share price.

From the above table, it can be concluded that SOCL, with correlation of 0.84, could be a good choice to play FB directly. It also represents a moderate risk choice for those seeking a pure play in the social media space to ride the most of the recent surge in Facebook, while also gaining exposure to a host of other firms in the sector.

The other two products – PNQI and MOAT – require lower risk tolerance levels and provide diversified exposure to other sectors. However, they have both clearly benefited from the jump in Facebook shares, and could continue to do well if this social giant remains a strong performer.

Original post

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.