- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Correction-Defying Bets To Buy As Markets Brave Coronavirus

Global markets are bearing the brunt of the harrowing effects of the novel coronavirus, a flu-like pandemic that sent central banks and investors around the world into frenzy. After all, the sharp and fast entry of major U.S. benchmarks into correction territory can’t be taken lightly. Principal sectors are witnessing ramped-down activities as consumers are imposing restrictions over many crucial ones over fears of contracting the deadly disease.

However, at such a critical juncture, investors can still find a ray of hope. The answer lies in a couple of medical stocks that defied the market correction and continued to climb.

Let’s delve deeper.

COVID-19’s Impact Continues to Intensify

The deadly coronavirus now spans across continents with the highest number of cases registered in China, South Korea, Italy and Iran.

The disease not only impacted the day-to-day life worldwide but is also taking a toll on global financial markets. In fact, it is this fear that dragged chief benchmarks into correction territory last week.

Global Markets Incur Steep Losses

In the week ended Feb 29, Wall Street witnessed its worst week in more than 11 years. The Dow lost 12.4%, the broader S&P 500 closed 11.5% lower and the tech-laden Nasdaq Composite declined 10.5%. It took the S&P 500 just six trading sessions to enter correction territory, which is its fastest pace, on record.

All U.S. benchmark indexes are therefore in correction territory right now, indicated by a 10-20% drop from recent highs. In fact, last week, the coronavirus-hit global markets shed $6 trillion in wealth, of which $4 trillion were lost by U.S. markets alone, per the S&P Dow Jones Indices’ senior index analyst Howard Silverblatt.

Additionally, the CBOE Volatility Index, considered the U.S. financial markets’ fear gauge, scaled to 49.48 last week, its highest level since February 2018.

Fed Cuts Benchmark Rates Unexpectedly

In a rare inter-meeting move, the central bank cut its benchmark interest rate on Mar 3 by a half percentage point to a range of 1-1.25%. In a statement, the Fed noted that although the U.S. economy remained strong, the coronavirus posed “evolving risks to economic activity”.

Fed Chairman Jerome Powell addressed the issue at a press conference later, saying that it was “time to act in support of the economy”. He said that officials saw the virus spread, which called for a material change in the outlook for economic growth.

However, Fed’s rate cut move failed to cheer the markets as stocks suffered heavy losses on Tuesday. In fact, this step by the central bank further stoked investor fears over the disease.

Other Central Banks Ready to Ease Grip

While the Fed arrived at a rate cut much later amid the coronavirus crisis, other major central banks, such as those of Malaysia and Australia already slashed their benchmark rates. In fact, the European Central Bank (ECB) and Bank of Japan (BOJ) took their interest rates into negative territory.

In the coming weeks, leading central banks, namely the ECB, BOJ and the Bank of England scheduled meetings. There is high possibility that these banks could also trim rates. However, there may not be any room for reducing rates by a wide margin since the benchmark rates have hovered around low levels since the global financial crisis.

3 Stocks to Pocket

As central banks worldwide continue to debate the issue, it remains to be seen if stocks can recover from the markets’ nosedive last week. Stocks have persistently declined this week as well.

Nonetheless, not all of them have taken the road south. We have noted that some biotech companies that are trying to surface with ways to combat the novel coronavirus are among those handful few that actually reaped gains while the broader markets took a sharp plunge. We therefore rounded up three stocks that have gained since Feb 19, all carry a Zacks Rank #2 (Buy).

Co-Diagnostics, Inc. (NASDAQ:CODX) a molecular diagnostics firm. The company has a patented platform to develop diagnostic tests. Co-Diagnostics recently completed the principle design work for a genetic screening test to detect the COVID-19 virus. The test kits are now available for sale to laboratories in the United States.

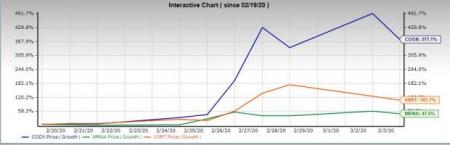

The Zacks Consensus Estimate for Co-Diagnostics’ current-year earnings has moved 66.7% north in the past 60 days. Shares of this company, which belongs to the Zacks Medical Services industry, have risen 377.1% since Feb 19.You can see the complete list of today’s Zacks #1 Rank stocks here.

Moderna, Inc. (NASDAQ:MRNA) is a clinical stage biotechnology company. Last week, the company saidthat its first batch of vaccine against the coronavirus, called mRNA-1273, was ready for the government to test on humans.

The Zacks Consensus Estimate for Moderna’s current-year earnings has moved 5% north in the past 60 days. Shares of this company, which belongs to the Zacks Medical - Biomedical and Genetics industry, have risen 47.5% since Feb 19.

Vaxart, Inc. (NASDAQ:VXRT) is a clinical-stage company. The company recently initiated a program to develop vaccine candidates to fight COVID-19.

The Zacks Consensus Estimate for Vaxart’s current-year earnings has moved 86.4% north in the past 60 days. Shares of this company, which belongs to the Zacks Medical - Drugs industry, have risen 107.7% since Feb 19.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Moderna, Inc. (MRNA): Free Stock Analysis Report

VAXART, INC. (VXRT): Free Stock Analysis Report

Co-Diagnostics, Inc. (CODX): Free Stock Analysis Report

Original post

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.