- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Cloud Stocks To Keep Your Portfolio Above The Coronavirus

It may be time to upgrade your portfolio with the most tenacious blue-chip stocks trading at a discount. Companies with the most durable balance sheets and strongest long-term outlooks that will help your portfolio weather this pathogen-induced storm. The coronavirus has been driving fear and volatility into the financial markets with the worst one-week equity break since the financial crisis occurring last week.

Tuesday, the Federal Reserve made an unprecedented decision to cut its benchmark interest rates by 50 basis points in an attempt to curb the financial impact of this potential pandemic. The markets have remained volatile and appear to be unsure of what to do next. Investors & traders are just waiting to see how rapidly this new pathogen will spread and how extensive the economic impact will be.

The Spread

Some analysts are saying that there is already a coronavirus epidemic in the US. We just don’t know it yet. There may be hundreds of people who have contracted the virus but are yet to show symptoms. This strain of the coronavirus has an incubation period that ranges from 2 to 14 days on average. This symptom lag is concerning because the virus may be contagious even before symptoms are seen.

The draconian measures that China put in place have been effective at controlling the spread of the disease. Still, these methods not only took away some of the people’s basic liberties but also shut down production in some major cities. The US would not be able to implement the same extreme measures, and the spread could be more severe if individuals do not take every precaution.

What Investors Should Be Doing

This is the time to look for long-term opportunities in the market at discounted prices and ignore the short-term volatility. I am personally holding a lot of cash right now, biding my time for the right entry points. I believe that a more considerable downside may be on the horizon.

We have already priced in the supply shock from Asian manufacturing shutdowns, but have we priced in a demand-side hit. The question that analysts are struggling to answer is whether demand will be destroyed from this pathogen or merely delayed. The US markets are just hoping that the Feds rates cut will give the economy enough stimulus to curb a potential economic downturn.

I have put a few small positions on some of my favorite blue-chip stocks. With hardware experiencing substantial supply issues and impending demand problems, I like software stocks right now, specifically cloud-based ones. If the virus spreads in the US, cloud software is going to become essential, with an increasing amount of people working from home.

My Picks

My favorite stock pick right now is Microsoft (MSFT). Microsoft is the largest cloud stock on the market right now and has been quite resilient to the corona scare thus far. Since the equity drop off Monday, February 24th, MSFT only falling 6%. This buoyancy is due to its strong long-term potential in cloud services and more than $134 billion in cash & equivalents. This virus may employ companies to implement some of Microsoft’s cloud services to allow their employees to work remotely. I see MSFT as a buy today, and I will progressively average down if the stock continues to fall.

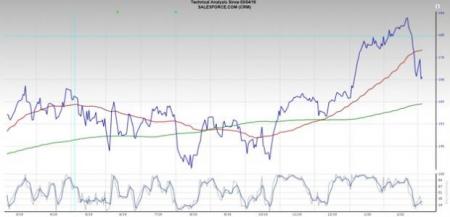

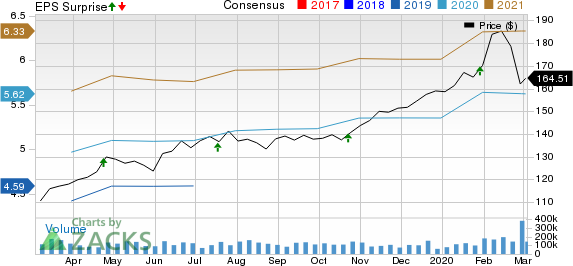

Salesforce (CRM) is another cloud giant that I would keep an eye on. Salesforce is the cloud king of enterprise solutions with a dominant positioning in customer relationship management. The company continues to stay ahead of the innovative curve with its best-in-class Sunshine platform. CRM continues to surpass expectations with 9 consecutive quarterly beats on both top and bottom-line. Salesforce’s recent acquisition of Tableau positions the company to be a leader in business analytics for actionable results in everything from operations to HR. I am going to start buying up this stock once it hits $160, which is where the shares’ current 200-day moving average lies.

Splunk (SPLK) is not a blue-chip quite yet, but it is well on its way to becoming one. I continue to be impressed by this company’s performance, even with its lofty expectations. The enterprise provides a platform that helps companies utilize real-time machine data for collection, indexing, and alerts, allowing companies to uncover actionable insight from this data no matter the source or format. The company is leveraging AI and machining learning for forecasting and anticipative decision making.

Real-time data management is becoming increasingly necessary in business across industries as this digital age makes speed a competitive advantage. Splunk is well-positioned to take on the massive addressable market that is yet to recruit Splunk’s services. This firm is well-suited to transform the way our economy utilizes real-time data. This stock has fallen 9% since last week’s sell-off, and the buying opportunity ripens every dollar it falls.

Take Away

The coronavirus anxiety is far from over, and I expect to see more volatility in the weeks to come as the full impact of the virus is quantified. Right now, the pathogen is accelerating in South Korea, Iran, and Italy. The US is praying that this does not happen here, but the economy is preparing itself for the worst with Jerome Powell and his dovish band of governors cutting its benchmark rate by a third (50 basis points).

Stocks will recover as they always have, and as long-term investors, we should be looking at this correction as an opportunity to buy our favorite equities at a discount.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Splunk Inc. (SPLK): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

salesforce.com, inc. (CRM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.