- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

2 Hot Consumer Loan Stocks Benefiting From Increasing Household Debt

2 Hot Consumer Loan Stocks as Americans Borrow More

Coming out of the Great Recession, Americans concentrated on reducing their debt burdens. You can see the effects of this deleveraging process by looking at the New York Fed’s Housing Debt and Credit Report. This report shows that household debt hit is peak of $12.68 trillion in the third quarter 2008, and has been declining for the past several years. Needless to add that this surge of fiscal prudence by American households was an unwelcome development for operators in the consumer finance industry. But, this may have started to change, as recent Fed data shows, Americans started borrowing again.

This might be one of the first indicators that consumer debt has hit the floor, and is now in the process of rebounding for the next several quarters. If we look at the last four quarters, we can see the final dip in the recession trough, and then the recent upswing.

For the first quarter 2013, household debt decreased by almost $110 billion from Q4 2012. During the second quarter of 2013, debt declined by another $78 billion from the previous quarter. But, in the third quarter of 2013, debt increased by 1.1% to $11.28 trillion. Then in the fourth quarter 2013, debt increased to $11.52 trillion, a 2.1% jump from Q3 2013, and now only 9.1% below our peak in 2008.

With unemployment coming down and interest rates still low by historical standards, American consumers are showing greater willingness to borrow. This is great news for companies that issue debt.

Companies positioned to benefit from increasing debt

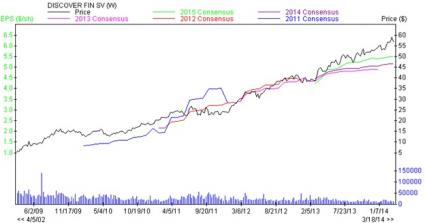

Discover Financial Services (DFS), a Zacks Rank #2 (Buy) stock, is not just a credit card issuer, but also provides private student loans, personal loans, home loans, home equity loans, and prepaid cards. Therefore, a positive swing of increasing American debt impacts Discover on several fronts.

In the past sixty days, the earnings estimates for Fiscal Year 2014 have increased from $5.09 to $5.17. Furthermore, Discover posted a Positive Earnings Surprise for three out of the last four quarters with an average positive surprise of 9.11%.

Credit card companies like American Express (AXP), and Capital One Financial (COF) also have exposure to this positive outlook, but for the near term, Discover Financial is the most promising.

The Price & Consensus chart below adequately captures the company’s strong momentum.

World Acceptance Corp. (WRLD), a Zacks Rank #2 (Buy), specializes in consumer installment loans, and markets electronic products and appliances to borrowers. WRLD also provides short and medium term loans and services to individuals. Moreover, World Acceptance also serves individuals with limited access to consumer credit from banks or credit unions.

Over the past sixty days, WRLD has seen their Q1 2014 earnings estimates increase from $3.44 to $3.55, and for the Fiscal Year 2014, earnings estimates have leaped up from $8.73 to $9.15. Furthermore, over the past four quarters, WRLD has an average positive earnings surprise of 2.38%.

Bottom Line

As consumer’s confidence in the recovering economy grows, they are increasing their household debt; in the forms of home, student, auto, and credit card debt. In 2013, auto and student loans both increased by 8%, with auto loans increasing for the past nine quarters.

So if you are like most Americans, you are probably feeling more confident in the economy, and are increasing your household debt. Therefore, it may make sense to look into the Financial-Consumer Loans segment to capitalize on this recent trend. A good look at Discover Financial, or World Acceptance Corp. could help your portfolio in the coming quarters.

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.